The Sterling rallies past 1.3500, boosted by the US Dollar’s weakness.

Fresh tariff threats, a new rift with China, and looming debt concerns are weighing on the US Dollar.

Soft US PCE inflation figures and dovish comments from Fed’s Wakker have added pressure on the Greenback.

The Pound is rallying at Monday’s London session opening times, favoured by an ailing US Dollar, which has reversed Friday’s gains following a new tariff threat by US President Trump and a fresh trade rift with China.

Investors are selling the US Dollar on Monday, wary that a 50% tariff on Aluminu¡ium and steel, as Trump announced on Friday, is likely to add strain on economic activity and boost inflationary pressures.

Tariffs and debt woes keep punishing the US Dollar

Apart from that, accusations that China violated an agreement on mineral trading have further poisoned the already fragile relationships between the world’s two major economies. Beijing has responded by taking forceful actions, in a new twist of Trump’s chaotic trade policy that has been weighing on the US Dollar for months.

Renewed trade fears add to looming concerns about the US fiscal stability. Trump´s “big, beautiful bill”, which will be discussed in the Senate for the coming weeks, is expected to add trillions of US Dollars to an already ballooning debt. This is keeping investors on their toes and feeding a gradual “sell America” trade.

In the macroeconomic front, Friday’s US PCE Prices Index eased concerns on inflation, at least for now, and kept hopes of further Fed easing alive. Fed Governor Waller endorsed this view on Monday, which has added negative pressure on the US Dollar.

All in all, the Pound advances, buoyed by Dollar weakness. Later today, the final reading of the UK S&P Manufacturing PMI and BoE’s Mann speech will provide further guidance for the pair. In the US session, the highlight will be the ISM Manufacturing PMI.

British Pound PRICE Today

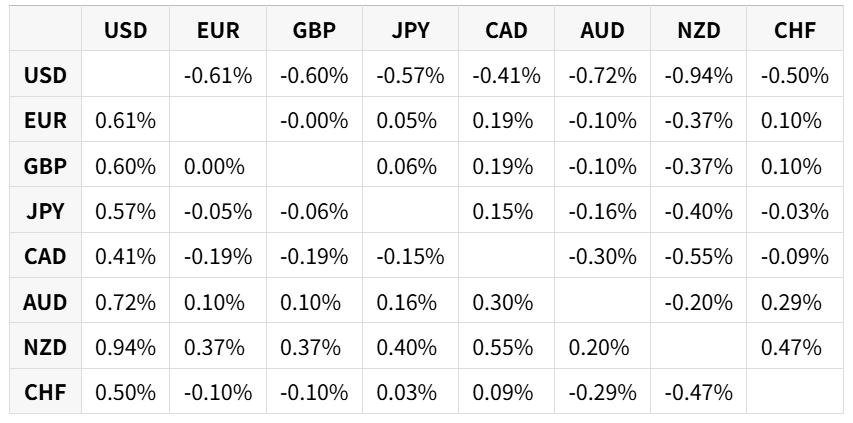

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.