EUR/USD trims some gains ahead of the Eurozone CPI release.

The US Dollar remains unable to take distance from multi-week lows.

US Manufacturing PMI confirmed tariffs’ negative impact on factory activity.

EUR/USD trades with moderate losses, following a strong performance on the previous day. The pair is moving around 1.1420 at the time of writing, with investors focusing on the preliminary Eurozone Consumer Prices Index (CPI) numbers, due later on Tuesday.

Consumer prices are expected to have cooled in May, with the headline inflation returning to a 2% year-over-year (YoY) growth rate, from the 2.2% reading seen in April. Likewise, the core CPI is seen moderating to 2.5% from April’s 2.7% reading.

These figures are likely to be welcomed by the European Central Bank (ECB), which is widely expected to cut interest rates for the eighth consecutive time on Thursday. These numbers give some margin for the central bank to take a pause in July, but ECB President Christine Lagarde will stick to her neutral tone, assuring that further decisions will depend on data.

The US Dollar, on the other hand, remains unable to show a significant recovery. US President Trump’s chaotic trade policy and growing concerns about fiscal stability are acting as headwinds to the Greenback, and recent US data failed to provide any relevant support.

Euro PRICE Today

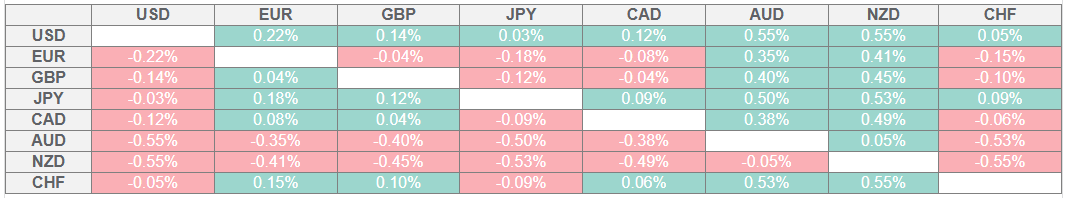

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: US Dollar weakness keeps Euro downside attempts limited

The Euro maintains its broader positive trend intact, with the US Dollar languishing near multi-week lows. The US Dollar Index DXY returned below the 100.00 psychological level last week, reaching fresh six-week lows at 98.60 on Monday.

US Manufacturing PMI deteriorated against expectations in May, with delivery times increasing, according to the report by the ISM. These figures have confirmed the negative impact of trade uncertainty on the sectors’ activity and triggered fears of supply chain disruptions.

May’s US ISM Manufacturing PMI contracted to a six-month low of 48.5 from 48.7 in the previous month, against market expectations of an increase to 49.5. The new orders and employment subindexes edged up, while the prices paid declined. The US Dollar extended losses after the release.

In Europe, May’s Manufacturing PMI confirmed the expected 49.4 reading, marking the fifth consecutive improvement in data, although still at levels consistent with a slight contraction of the sector’s activity.

Germany’s PMI was revised down to a 48.3 reading, from the previously estimated 48.8, highlighting the soft momentum of the region’s major economy. The impact on the Euro, however, was muted.

The main attraction today in Europe will be the Eurozone CPI data, due at 09:00 GMT, which is expected to show cooling price pressures and will frame Thursday’s ECB decision.

The US Factory Orders will be observed with special interest after the soft manufacturing figures seen on Monday. New orders are expected to have dropped month-over-month (MoM) in April by 3%, following a 3.4% increase in March. The risk for the USD is skewed to the downside.

Somewhat later, the US JOLTS Job Openings will open a string of labour market releases this week, which ends with the all-important US Nonfarm Payrolls on Friday. Job openings are expected to have remained steady at 7.1 million in April.

Technical analysis: EUR/USD bulls are capped below the 1.1450 resistance area

EUR/USD hit six-week highs at 1.1450 on Monday but failed to consolidate above the resistance area between 1.1415 and 1.1435, which has been holding bulls since mid-April.

The pair, however, maintains its positive trend intact, as the broad-based US Dollar weakness is keeping bears at bay for now. Immediate resistance is now at the 1.1450 reverse trendline, which closes the path towards the April 22 high, at 1.1545.

Failure to break 1.1450, on the contrary, might put the May 30 low at 1.1310 back in play ahead of the 1.1220 support area.

EUR/USD 4-Hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.