- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

GBP/USD is stuck near 1.3300 ahead of Fed, BoE showings.

Fed is set to keep rates on hold again as Fed policymaker rhetoric takes center stage.

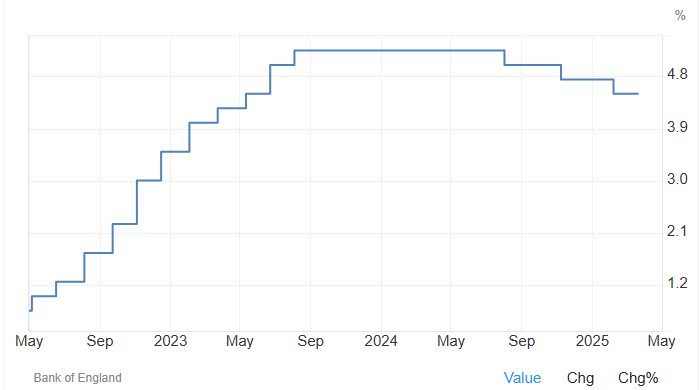

BoE broadly expected to deliver another quarter-point cut this week.

GBP/USD snapped a near-term losing streak, pumping the breaks and holding steady near the 1.3300 handle to kick off a fresh trading week. Cable remains down from recent multi-year highs, but price action has pushed into a holding pattern ahead of key showings from both the Federal Reserve (Fed) and the Bank of England (BoE).

The Fed is broadly expected to keep interest rates on hold for the time being, a move that is likely to draw more fire from the Trump administration which remains staunchly determined to try and squeeze early rate cuts out of Fed Chair Jerome Powell. Labor and inflation figures remain largely on-balance, with roughshod and opaque trade policies out of the White House shooting its own hopes for rate cuts in the foot as the Fed remains committed to its mandate of keeping unemployment and price volatility in check.

Despite the Fed’s all but assured rate hold on the cards this week, Fed head Powell’s words will take on additional weight for investors following the Fed’s rate call on Wednesday. Markets are still hoping for a pivot into a fresh rate cutting cycle, and traders will be sniffing out any signs of dovishness from Fed policymakers.

On the UK side, the BoE is broadly expected to deliver another quarter-point rate cut on Thursday. The BoE’s Monetary Policy Committee (MPC) is expected to vote 9-to-1 in favor of a 25 bps rate trim.

GBP/USD price forecast

GBP/USD traders found the bid button on Monday, halting a four-day losing streak that dragged Cable down 1.37%. Despite pumping the breaks on a near-term decline, bullish potential remains limited, with technical oscillators mired in a sluggish midrange. The pair appears poised for a slow walkback after a sharp bounce from the 200-day Exponential Moving Average (EMA) near 1.2750 back in early April.

GBP/USD daily chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.