Here is what you need to know on Friday, May 2:

After reaching its highest level in three weeks near 100.40 on Thursday, the US Dollar (USD) Index corrects lower to start the European session on Thursday. The US Bureau of Labor Statistics will publish April employment data, which will feature wage inflation, Unemployment Rate and Nonfarm Payrolls figures. Earlier in the day, the European economic calendar will offer preliminary Harmonized Index of Consumer Prices (HICP) data, the European Central Bank's (ECB) preferred gauge of inflation, for April.

US Dollar PRICE This week

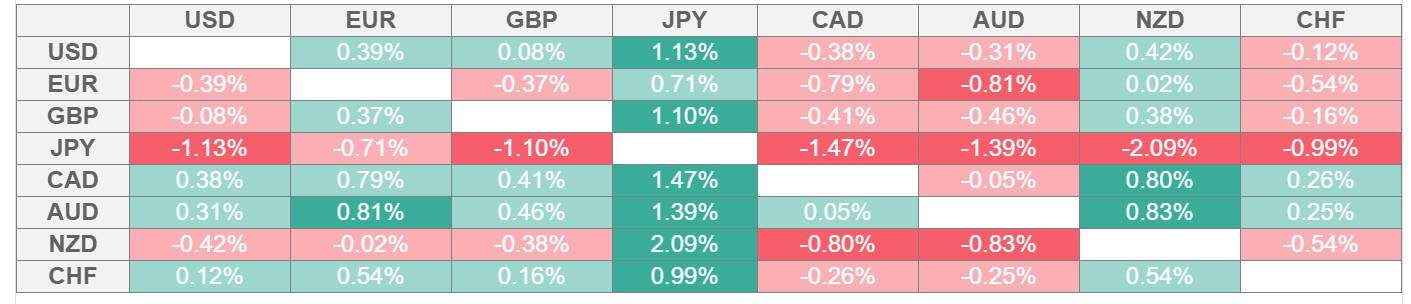

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Despite mixed macroeconomic data releases from the US, the USD outperformed its rivals on Thursday on growing optimism about a de-escalation of the US' conflict with its trading partners. The US Department of Labor reported that weekly Initial Jobless Claims climbed to 241,000 from 223,000 in the previous week. Other data showed that the ISM Manufacturing Purchasing Managers' Index (PMI) edged lower to 48.7 in April from 49 in March but came in above the market expectation of 48. Meanwhile, Bloomberg reported that China Commerce Ministry said that the US has taken the initiative to convey to China that the US is hoping to talk on trade.

EUR/USD closed in negative territory for the third consecutive day on Thursday before stabilizing above 1.1300 in the European morning on Friday. The annual HICP inflation in the Eurozone is forecast to soften to 2.1% from 2.2% in March.

Gold lost more than 1% on Thursday and came within a touching distance of $3,200. XAU/USD stages a rebound and rises about 0.5% on the day at around $3,250.

GBP/USD lost 0.4% on Thursday and dropped to 1.3260. The pair holds its ground in the European morning and trades near 1.3300.

USD/JPY gained more than 1.5% on Thursday and extended its weekly rally to a fresh multi-week high near 146.00 in the Asian session on Friday. The pair edges lower toward 145.00 amid renewed USD weakness in the European trading hours. Japanese Prime Minister (PM) Shigeru Ishiba said on Friday that there is no change at all to their stance of requesting the US to cancel tariffs.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.