Australian Dollar remains steady following Chinese economic data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The Australian Dollar moves little after disappointing economic data from China.

China’s Retail Sales climbed 3.7% YoY in July, falling short of the 4.6% expected and 4.8% in June.

The US Dollar edges lower after registering a nearly 0.5% gain in the previous session.

The Australian Dollar (AUD) remains subdued against the US Dollar (USD) on Friday, following disappointing key economic data from China, Australia’s major trading partner. The AUD/USD lost more than 0.5% in the previous session as the US Dollar gained ground following stronger US economic data.

China’s Retail Sales rose 3.7% year-over-year in July, falling short of 4.6% expected and 4.8% in June. Meanwhile, Industrial Production increased 5.7% YoY, compared to the 5.9% forecast and 6.8% seen previously.

The downside of the AUD/USD pair could be limited as the US Dollar struggles amid rising expectations that the Federal Reserve (Fed) will cut rates in September. The US July Retail Sales data and the preliminary Michigan Consumer Sentiment Index will be eyed later in the day.

Australian Dollar steadies as US Dollar edges lower ahead of Retail Sales data

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is losing ground and trading around 98.10 at the time of writing.

The US Producer Price Index (PPI) rose 3.3% YoY in July, versus the 2.4% increase prior. This reading came in stronger than the expectations of 2.5% by a wide margin. The annual core PPI climbed 3.7% in July, compared to 2.6% in June and the 2.9% expected.

US Initial Jobless Claims for the week ending August 9 fell to 224K versus 227K prior (revised from 226K). This figure was below the market consensus of 228K.

CME’s FedWatch tool indicates that Fed funds futures traders are now pricing in nearly a 92% chance of a 25 basis point (bps) interest rate cut at the September meeting.

US Treasury Secretary Scott Bessent said in an interview on Wednesday that short-term Fed interest rates should be 1.5-1.75% lower than the current benchmark rate at an effective 4.33%. Bessent added that there is a good chance the central bank could opt for a 50-basis-point rate cut in September.

US President Donald Trump shared his "paper calculation" that Fed interest rates should be at or near 1%. Trump also noted interest rates should be three or four points lower. Interest rates are just a paper calculation, he added.

Chicago Fed President Austan Goolsbee said on Wednesday that economists are unanimous that the Fed must be independent from political interference. Goolsbee added that the central bank’s independence is essential “because we don’t want inflation to come back.”

White House spokeswoman Karoline Leavitt said on Tuesday that US President Donald Trump is considering legal action against Fed Chair Jerome Powell over his handling of renovations at the central bank’s headquarters, raising concerns about the Fed’s independence, per Reuters.

US Treasury Secretary Scott Bessent said on Wednesday that US and Chinese trade officials will meet again within the next two to three months to discuss the future of their economic ties. “The US would need to see sustained progress on curbing fentanyl flows from China, potentially over months or even a year, before considering tariff reductions,” Bessent said.

Australia’s Employment Change arrived at 24.5K in July from 1K in June (revised from 2K), against the consensus forecast of 25K. Meanwhile, the Unemployment Rate fell to 4.2%, as expected, from 4.3% in June.

The Reserve Bank of Australia (RBA) delivered a 25 basis points (bps) interest rate cut on Tuesday, as widely expected, bringing the Official Cash Rate (OCR) to 3.6% from 3.85% at the August policy meeting.

RBA Governor Michele Bullock stated that current forecasts suggest the cash rate may need to be reduced to ensure price stability. However, Bullock emphasized the Board’s meeting-by-meeting approach and refrained from making any commitments on rate moves should financial markets experience a bout of volatility.

The RBA’s monetary policy statement noted that inflation has continued to moderate. The outlook remains uncertain. It reaffirmed that maintaining price stability and full employment remains the top priority.

Australian Dollar rebounds toward confluence resistance zone near 0.6500

The AUD/USD pair is trading around 0.6490 on Friday. Technical analysis on the daily chart suggests a momentum shift from bullish to bearish bias as the pair has broken below the ascending channel pattern. The pair also moved below the nine-day Exponential Moving Average (EMA), signaling that short-term momentum is weaker. Moreover, the 14-day Relative Strength Index (RSI) is positioned below the 50 level, suggesting that market bias is bearish.

On the downside, as the short- and medium-term price momentum is dampened, the AUD/USD pair could navigate the region around the two-month low of 0.6419, recorded on August 1, followed by a three-month low at 0.6372, recorded on June 23.

The AUD/USD pair may target the immediate barrier at the 50-day EMA of 0.6500, followed by the nine-day EMA at 0.6508. A rebound toward the ascending channel would suggest a bearish trap and a bullish recovery.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

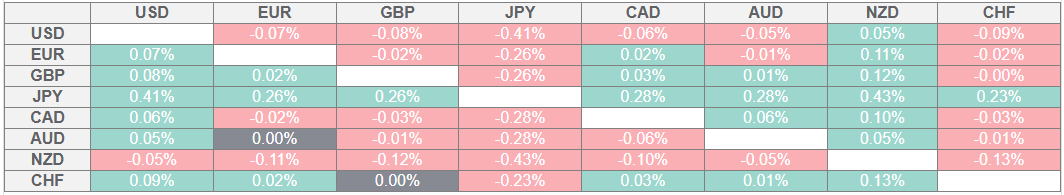

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.