Australian Dollar declines as Trump prepares to send tariff letters to trading partners

The Australian Dollar declines amid renewed US tariff concerns.

Australia’s ANZ Job Advertisements climbed 1.8% in June following a decline of 1.2% in May.

US Treasury Secretary Scott Bessent noted that US tariffs could be rolled back to April 2 levels on August 1.

The Australian Dollar (AUD) loses ground against the US Dollar (USD) on Monday, continuing its losing streak for the third successive session. The AUD/USD pair depreciates due to renewed tariff concerns as US President Donald Trump may send out 12 or 15 letters on tariffs later in the day, with expecting that trade deals or letters with most nations will be done by July 9.

ANZ Job Advertisements increased by 1.8% in June after a decline of 1.2% in May. The data presents the number of job advertisements in the major metropolitan newspapers and on the internet sites in Australia.

The Financial Times reported that China is increasingly rerouting its exports through Southeast Asia in an effort to dodge US tariffs imposed by the Trump administration. Data indicates that direct shipments from China to the US dropped by 43% in May, even as China's overall exports rose by 4.8%. This shift was marked by a 15% surge in exports to Southeast Asia and a 12% increase to the European Union (EU). However, the US trade agreement with Vietnam now includes a 40% tariff on trans-shipped goods to curb such practices. Any change in Chinese economy could impact the AUD as China and Australia are close trading partners.

Traders will focus on the Reserve Bank of Australia's (RBA) monetary policy meeting on Tuesday. The latest Reuters poll indicated that 31 out of 37 economists expect the RBA to deliver a quarter basis point rate cut in July. The median forecast now sees the cash rate falling to 3.10% by the end of 2025, down from 3.35% in the May survey.

Australian Dollar falls due to renewed US tariff concerns

The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading higher at around 97.00 at the time of writing.

US Treasury Secretary Scott Bessent said on Sunday that US President Donald Trump will send letters to some trading partners, warning that tariffs could revert to April 2 levels on August 1 if no progress is made on a trade deal. He clarified that August 1 is not another new tariff deadline but suggested that it could still give trading partners more time to renegotiate tariff rates.

Commerce Secretary Howard Lutnick confirmed the new tariffs are set to take effect on August 1. Lutnick added that Trump is currently finalizing the specific rates and agreements and may send out 12 or 15 letters on tariffs on Monday. He also indicated that trade deals or letters with most nations will be done by July 9.

On Thursday, Trump told reporters that he “will begin sending letters on trade tariffs starting Friday.” He added that he would send letters to 10 countries at a time, laying out tariff rates of 20% to 30%, reported by Reuters.

President Trump's “one, big, beautiful” tax bill passed the House of Representatives and was sent to him for signing into law. The legislation includes significant tax cuts designed to stimulate economic growth. Trump hailed the bill's passage on Truth Social, calling it a “historic victory for American workers, families, and businesses.”

US Nonfarm Payrolls indicated that the US labor force grew by 147,000 jobs, surpassing the anticipated 110,000 in June. Additionally, the Unemployment Rate declined to 4.1% from 4.2%. Meanwhile, weekly Jobless Claims fell to 233,000, down from 237,000, reflecting a resilient US labor market.

US ADP Employment Change fell for the first time in more than two years in June. The private-sector payrolls decreased by 33,000 in June after a downwardly revised 29,000 gain in May. This figure came in below the market consensus of 95,000.

The Chinese Commerce Ministry said in a statement on Friday that “China and the US are stepping up efforts to implement the outcomes of the London framework.” The US has notified China of canceling restrictive measures against Chinese exports. China is reviewing applications for export licenses of controlled items under laws and regulations.

China’s Caixin Services PMI declined to 50.6 in June from 51.1 in May, missing the market forecast of 51.0. China's Caixin Manufacturing Purchasing Managers' Index improved to 50.4 in June from 48.3 in May, according to the latest data released on Tuesday. The reading surpassed the market forecast of 49.0.

Australia’s trade surplus narrowed to 2,238M month-over-month in May, against 5,091M expected and 4,859M (revised from 5,431M) in April. Meanwhile, Exports fell by 2.7% MoM from -1.7% (revised from -2.4%) prior. Imports increased by 3.8% MoM, against the previous increase of 1.6% (revised from 1.1%).

Australian Dollar breaks below nine-day EMA near 0.6550

The AUD/USD pair is trading around 0.6530 on Monday. Daily chart’s technical analysis indicated a persistent bullish bias as the pair remains within the ascending channel pattern. The 14-day Relative Strength Index (RSI) is positioned slightly above the 50 mark, suggesting the bullish sentiment is prevailing. However, the pair has moved below the nine-day Exponential Moving Average (EMA), suggesting that short-term price momentum is weakening.

The AUD/USD pair may test the primary barrier at the nine-day EMA of 0.6546. A break above this level could improve the price momentum and support the pair to approach the eight-month high of 0.6590, recorded on July 1. Further advances would support the pair to explore the region around the upper boundary of the ascending channel around 0.6670.

On the downside, the AUD/USD pair may navigate the area around the ascending channel’s lower boundary around 0.6500, followed by the 50-day EMA at 0.6472.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

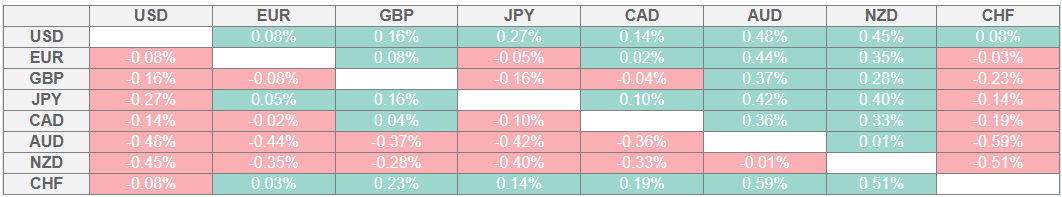

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Swiss Franc.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.