Australian Dollar advances as US Dollar receives downward pressure from cautious Fedspeak

The Australian Dollar strengthens as the US Dollar weakens amid concerns over the economic outlook and declining business sentiment.

Federal Reserve officials highlighted a drop in both business and consumer confidence, partly blaming shifts in US trade policy.

RBA’s Bullock described the rate cut as a proactive step aimed at bolstering confidence and aligning with the current economic landscape.

The Australian Dollar (AUD) edges higher against the US Dollar (USD) on Wednesday, rebounding after falling more than 0.50% in the previous session. The AUD/USD pair gains ground as the US Dollar extends its decline, pressured by cautious remarks from Federal Reserve (Fed) officials regarding the economic outlook and business sentiment.

Speaking at a panel discussion hosted by the Federal Reserve Bank of Atlanta, San Francisco Fed President Mary C. Daly and Cleveland Fed President Beth Hammack expressed growing concerns about the US economy. While key economic indicators remain solid, both officials pointed to deteriorating business and consumer confidence, attributing part of the sentiment shift to US trade policy.

The Reserve Bank of Australia (RBA), at its May policy meeting, lowered its Official Cash Rate (OCR) by 25 basis points, from 4.1% to 3.85% — a move widely anticipated by markets. In a press conference following the decision, RBA Governor Michele Bullock emphasized the importance of curbing inflation and reaffirmed confidence in the central bank’s strategy. Bullock characterized the rate cut as a proactive, confidence-boosting measure appropriate for current economic conditions. She also noted the Board’s readiness to take further steps if needed, hinting at the possibility of future adjustments.

Political instability in Australia also weighed on the AUD. The opposition coalition fractured after the National Party withdrew from its alliance with the Liberal Party. Meanwhile, the ruling Labor Party capitalized on the turmoil, returning to power with a stronger and broader mandate.

Australian Dollar appreciates as US Dollar weakens on economic concerns

The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, is losing ground for the third successive session and trading lower at around 99.90 at the time of writing.

On Tuesday, Atlanta Fed President Raphael Bostic expanded on remarks he made the previous day. Bostic warned that the inconsistent and shifting tariff policies introduced during the Trump administration risk disrupting US trade logistics, which are heavily dependent on large-scale imports to satisfy domestic demand.

The US Dollar struggles in the wake of Moody’s Ratings downgrading the US credit rating from Aaa to Aa1. This move aligns with similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now projects US federal debt to climb to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to widen to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues.

Economic data released last week pointed to easing inflation, as both the Consumer Price Index (CPI) and Producer Price Index (PPI) signaled a deceleration in price pressures. This has heightened expectations that the Federal Reserve may implement additional rate cuts in 2025, contributing to further weakness in the US Dollar. Additionally, disappointing US Retail Sales figures have deepened concerns over an extended period of sluggish economic growth.

The PBoC announced a reduction in its Loan Prime Rates (LPRs) on Tuesday. The one-year LPR was lowered from 3.10% to 3.00%, while the five-year LPR was reduced from 3.60% to 3.50%.

The National Bureau of Statistics (NBS) reported on Monday that China’s Retail Sales rose by 5.1% year-over-year (YoY) in April, falling short of the 5.5% forecast and down from 5.9% in March. Industrial Production grew by 6.1% YoY during the same period, beating the expected 5.5% but slowing from the previous 7.7% growth.

The risk-sensitive Australian Dollar gained support from renewed optimism surrounding a 90-day US-China trade truce and hopes for further trade deals with other countries. Meanwhile, US Treasury Secretary Scott Bessent told CNN on Sunday that President Donald Trump intends to implement tariffs at previously threatened levels on trading partners that do not engage in negotiations “in good faith.”

According to the Australian Bureau of Statistics (ABS), employment surged by 89,000 in April, significantly higher than the 36,400 increase in March and far above the forecasted 20,000. Meanwhile, the Unemployment Rate remained unchanged at 4.1%.

Australian Dollar remains below 0.6450, support appears at nine-day EMA

The AUD/USD pair is trading around 0.6450 on Wednesday, with daily technical indicators reflecting a bullish tone. The pair continues to trade above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) remains above the neutral 50 level—both signals supporting sustained upward momentum.

On the upside, immediate resistance is seen at the six-month high of 0.6515, recorded on December 2, 2024. A decisive break above this barrier could pave the way for a test of the seven-month high at 0.6687, which was reached in November 2024.

Initial support lies at the nine-day EMA of 0.6426, followed by the 50-day EMA near 0.6365. A firm move below these levels would undermine the short- to medium-term bullish outlook, possibly opening the path toward the March 2020 low of 0.5914.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

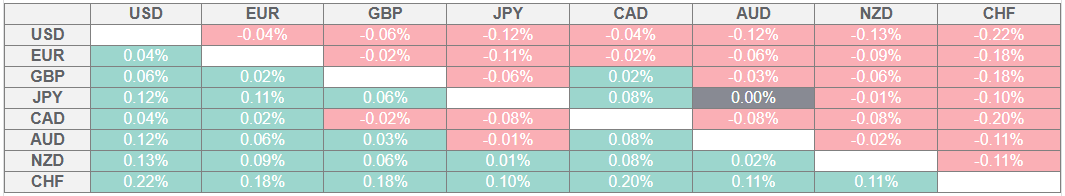

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.