Bank of Japan Policy Rate Commentary: Rate Hike May Be Less Than Expected, But It Won’t Alter the Yen’s Upward Trend

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

On 19 March 2025, the Bank of Japan (BoJ) announced its March interest rate decision. In line with widespread market expectations, the central bank kept its policy rate unchanged at 0.5%. This decision reflects caution amid Japan’s moderate economic recovery and modest inflation growth, overshadowed by external uncertainties—most notably Trump’s tariff policies—which have made the BoJ’s path to monetary normalization more tentative. The central bank’s stance remained neutral. Governor Kazuo Ueda noted that the upward trend in wage growth is encouraging, but rising inflation and uncertainties surrounding U.S. foreign policy could pose risks to the economy. He reiterated that rate hikes would continue if economic data aligns with expectations.

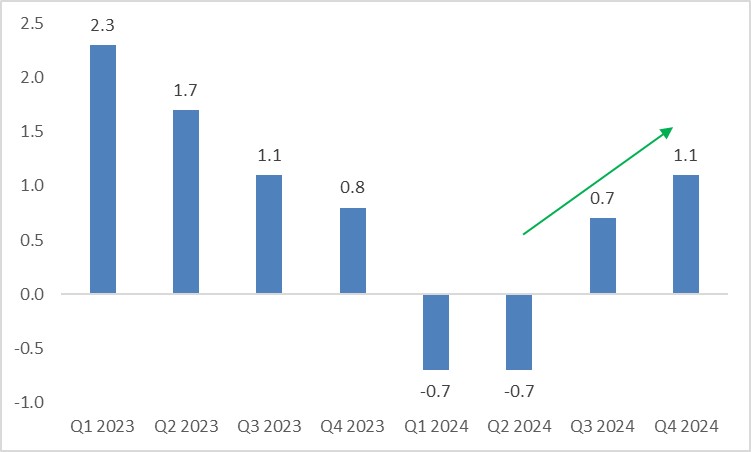

Looking ahead, we expect the BoJ to maintain its broader trajectory toward rate hikes, though a cautious approach will remain the cornerstone of its monetary policy. On the growth front, after experiencing negative growth in the first half of last year, Japan’s economy has been recovering since the second half (Figure 1), supported by low interest rates—significantly below those of other developed economies. This recovery provides a feasible foundation for further rate increases.

Figure 1: Japan's real GDP growth (y-o-y, %)

Source: Refinitiv, Tradingkey.com

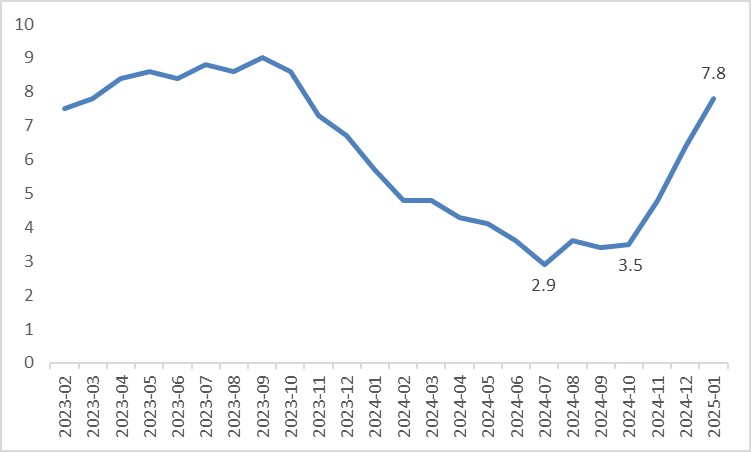

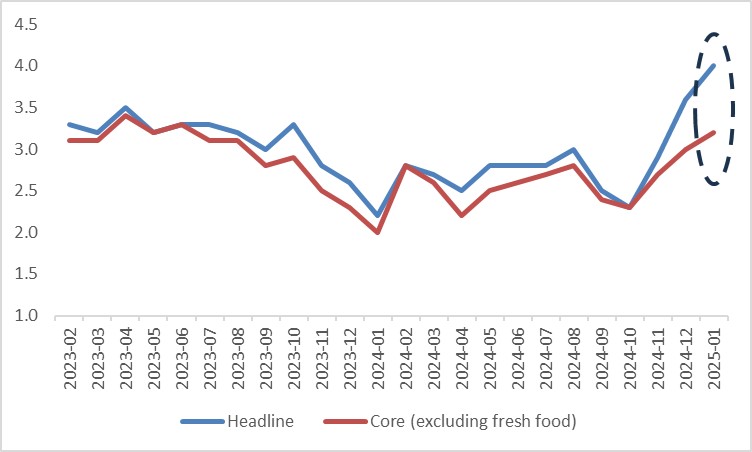

On the inflation front, elevated food prices—particularly rice (Figure 2)—combined with persistent labour market tightness have driven a recent rebound in both Headline CPI and Core CPI (excluding fresh food) from their lows (Figure 3). Additionally, the “Shunto” spring wage negotiations have shown slightly stronger wage growth. This wage-inflation spiral creates a necessary condition for sustained rate hikes.

Figure 2: Japan food CPI (%)

Source: Refinitiv, Tradingkey.com

Figure 3: Japan CPI (%)

Source: Refinitiv, Tradingkey.com

However, external factors will limit the BoJ’s ability to raise rates aggressively. Following the implementation of U.S. tariff policies on 2 April, any tariffs imposed on Japan would directly slow its economic growth. Even if the direct tariff impact is modest, a trade war’s broader suppression of global growth would indirectly affect Japan, an export-oriented economy.

Moreover, retaliatory measures from trading partners are expected to further decelerate U.S. economic growth. This could prompt the Federal Reserve to restart its rate-cutting cycle, with cuts potentially exceeding current market expectations. In turn, this would slow the BoJ’s monetary policy normalization.

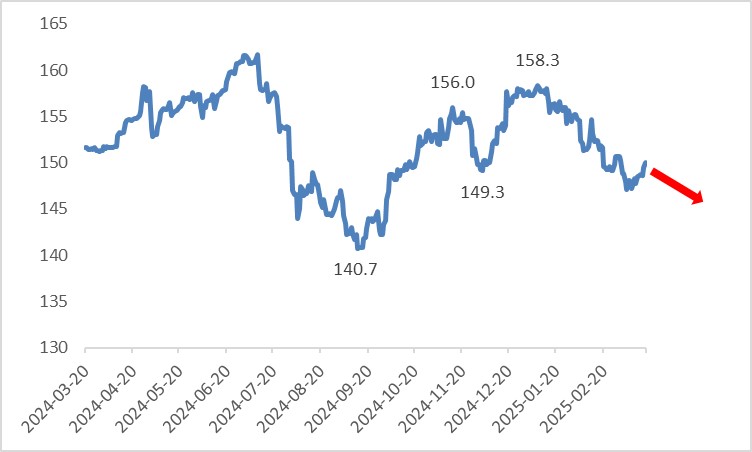

In summary, under the dual forces of supporting and constraining rate hikes, we anticipate the BoJ will raise rates once by 25 basis points by year-end—fewer than the market’s expected two hikes. Nevertheless, against a backdrop of widespread rate cuts by other global central banks, the BoJ’s tightening is likely to bolster the yen’s exchange rate (Figure 4).

Figure 4: USD/JPY

Source: Refinitiv, Tradingkey.com

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.