USD/JPY climbs slightly above 143.00 as Yen weakens on fears that Japan could face economic turbulence due to the fallout of the US tariff policy.

BoJ’s Ueda warned that US tariffs could hurt domestic wage growth.

Poor US private employment data weighs on the US Dollar.

The USD/JPY pair is up 0.25% to near 143.10 during European trading hours on Thursday. The pair trades firmly as the Japanese Yen (JPY) underperforms across the board. The Japanese currency faces a sharp selling pressure as Bank of Japan (BoJ) Governor Kazuo Ueda has warned that the United States (US) tariff policy could hurt domestic wage growth, a scenario that could delay central bank’s plans to raise interest rates in the near term.

Japanese Yen PRICE Today

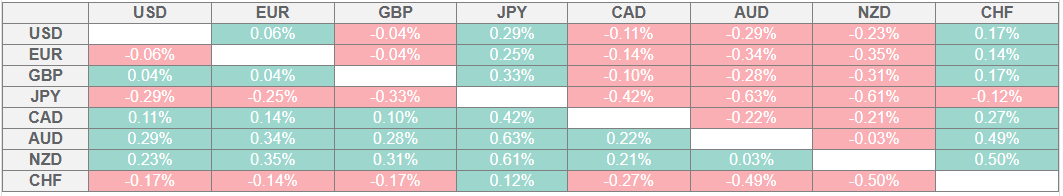

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

On Tuesday, Kazuo Ueda warned that US tariffs could weigh somewhat on “Japanese companies' winter bonus payments and next year's wage talks with unions”, Reuters reported. However, Ueda expressed confidence that the “economic and wage growth would re-accelerate, and keep consumption on a moderate uptrend”.

About the monetary policy outlook, BoJ Ueda stated that interest rate hikes would become appropriate once officials get convinced that the economy and inflation will re-accelerate after a period of economic sluggishness.

However, the upside in the pair is expected to remain limited as the US Dollar (USD) struggles to gain ground due to disappointing US economic data for May, notable poor ADP Employment Change. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, appears vulnerable near the six-week low of 98.60.

On Wednesday, the ADP report showed that the private sector added 37K fresh workers, which were lowest since January 2021. Economists anticipated a robust hiring of 115K against 60K seen in April. Additionally, an unexpected decline in the Service PMI also battered the US Dollar.

Going forward, investors will focus on the US Nonfarm Payrolls (NFP) data for May, which will be released on Friday. The official employment data will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.