Here is what you need to know on Wednesday, July 2:

The US Dollar (USD) stays resilient against its rivals early Wednesday, with the USD Index recovering toward 97.00 after closing the previous seven consecutive trading days in negative territory. Later in the day, the private sector employment report for June, published by Automatic Data Processing (ADP), will be featured in the US economic calendar.

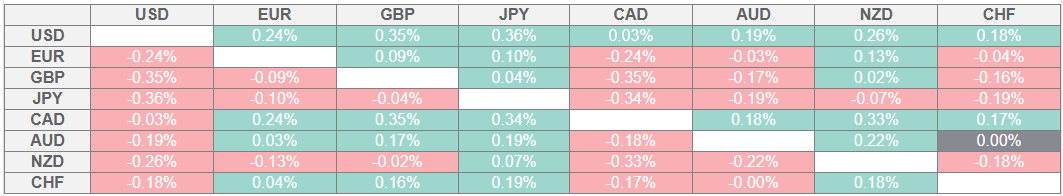

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

On Tuesday, the Senate passed United States (US) President Donald Trump's "Big Beautiful Bill," which includes a permanent extension to the 2017 tax cuts, after Vice President JD Vance made the rare tie-breaking vote. The bill now moves to the House before it's finally brought back to the White House by July 4. In the European morning on Wednesday, US stock index futures trade modestly higher, reflecting an upbeat market mood.

While speaking at a policy panel at the European Central Bank's (ECB) Forum on Central Banking on Tuesday, Federal Reserve (Fed) Chairman Jerome Powell reiterated they need to be patient with regard to policy-easing, for as long as the economy remains solid.

EUR/USD reached a fresh multi-year high at 1.1830 on Tuesday but erased a portion of its daily gains to close marginally higher. Early Wednesday, the pair stays on the back foot and trades below 1.1800. The data from the Eurozone showed that the Unemployment Rate edged higher to 6.3% in May from 6.2% in April.

GBP/USD stays in negative territory at around 1.3700 in the European session on Wednesday after posting small gains on Tuesday. Bank of England Governor Andrew Bailey repeated on Tuesday that they see signs of softening in the economy and the labour market.

USD/JPY gains traction and tests 144.00 after registering losses on Monday and Tuesday. US President Trump said late Tuesday that he is mulling over the possibility of adding additional tariffs on Japan and not extending the self-imposed July 9 deadline on the currently-suspended reciprocal tariffs.

Gold preserved its bullish momentum and gained more than 1% on Tuesday. XAU/USD stays in a consolidation phase at fluctuates below $3,350.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.