EUR/USD trades near 1.1476 after briefly breaching 1.1500 post-Fed.

Fed maintains rates; projections show slower growth, stickier inflation.

Trump open to Iran meeting, while ECB officials flag Eurozone economic weakness.

The EUR/USD trades almost flat after climbing past the 1.1500 figure, following the Federal Reserve's (Fed) decision to hold rates unchanged, amid increasing tensions in the Middle East. This, along with comments from US President Donald Trump, boosted the Dollar, capping the Euro’s (EUR) advance. At the time of writing, the pair trades at 1.1476, virtually unchanged.

Recently, the Fed kept rates at the 4.25%–4.50% range, reaffirming that the economy is expanding solidly, with strong labor market conditions. The US central bank reiterated its commitment to monitoring risks associated with both sides of its dual mandate and confirmed plans to further reduce its holdings of Treasury securities.

Additionally, Fed officials updated their economic projections. The Gross Domestic Product (GDP) was downwardly revised, the Unemployment Rate was barely affected, and inflation is expected to be slightly higher.

Regarding monetary policy, policymakers see two interest rate cuts toward the end of the year.

Aside from this, US President Donald Trump said that if Iran wants to come to the White House, he said, “I may do that.”

At the same time, Fed Chair Jerome Powell stood to his mildly neutral stance, reaffirming that monetary policy is “well positioned to respond” to external shocks like tariffs or geopolitical risks.

Earlier, the Eurozone (EU) revealed that inflation remains within the European Central Bank (ECB) target, according to May data. Meanwhile, some ECB speakers, led by Mario Centeno and Fabio Panetta, stated that the weakness of the EU economy is a cause for greater concern within the ECB, and over time it does not appear compatible with the 2% inflation target.

This could pave the way for additional cuts by the ECB, although most officials are favoring a pause in the central bank's easing cycle.

Euro PRICE This week

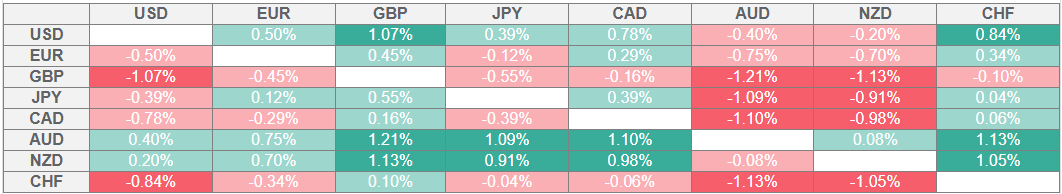

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: EUR/USD drops as Fed seems poised for two rate cuts

The EUR/USD extended its losses as Trump opens the door for Iran talks, while the Fed Chair Jerome Powell signals that rates could remain on hold for some time.

Powell said, “The effects of tariffs will depend on the level,” adding that “Increases this year will likely weigh on economic activity and push up inflation.” He said that “As long as we have the kind of labor market we have and inflation is coming down, right thing to do is hold rates.”

US Initial Jobless Claims rose by 245,000 for the week ending June 14, matching market expectations. Continuing Claims, used to soften the rate of change in the weekly print, fell 6,000 to a seasonally-adjusted 1.945 million during the week ending June 7.

Meanwhile, the housing sector showed signs of cooling. May Housing Starts fell to 1.256 million units, marking a 9.8% MoM drop from April’s 1.392 million. Building Permits also edged lower, down 2% on the month to an annual rate of 1.393 million from 1.422 million previously.

The EU Harmonized Index of Consumer Prices (HICP) in May increased by 1.9% YoY as expected, down from April’s 2.2% rise. Core HICP dipped from 2.7% to 2.3% YoY for the same period, as projected by economists.

It should be noted that the latest rise in Oil prices, sparked by the Middle East conflict, could trigger an inflation spiral, pushing prices higher and prompting central banks to become slightly hawkish.

Financial market players do not expect that the ECB will reduce its Deposit Facility Rate by 25 basis points (bps) at the July monetary policy meeting.

EUR/USD technical outlook: Fiber tumbles below 1.1500 as bears eye 1.1450

The EUR/USD uptrend remains intact as long as the Fiber pair is above the 20-day Simple Moving Average (SMA) at 1.1493. Price action shows that a successive series of higher highs and higher lows remain, which could pave the way for further gains.

For a bullish continuation, the pair needs to clear 1.1500 and the June 17 high of 1.1578. If surpassed, the next stop would be 1.1600, followed by the yearly high of 1.1631. Conversely, a daily close below 1.1500 paves the way for a challenge of 1.1450. The next key support would be the 20-day SMA at 1.1419, followed by 1.1400.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.