EUR/USD trades sideways around 1.1440 as investors await the US NFP data for May.

Easing US-China trade worries have supported the US Dollar.

The ECB reduced its key borrowing rates by 25 bps on Thursday.

The EUR/USD pair trades in a limited range around 1.1440 during Asian trading hours on Friday. The major currency pair consolidates as investors await the United States (US) Nonfarm Payrolls (NFP) data for May, which will be published at 12:30 GMT.

Investors will pay close attention to the US official employment data as it will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook. According to the estimates, the US economy added 130K fresh workers, lower than 171K hired in April. The Unemployment Rate is seen as steady at 4.2%.

Ahead of the US employment data, the US Dollar (USD) ticks up after holding late-Thursday’s recovery move. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, edges higher to near 98.80.

The USD Index bounced back on Thursday after comments from US President Donald Trump in a post on Truth.Social suggested de-escalation in trade tensions between Washington and Beijing. "The call lasted approximately one and a half hours, and resulted in a very positive conclusion for both countries.” Trump wrote. The scenario of stable trade relations between the US and China is favorable for the US Dollar, given that Beijing is key exporter to the US.

Meanwhile, the Euro (EUR) underperforms across the board while comments from European Central Bank (ECB) officials suggest that the monetary expansion cycle has been concluded for now. ECB policymaker and Governor of the Bank of Estonia Madis Muller stated during early European trading hours that he is comfortable with President Christine Lagarde’s comments, which indicated that the “policy-easing cycle is almost finished”.

Euro PRICE Today

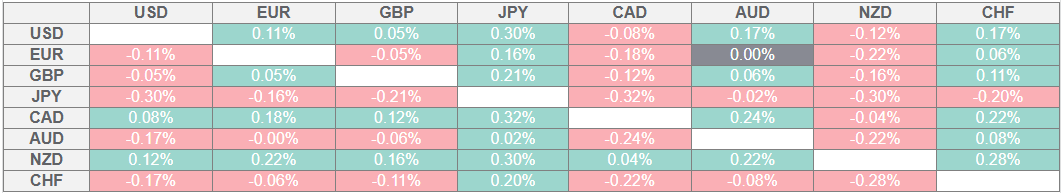

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The comments from Christine Lagarde came in the press conference after the monetary policy announcement in which the ECB reduced the Deposit Facility rate by 25 basis points (bps) to 2%, as expected. This was the seventh straight interest rate cut by the ECB and eighth since June last year when it started the monetary expansion cycle.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.