The Euro hesitates as markets brace for an ECB interest rate cut.

Weak Eurozone growth and soft inflation figures point to further easing this year.

The US Dollar struggles after downbeat US services data.

EUR/USD edged lower in a calm Asian session on Thursday and trades right above the 1.1400 level at the time of writing. The US Dollar (USD) was hit by downbeat US macroeconomic data on Wednesday before stalling at 1.1435 and the focus has shifted to the European Central Bank’s (ECB) monetary policy decision due later in the day.

The ECB is widely expected to cut interest rates for the eighth consecutive time, and is highly likely to signal a pause in July. The bank’s President Christine Lagarde will try to convey a neutral message, but the Eurozone’s weak economic growth and the moderating inflation point to further easing down the road.

The US Dollar, on the other hand, remains frail, as downbeat US data has revived fears of an economic recession, amid uncertainty over tariffs and looming concerns about US debt.

The US services sector’s activity contracted against expectations in May, according to the ISM PMI release. This is the first contraction in almost a year and follows another decline in manufacturing activity and poor factory orders seen early this week, which has revived concerns of an economic recession.

Beyond that, US ADP figures revealed a shorter-than-expected increase in employment, dampening enthusiasm about the upbeat job openings seen on Tuesday and casting doubts about Friday’s Nonfarm Payrolls report. Wednesday’s data soured market sentiment and triggered a significant reversal on the US Dollar Index (DXY).

Euro PRICE Today

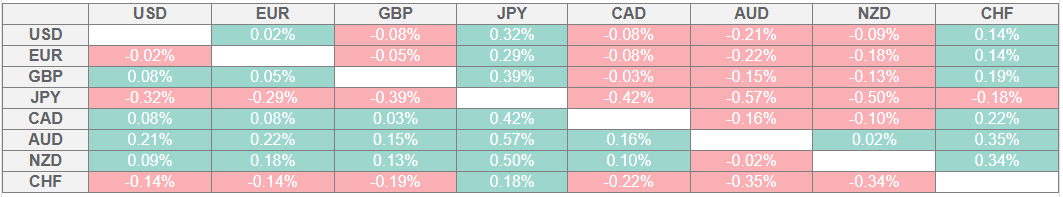

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Euro hesitates ahead of the ECB decision

The Euro is trading sideways, right above the 1.1400 level, buoyed by a US Dollar on the back foot. Investors, however, are wary of placing large Euro bets, awaiting the ECB monetary policy decision and further insight into the next steps.

The ECB will, most likely, cut interest rates by 25 basis points to a 2% level. The main attraction of the event will be President Lagarde’s press conference, from which markets are expected to draw some fresh cues into the central bank’s plans.

Lagarde will stick to the “meeting by meeting” line, but recent Eurozone data has shown a frail economic growth and cooling inflationary pressures, which suggest that the ECB might cut rates further later this year to support economic activity.

In the US, ISM Services PMI fell against expectations and soured market sentiment. May’s PMI declined to 49.9 from April’s 51.6, against market expectations of a 52.00 level. Prices paid increased, and the employment subindex expanded after having contracted in the previous months.

The negative impact of the PMI was heightened by a downbeat ADP Employment Change report, which showed a 37K increase in May’s private payrolls, well below the 115K rise anticipated by the market consensus.

Beyond that, trade uncertainty remains high. US President Donald Trump’s 50% levies on Steel and Aluminum came into effect on Wednesday amid a lack of progress on any significant trade deal. He complained that it is “extremely hard to make a deal” with Chinese President Xi Jinping, which confirms that the world’s major economies are far from solving their trade issues.

Technical analysis: EUR/USD wavers around 1.1400 lacking a clear bias

EUR/USD reversal from the six-week highs hit on Tuesday has been contained at the mid-range of the 1.1300s, but the pair has lost momentum above 1.1400 with investors looking from the sidelines, a few hours ahead of the ECB’s monetary policy decision.

The four-hour chart RSI is turning flat near the 50 level, suggesting that the pair’s bullish momentum is ebbing. The lower high on Wednesday, despite the weak US data, is a negative sign.

The pair would need to breach 1.1460 to confirm the bullish trend and aim to 1.1545, where the April 22 high and the trendline resistance meet.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.