EUR/USD appreciates on Monday, with the US Dollar weighed by fresh tariff threats and a trade rift with China.

Looming concerns about US fiscal stability keep undermining confidence in US assets.

Euro bulls are likely to be challenged at the 1.1415 area.

EUR/USD is trading with minor gains on Monday. The pair is moving near 1.1400 at the time of writing, with the US Dollar undermined by US President Donald Trump’s fresh tariff threats, a new trade rift with China, while debt concerns remain looming.

Trump rattled markets late Friday, announcing to double tariffs on Steel and Aluminum imports, from 25% to 50%. Investors are wary that such levies will hurt economic growth and boost US inflation.

Beyond that, the US president has further poisoned an already frail trade relationship with China, complaining that Beijing violated an agreement on minerals. Chinese authorities have deemed the accusations as “groundless and threatened to respond with forceful measures.”

This new chapter on the US chaotic trade policy adds to the looming concerns about the country’s fiscal stability. A sweeping tax bill that is expected to add trillions of US Dollars to the Government debt prompted Moody’s to downgrade US ratings two weeks ago and has been fuelling the “Sell America” trade.

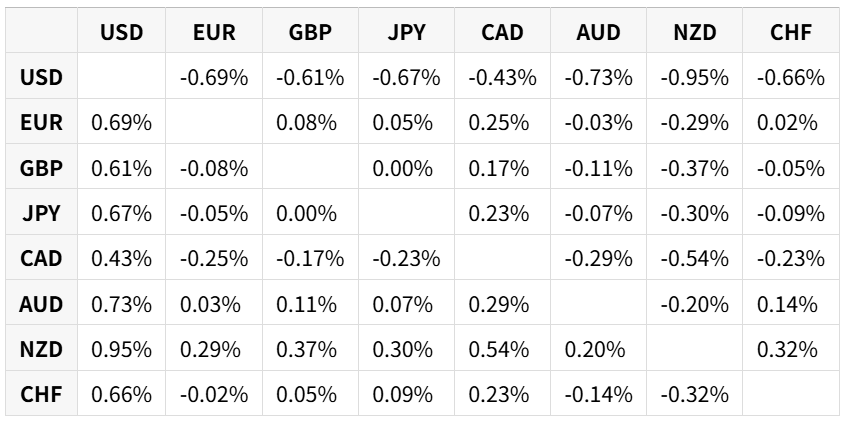

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The US Dollar opens the week on the back foot

The Euro is drawing support from US Dollar weakness, with market sentiment faltering ahead of a busy week in terms of data. Asian markets are posting losses, with European and US indexes pointing to negative openings. The US Dollar Index dips 0.3%, retracing Friday’s gains.

Earlier on Monday, Federal Reserve (Fed) Governor Christopher Waller remained optimistic about the possibility of interest rate cuts in the coming months, despite higher inflationary tensions stemming from tariffs. His comments have increased negative pressure on the US Dollar.

The US Personal Consumption Expenditures (PCE) Price Index data released on Friday endorses Fed Waller’s views. The central bank’s inflation gauge of choice year-over-year (YoY) eased to 2.1% in April, from the previous 2.3% and beyond market expectations of a 2.2% reading. Likewise, the core PCE YoY moderated to 2.5% from 2.7% in March.

US Treasury Secretary Scott Bessent affirmed on Sunday that he is confident that the latest rift with China will be solved when Trump and Chinese President Xi Jinping have a conversation. Beijing’s reactions to the accusation, however, do not give the impression that the Chinese authorities are going to take the first step.

Euro bulls are likely to be challenged on an event-packed week. Eurozone CPI will be released on Tuesday. Previous inflation data from member countries suggests that price pressures have continued cooling, which paves the way for further monetary easing by the European Central Bank (ECB).

On Thursday, the ECB is widely expected to cut interest rates for the eighth consecutive time. ECB President Christine Lagarde will try to deliver a neutral message, but with the Eurozone economy stalled and inflation coming down to target, the bank will be forced to ease monetary policy further to support growth. This might trigger some Euro selling.

In the US, the focus today will be on May’s ISM Manufacturing PMI, which is expected to have improved from the previous month, although still at levels consistent with contraction in the sector’s activity. The US Dollar would need a positive surprise to ease concerns about an economic slowdown.

Technical analysis: EUR/USD is likely to face resistance at the 1.1415 - 1.1435 area

EUR/USD is moving up on Monday, with technical indicators pointing higher. Price action has returned to levels right below 1.1400, and looks likely to test the area between 1.1415 and 1.1435 where the pair has been capped several times.

A successful move above this area would put bulls back in control and shift the focus towards 1.1545.

Failure to break this level, on the contrary, might put the May 30 low at 1.1315 back in play ahead of the 1.1220 support area.

EUR/USD 4-Hour Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.