EUR/JPY Price Forecast: Keeps bullish vibe above 172.00, overbought RSI warrants caution for bulls

EUR/JPY trades in positive territory for the third consecutive day around 172.20 in Wednesday’s early European session.

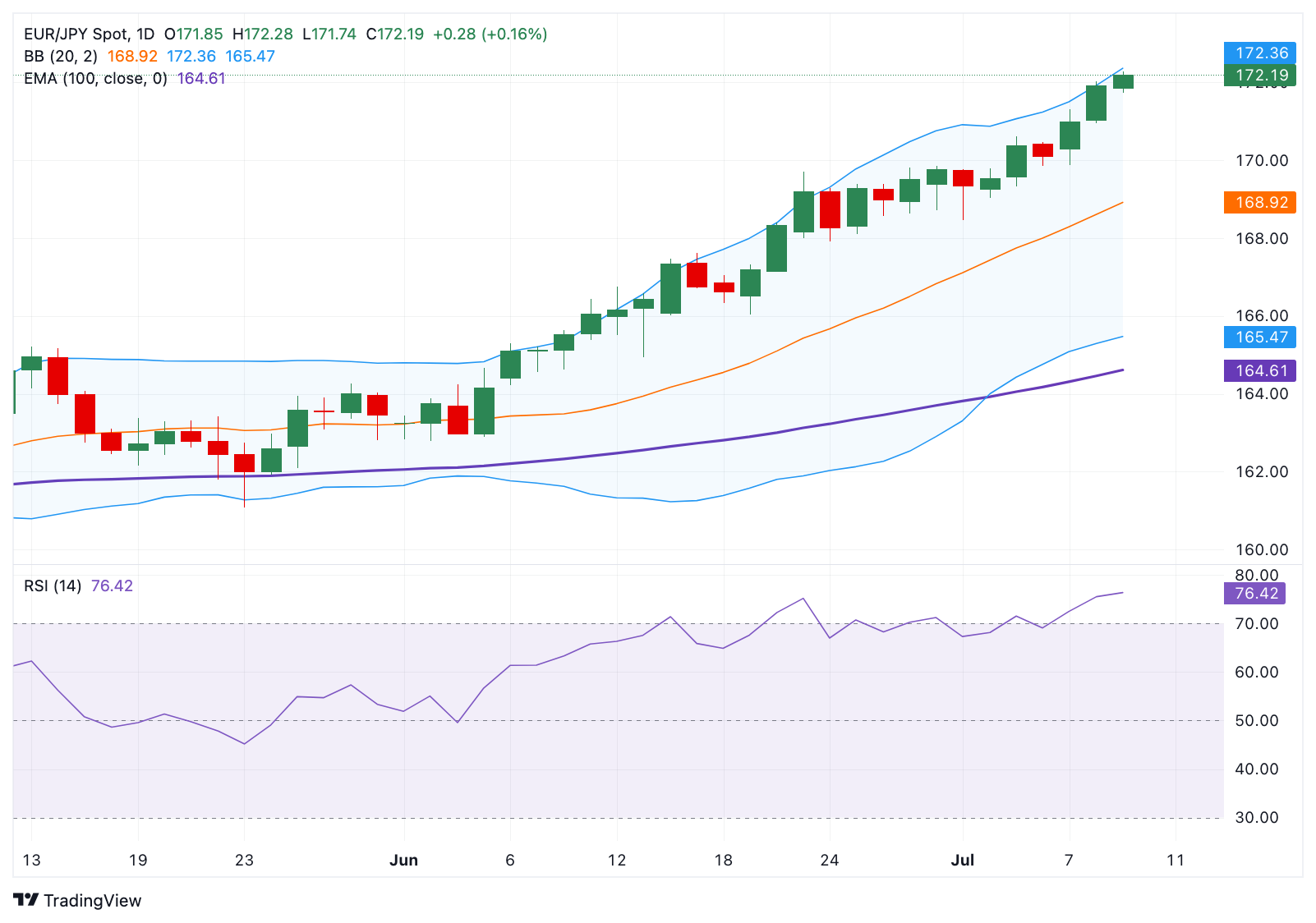

The positive bias of the cross prevails above the 100-day EMA, but the overbought RSI condition might cap its upside.

The immediate resistance level emerges at 172.35; the first downside target to watch is the 170.00 round mark.

The EUR/JPY cross extends its upside to near 172.20 during the early European session on Wednesday. The Japanese Yen (JPY) edges lower against the Euro (EUR) due to concerns about the economic fallout from US President Donald Trump's 25% tariffs from a new deadline of August 1 on Japanese goods.

Technically, the constructive outlook of EUR/JPY remains in place as the cross is well-supported above the key 100-day Exponential Moving Average (EMA) on the daily chart. However, the 14-day Relative Strength Index (RSI) stands above the midline near 76.40, indicating the overbought RSI condition. This suggests that further consolidation or temporary sell-off cannot be ruled out before positioning for any near-term EUR/JPY appreciation.

The upper boundary of the Bollinger Band of 172.35 acts as an immediate resistance level for the cross. Extended gains could see a rally to 172.83, the high of July 17, 2024. The additional upside filter to watch is 174.52, the high of July 3, 2024.

On the flip side, the initial support level for EUR/JPY is located at the 170.00 psychological level. Sustained trading below the mentioned level could see a drop to 169.04, the low of July 2. The next downside target emerges at 168.10, the low of June 25.

EUR/JPY daily chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.