XRP funding rates’ decline suggests rising caution among investors as the crypto market correction extends.

Spot traders have managed to soak up the selling pressure with net outflows across Binance, OKX, Kraken and Bybit.

XRP could decline to find support near $2.17 after posting a double-top pattern in the recent market decline.

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

XRP funding rates decline as spot traders attempt to weather selling pressure

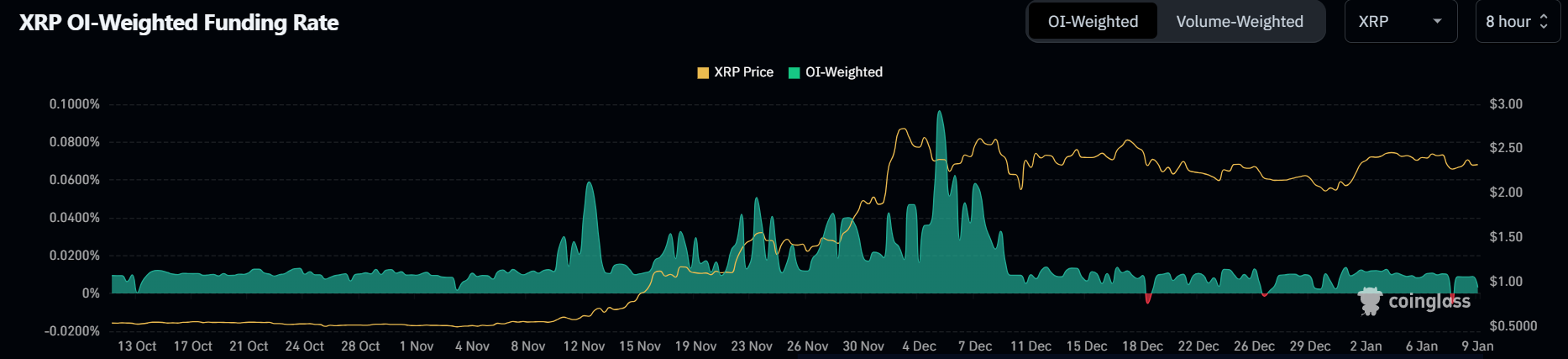

XRP's funding rate briefly flipped negative in the past 24 hours and is well below the stable 0.01% level following the extended decline in the crypto market, per Coinglass data.

XRP Funding Rates. Source: Coinglass

Funding rates are periodic payments between crypto futures traders to help keep the price of a derivatives contract close to its underlying asset's spot price. When funding rates are negative, it suggests rising bearish pressure and short traders pay a fee to long traders — and vice versa when funding rates are positive.

Additionally, XRP's open interest has remained at elevated levels since seeing a spike on Monday.

The recent XRP funding rates decline to 0.03% with open interest remaining at high levels, suggests a cautioned optimism among traders as bearish sentiments have continued to prevail in the market. Conversely, markets often rebound when funding rates decline below normal levels during bullish seasons.

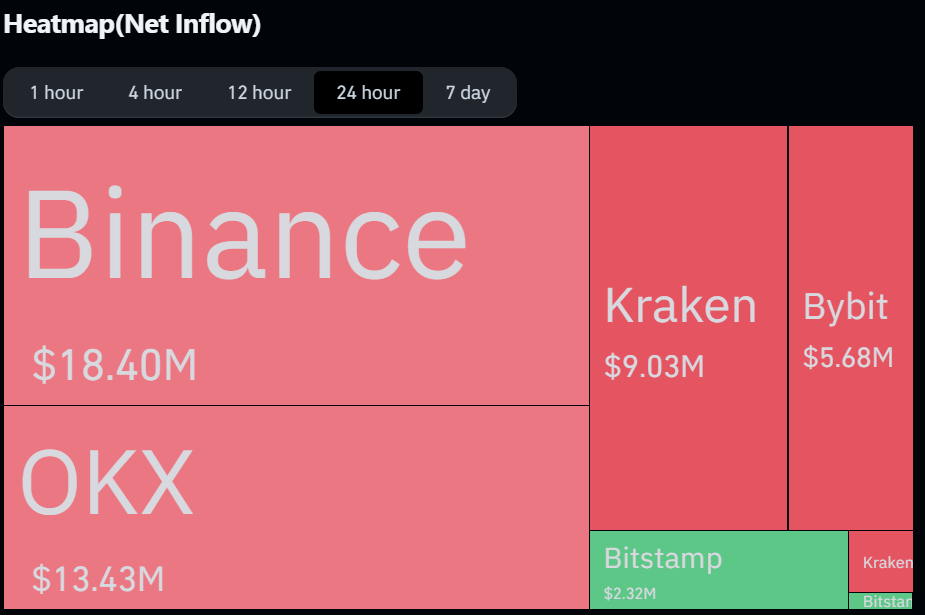

This partially explains why XRP spot traders are buying the dip, with exchanges like Binance, OKX, Kraken and Bybit seeing net outflows. Net outflows in crypto exchanges indicate rising buying pressure.

XRP Exchange Net Flows. Source: Coinglass

Meanwhile, Ripple's President Monica Long has stated in an interview with Bloomberg Crypto that the firm's RLUSD stablecoin will expand into prominent exchanges in 2025, with Bitstamp as the latest to support the token. She also expressed that an XRP ETF could be next in line after Bitcoin and Ether ETFs launched last year.

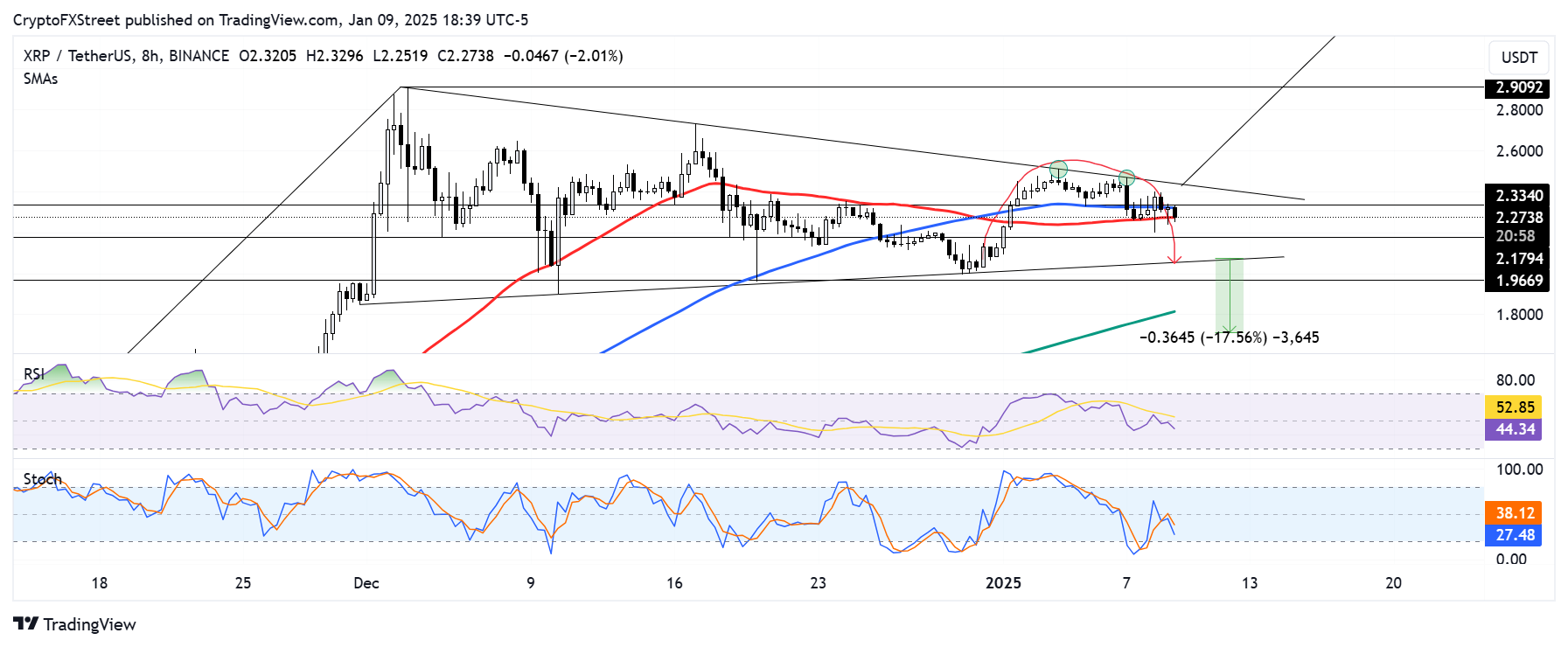

XRP could test the $2.17 support after posting a double-top pattern

Ripple's XRP sustained $11.76 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions crossed $9.54 million, while short liquidations were $2.22 million.

XRP formed a double top pattern after two rejections at the upper boundary of a pennant, subsequently falling below the $2.33 support level. Consequently, the remittance-focused token may decline further to find support around $2.17.

XRP/USDT 8-hour chart

If XRP extends the decline and breaks below $2.17, it could bounce off the lower boundary support of the pennant. However, a move below the pennant and the support level at $1.96 will validate a rounding top pattern that could send XRP toward $1.71 — a level obtained by measuring the pattern's height and projecting it downward.

On the upside, XRP could rally to test the $2.90 resistance if it sustains a candlestick close above the pennant.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating dominant bearish momentum.

A daily candlestick above $2.90 will invalidate the thesis.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.