- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

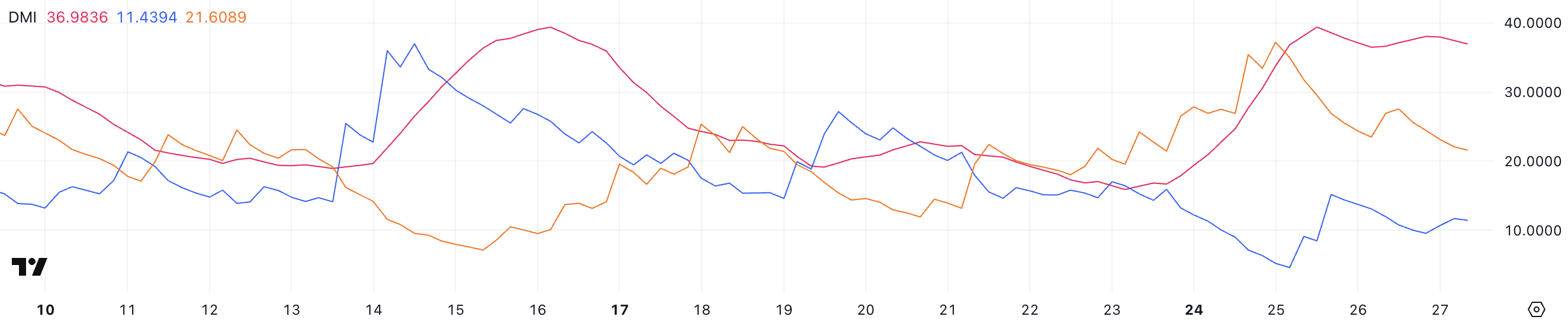

XRP is correcting by almost 30% in the last 30 days, with its price trading below $3 for nearly a month. The Directional Movement Index (DMI) shows a strong downtrend, with the Average Directional Index (ADX) surging above 35, indicating increased bearish momentum.

However, a potential reversal could occur if the SEC drops its lawsuit against XRP, possibly triggering a rally toward key resistance levels.

XRP DMI Shows the Lack of a Clear Direction

XRP’s Directional Movement Index (DMI) reveals that its Average Directional Index (ADX) is currently at 36.98, a significant increase from 15.89 just four days ago.

The ADX is a trend strength indicator that does not indicate the direction of the trend but measures its intensity. Typically, an ADX value above 25 signals a strong trend, while a value below 20 suggests a weak or non-trending market.

With XRP’s ADX rising sharply above 35, it indicates that the current downtrend is gaining momentum.

This surge in ADX suggests that market participants are showing stronger conviction, making the existing trend more likely to continue.

XRP DMI. Source: TradingView.

XRP DMI. Source: TradingView.

Meanwhile, XRP’s +DI (Positive Directional Indicator) is at 11.4, down from a high of 15.1 two days ago, indicating weakening bullish pressure. In contrast, the -DI (Negative Directional Indicator) has declined to 21.6 from 37.2 on February 2, showing a decrease in bearish momentum.

Despite the reduction in bearish pressure, the -DI remains above the +DI, confirming that the downtrend is still intact. The widening gap between the ADX and the directional indicators suggests that the downward trend is strong and persistent.

Until the +DI crosses above the -DI, signaling a potential trend reversal, XRP is likely to remain in a bearish phase.

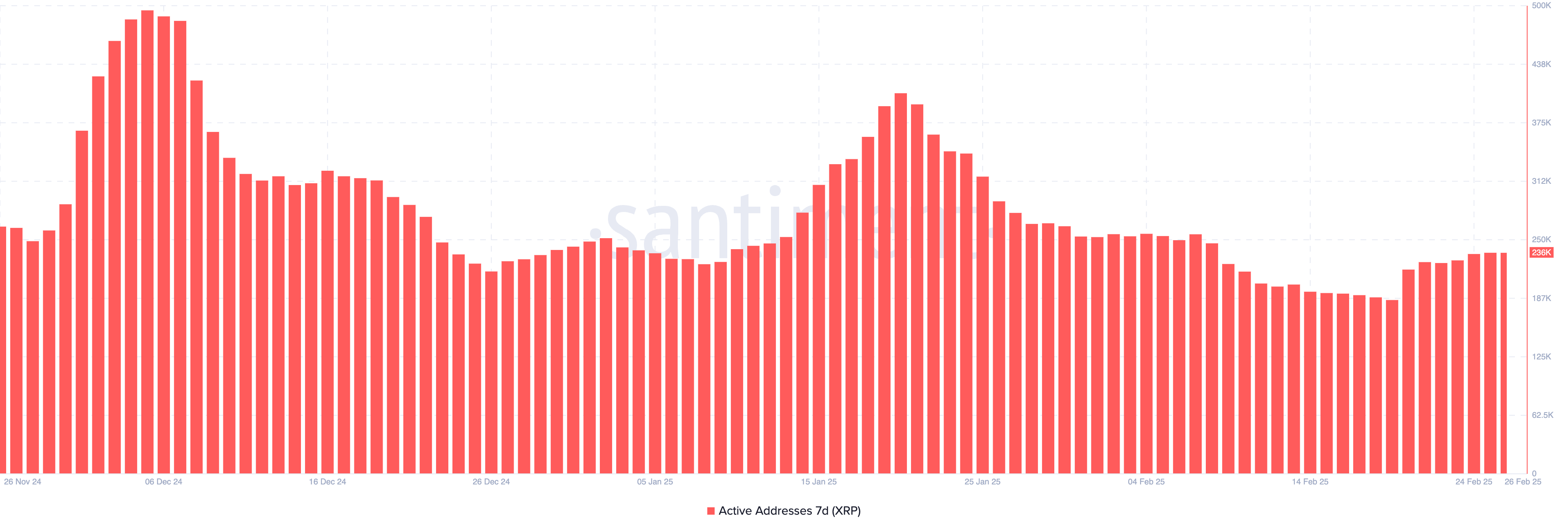

XRP Active Addresses Are Recovering After Reaching Its Lowest Level In 3 Months

The number of 7-day XRP Active Addresses dropped from 407,000 on January 20 to about 186,000 on February 19, the lowest level since November 2024.

This metric is important because it measures user engagement and network activity, reflecting demand for XRP. A decline suggests reduced interest and bearish sentiment, while an increase indicates growing participation and potential buying pressure. The sharp drop signaled waning investor interest, contributing to XRP’s bearish outlook.

7-Day XRP Active Addresses. Source: Santiment.

7-Day XRP Active Addresses. Source: Santiment.

Recently, XRP Active Addresses started to recover, reaching 236,000 – up 26.8% in the last week. This increase suggests growing user activity and renewed interest in the network.

Historically, rising active addresses can precede price recoveries as participation leads to higher demand. If this trend continues, it could support a potential price rebound, but sustained growth is needed to confirm a bullish shift.

XRP’s Uptrend Largely Depends on the SEC and Ripple Lawsuit

XRP’s EMA lines currently show a bearish setup, with short-term lines below long-term ones. The price has been trading below $3 since February 1.

This alignment suggests continued downward momentum, as shorter EMAs reflect recent bearish sentiment. If the downtrend persists, XRP could test two strong support levels at $2.15 and $2.06.

If these are lost, XRP price could fall to $1.77, dropping below $2 for the first time since November 2024.

XRP Price Analysis. Source: TradingView.

XRP Price Analysis. Source: TradingView.

However, a trend reversal is possible, especially if the SEC drops its lawsuit against XRP in March. Recently, the SEC dropped cases against Gemini, Uniswap, Robinhood, and Coinbase, signaling a shift in regulatory pressure.

If the lawsuit is dropped, it could trigger an uptrend, with XRP testing resistances at $2.36 and $2.52. If these levels are broken, XRP could continue rising towards $2.71, potentially reversing the bearish outlook.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.