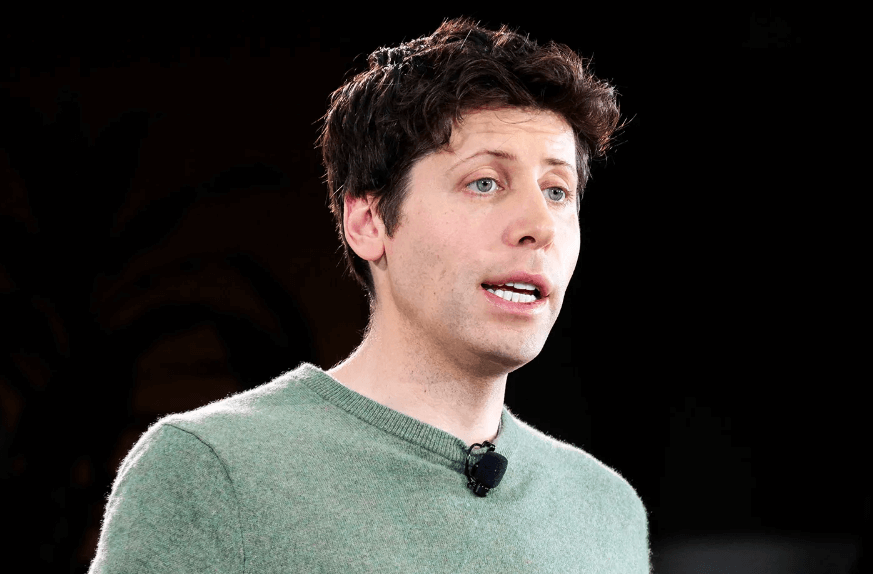

Sam Altman’s Worldcoin Raises $135 Million—WLD Token Jumps 15%

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Worldcoin’s parent entity, the nonprofit World Foundation, has injected fresh momentum into its biometric-identity project after selling $135 million worth of liquid WLD tokens at spot price to two of its earliest backers, Andreessen Horowitz (a16z) and Bain Capital Crypto. The direct purchase—explicitly “not a venture round… a direct purchase of non-discounted liquid tokens,” according to the foundation—adds the same amount of WLD to circulating supply and leaves no lock-ups or preferential terms on the table.

Worldcoin Rakes In $135 Million

The sale is meant to bankroll a rapid expansion of Worldcoin’s iris-scanning “Orb” hardware in the United States—still the project’s toughest regulatory theater—and to keep pace with surging demand abroad. “To date, more than 26 million users participate in the World network and more than 12.5 million people have an Orb-verified World ID,” the foundation said in its press release, adding that the capital will help the network become “one of the first self-sustaining protocols.”

Andreessen Horowitz’s participation is consistent with its early role in the project. The venture firm was a lead investor in Tools for Humanity—the company that incubated Worldcoin—during its 2021 Series A, making it a foundational backer of the ecosystem even before the World Foundation was established.

Market observers were struck by the size and terms of the buy. Bitwise CIO Matt Hougan noted on X that “a16z and Bain just bought $135 m of Worldcoin (WLD) at the current market price … a price that is down 90% over the past 14 months. I’m not sure I’ve ever seen something like that. Intriguing tbh.” When a user suggested the purchase might simply be a “look at this thing that Sam Altman is involved with that’s so cheap,” Hougan replied, “yes, could be.”

Worldcoin casts its “proof-of-personhood” scheme as a necessary counterweight to the acceleration of artificial general intelligence. The foundation insists that identity verification tools “should scale at a similar pace to help prepare humanity for the AGI era,” and says the latest funding will be deployed primarily to manufacture more Orbs, subsidize US city roll-outs, and refine the protocol’s fee model.

With venture capital titans effectively doubling down at market price—and doing so after a near-90% drawdown—the trade is being interpreted as a high-conviction signal that the biometric-identity narrative may be poised for a second act. Whether that confidence can overcome regulatory headwinds and lingering privacy concerns will define the next chapter for Sam Altman’s most controversial crypto experiment.

WLD Chart Check

A weekly chart of WLD/USDT (Binance) shows price rebounding in a V-bottom manner from the low at $0.57—the 0-Fib anchor in the current retracement grid—and pushing into the cluster of moving averages that have capped every rally since the beginning of the year.

The 20-week EMA ($1.27) is the immediate hurdle; clearing it would expose the 50-week EMA at $1.87 and then the 0.236 Fibonacci retracement at $3.27.The psychologically weighty $5 region around the 0.382 level could come afterwards.

Notably, momentum has brightened: the weekly RSI is curling upwards, while higher volume bars confirm fresh dip-buying interest. Still, the longer-term structure remains decisively bearish so long as price trades beneath the $1.33-$1.41 resistance area.

At press time, WLD traded at $1.337.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.