Shiba Inu Price Drops 22% Due to SHIB Holders’ Skepticism

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- U.S. to freeze and take control of Venezuela's Bitcoin holdings after Maduro capture

- US Q4 Earnings Season Set to Begin: Can US December CPI Data Bolster Rate Cut Case? [Weekly Preview]

- Silver Price Forecast: XAG/USD bulls look to build on momentum beyond $79.00

- Trump’s Tariff Ruling Lands Today: Market to Rise or Fall — The Decision Will Tell

Shiba Inu’s (SHIB) price is being affected by rising bearish sentiment among its investors, which is evident in their behavior.

If this skepticism intensifies further, the meme coin might find recovering from the five-month low difficult.

Shiba Inu Investors Vote for a Decline

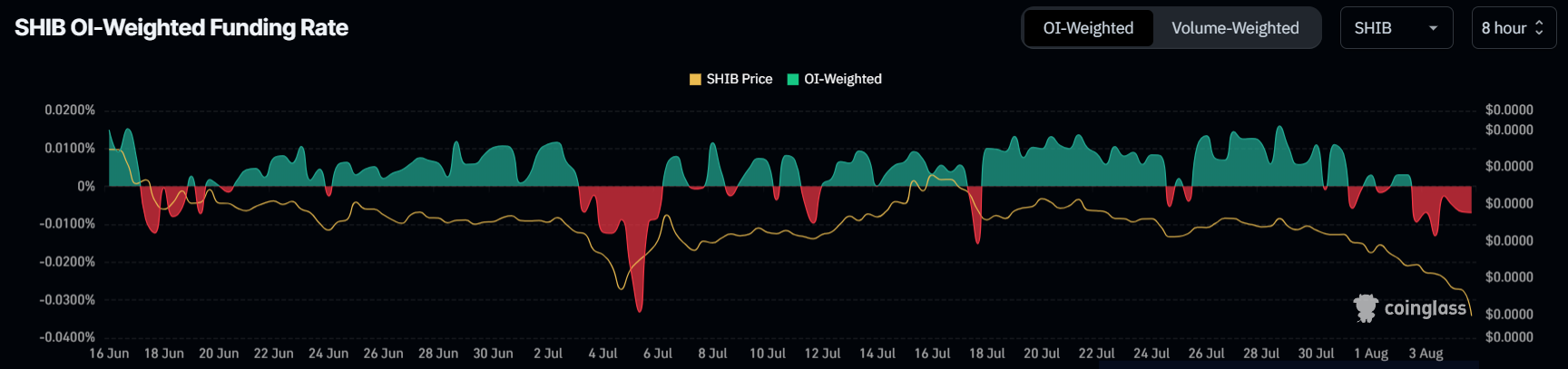

The 22% drop in Shiba Inu’s price over the last 24 hours results from bearish investors and similar market conditions. Signs of SHIB holder’s negative sentiment became evident following the shift in funding rate.

The funding rate indicates that SHIB investors have been anticipating a decline, with their expectations aligning with the recent drop in price. Their concerns about a downturn were realized as soon as the price turned red.

Shiba Inu Funding Rate. Source: Coinglass

Shiba Inu Funding Rate. Source: Coinglass

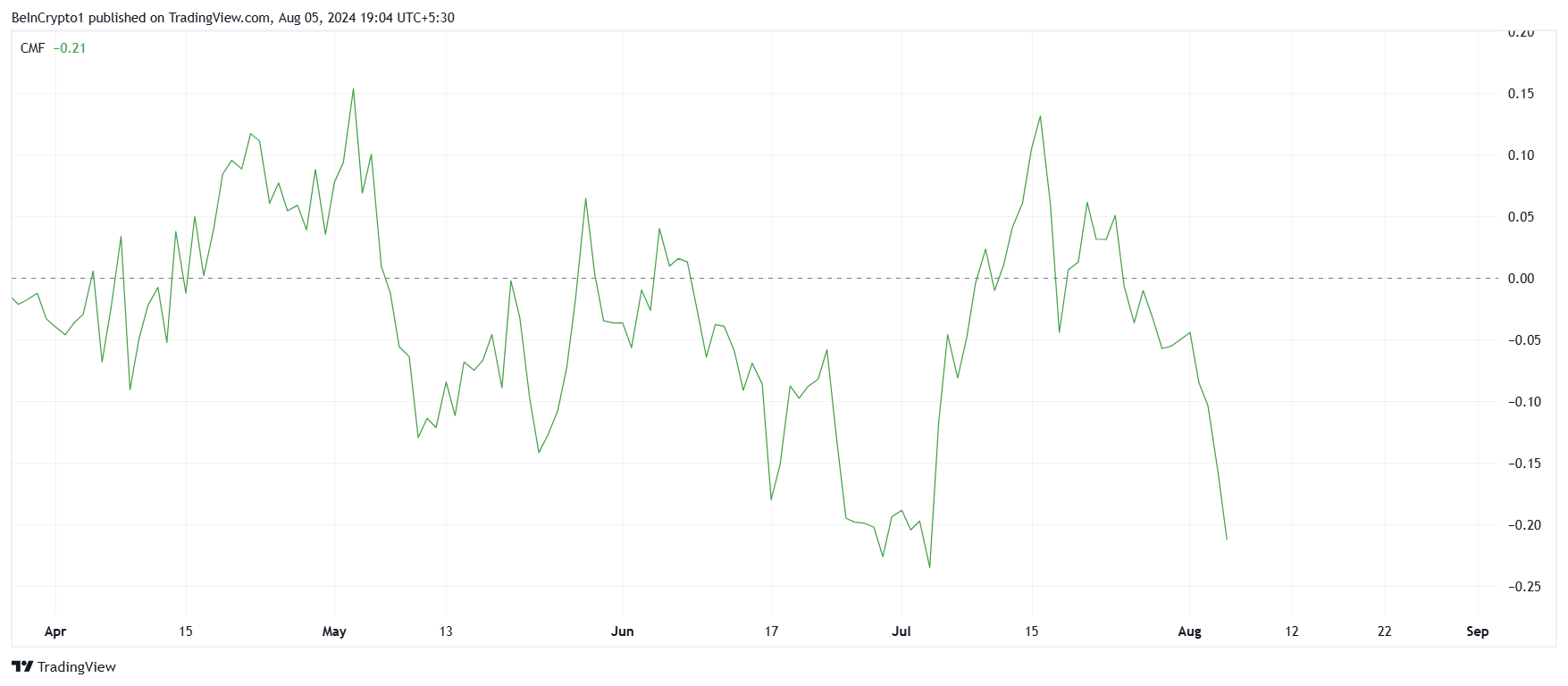

The Chaikin Money Flow (CMF) further illustrates that Shiba Inu investors have been actively withdrawing their investments. This trend of significant outflows highlights growing caution or dissatisfaction among the investor base.

CMF shows that the outflows have reached a two-month high, stressing out the scale of the withdrawals. This heightened activity substantiates the notable shift in investor sentiment regarding SHIB.

Shiba Inu CMF. Source: TradingView

Shiba Inu CMF. Source: TradingView

The increase in outflows reflects a broader trend of investors pulling back from Shiba Inu. This is potentially due to concerns about the token’s performance or broader market conditions reflected in the price.

SHIB Price Prediction: Breaching the Trend Line

Shiba Inu’s price at $0.00001105 fell below the support of $0.00001141, leaving the altcoin vulnerable to falling to the support of $0.00000898. This level has prevented further decline in the past, and SHIB could bounce back from it.

To recover and break the downtrend line, the meme coin must first turn $0.00001473 into support. Given the current challenges, this could be difficult, and SHIB might consolidate below this level.

Shiba Inu Price Analysis. Source: TradingView

Shiba Inu Price Analysis. Source: TradingView

On the other hand, if SHIB investors change their stance and turn bullish again, recovery is possible. Breaching the downtrend line would invalidate the bearish thesis and help reclaim lost profits.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.