Ethereum Layer 2 chains see nearly 32 million transactions per week after Dencun upgrade

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises above $4,950 as US-Iran tensions boost safe-haven demand

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Silver Price Forecast: XAG/USD rises to near $78.00 on safe-haven demand

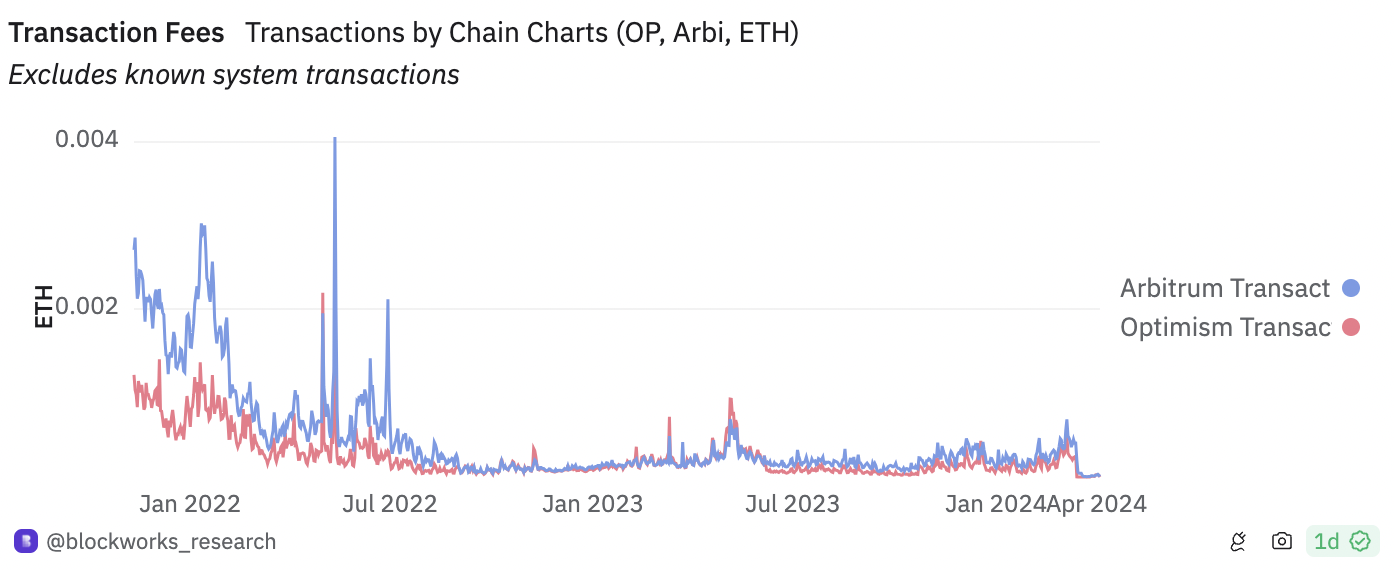

■ Ethereum Dencun upgrade resulted in a significant decline in Layer 2 gas costs, driving higher on-chain activity to these protocols.

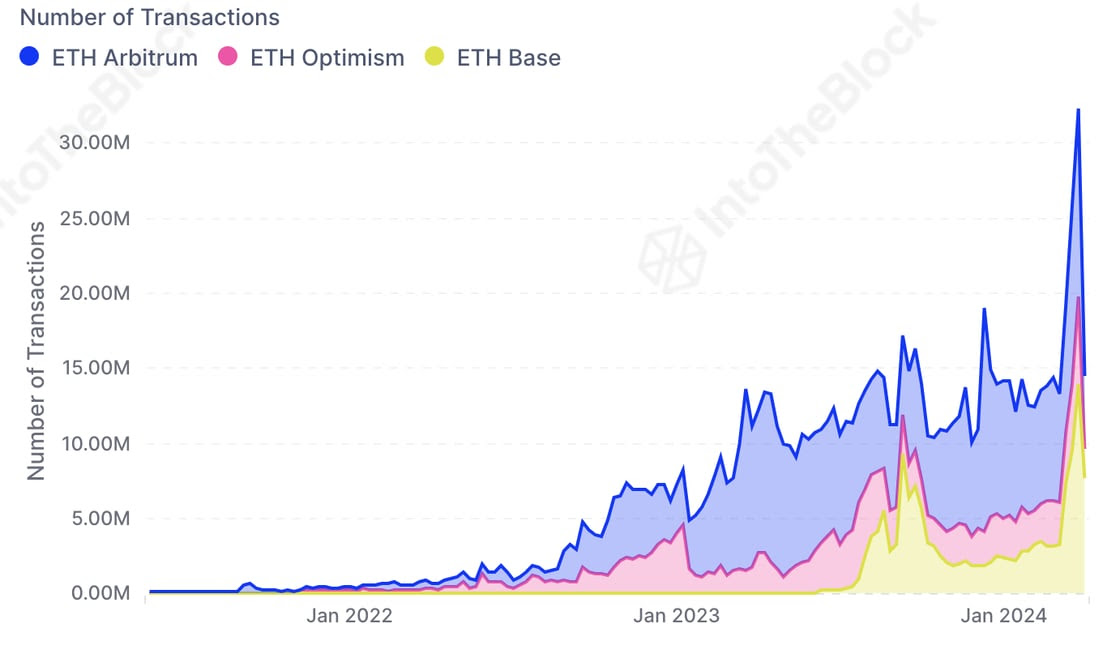

■ Transactions climbed to nearly 32 million per week on Arbitrum, Optimism and Base.

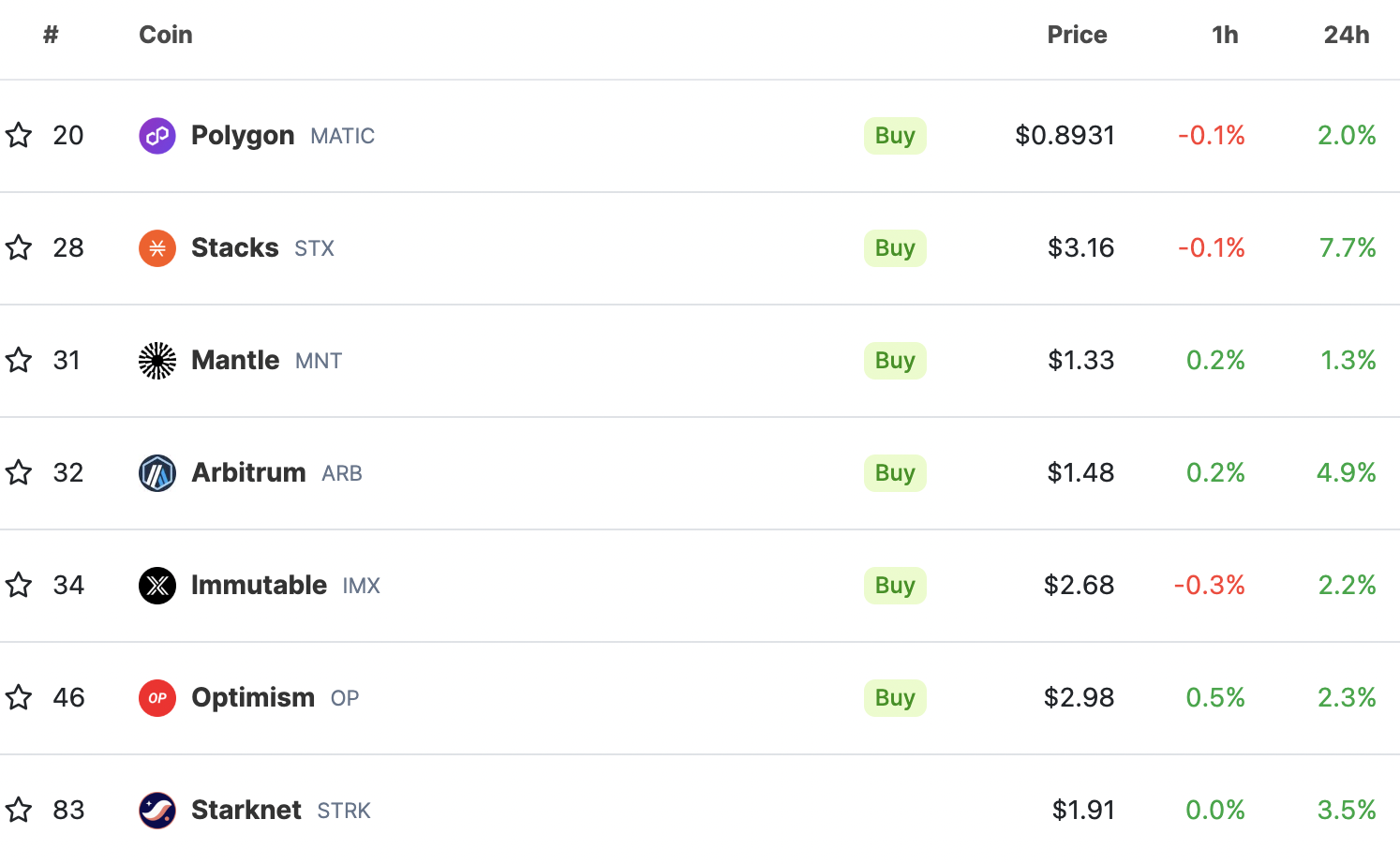

■ Prices of Layer 2 tokens climbed between 1% and 8% on Saturday.

Ethereum Layer 2 gas costs plummeted in response to the Dencun upgrade. Data from intelligence tracker IntoTheBlock show that the Dencun upgrade has reduced the transaction cost of Layer 2 chains and promoted an increase in on-chain activity on these protocols.

Ethereum Layer 2 chains see spike in activity

While Solana is making headlines for failed transactions and rising DEX activity and meme coin narrative, Ethereum Layer 2 chains are seeing a consistent growth in activity. The Dencun upgrade resulted in a significant decrease in transaction cost on Layer 2 chains like Arbitrum (ARB), Optimism (OP) and Base (BASE).

Transaction fees on Layer 2 chains

Data from IntoTheBlock shows an increase in activity on the Layer 2 chains, as users respond to the declining transaction costs. This was anticipated as a result of the Dencun upgrade.

Number of transactions on Ethereum Layer 2 chains

The radical increase in number of transactions despite rising competition from Solana and alternative chains marks a significant development in the Layer 2 ecosystem. As on April 6, Layer 2 tokens Polygon (MATIC), Stacks (STX), Mantle (MNT), ARB, ImmutableX (IMX), Starknet (STRK) piled on between 1% and 8% gains on Saturday.

Layer 2 tokens

On the weekly timeframe, Layer 2 tokens have printed nearly double-digit losses for holders. It remains to be seen whether the demand from users can aid recovery in L2 tokens in the coming week.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.