Ethereum Whales are Coming Back as ETFs Show Net Inflow After 8-Weeks

- Gold Price Forecast: XAU/USD drifts higher above $4,200 as Fed delivers expected cut

- Gold Price Steady Climb and the Sudden Surge of Silver and Copper: Will Their Bull Run Extend Into 2026?

- Gold Price Forecast: XAU/USD climbs above $4,250 as Fed rate cut weakens US Dollar

- Bitcoin Cash Unveiled: Why Did BCH Price Surpass BTC? Can it Soar to $1,000 in the Future?

- Silver Price Forecast: XAG/USD refreshes record high, looks to build on move beyond $61.00

- AUD/USD holds steady below 0.6650, highest since September ahead of China's trade data

Ethereum’s major holders are returning to the market. Amid the past week’s market consolidation, major players have seized the opportunity to accumulate ETH aggressively.

On-chain data reveals an uptick in whale holdings, while ETH-based exchange-traded funds (ETFs) recorded their first weekly net inflow in eight weeks, signaling a significant shift in sentiment.

ETH Whale Accumulation and ETF Inflows Hint at Imminent Price Surge

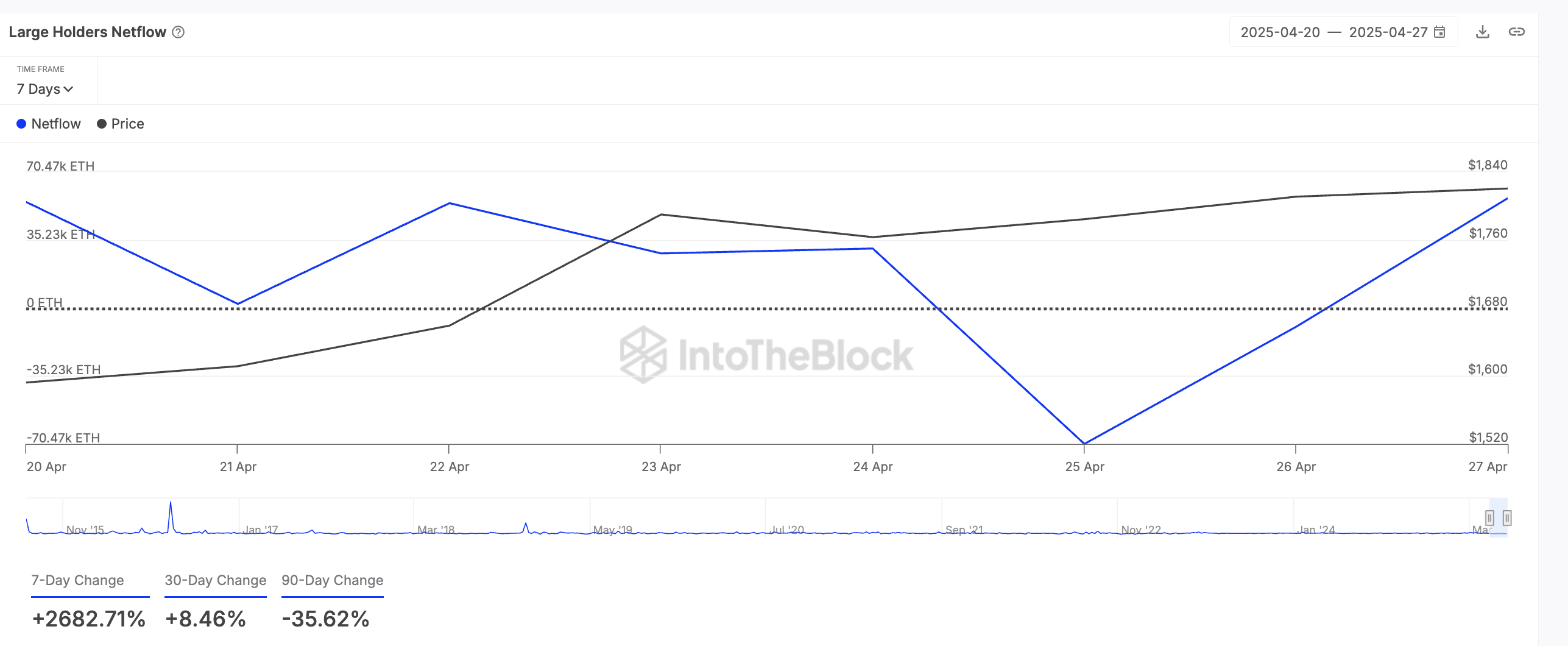

According to on-chain data, leading altcoin ETH has noted a significant spike in its large holders’ netflow over the past week. According to the on-chain data provider, this has rocketed 2682% in the past seven days.

ETH Large Holders’ Netflow. Source: IntoTheBlock

Large holders of an asset refer to whale addresses holding more than 0.1% of its circulating supply. The large holders’ netflow metric tracks the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow surges, its whale investors are ramping up their coin accumulation. This accumulation trend suggests a belief in ETH’s future upside, as major holders tend to act when they see value at current price levels.

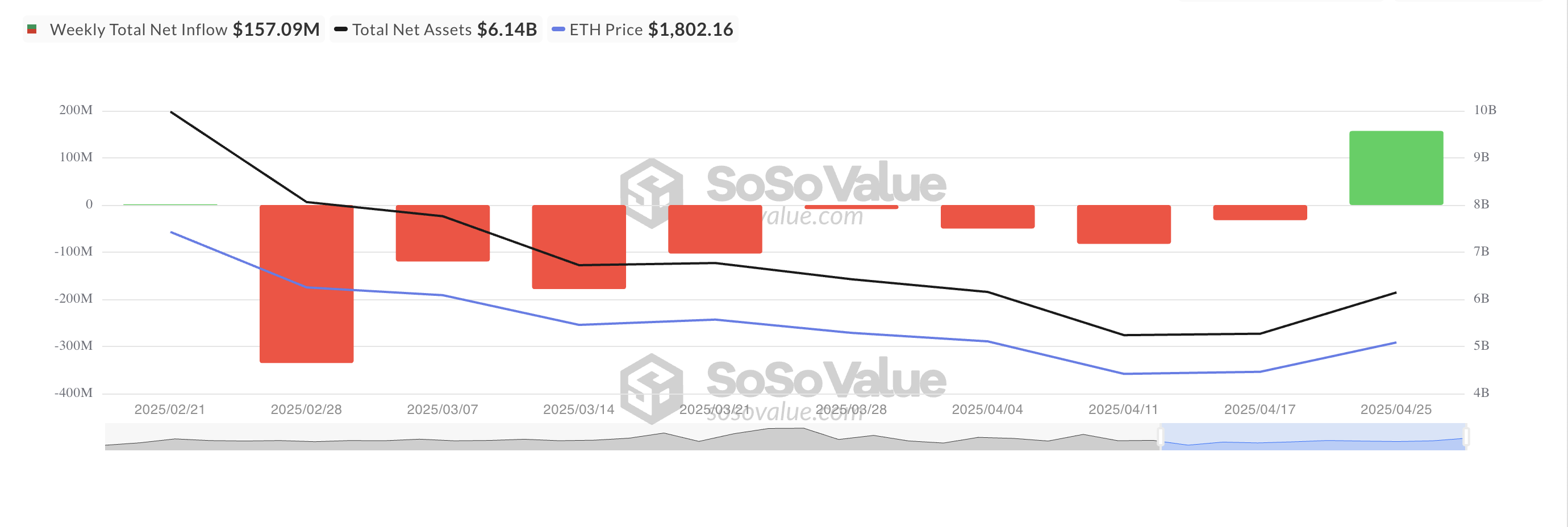

Adding to the bullish narrative, ETH-backed ETFs recorded their first weekly net inflow in eight weeks. According to SosoValue, net inflows into ETH-backed ETFs reached $157.09 million between April 21 and April 25, reversing an eight-week streak of outflows totaling over $700 million.

Total Ethereum Spot ETF Net Inflow. Source: SosoValue

With major players re-entering the market, ETH could be poised for further upside in the near term.

Ethereum Sees Bullish Momentum

On the technical side, ETH’s positive Balance of Power (BoP) highlights the resurgence in demand for the leading altcoin. This is currently at 0.31.

This indicator measures the buying and selling pressure of an asset. When its value is positive, pressure outweighs selling pressure. This indicates strength in the ETH’s price movement and signals further potential upward momentum. If this happens, ETH could rally back above $2,000 to exchange hands at $2,027.

ETH Price Analysis. Source: TradingView

However, if market sentiment worsens, ETH could shed recent gains and plummet to $1,385.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.