Dog-based meme coins DOGE and SHIB hint at a rally as bullish bets and holders’ accumulation increase

Dogecoin price rebounds and trades around $0.17 on Monday after retesting its previously broken trendline last week.

Shiba Inu hovers slightly below its key resistance level at $0.0000123, and a breakout could indicate a further rally ahead.

Derivatives data and on-chain metrics show rising bullish bets and growing accumulation among DOGE and SHIB holders.

Dog-themed meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) are showing signs of a potential rally as bullish momentum builds across the market. DOGE has rebounded after retesting its key level, while SHIB hovers closer to its critical resistance. Supporting the optimistic outlook, both derivative data and on-chain metrics indicate increased accumulation and a surge in bullish bets from traders, suggesting that a breakout could be on the horizon for these popular meme assets.

DOGE and SHIB could rally as derivative data and on-chain metrics hint at a bullish bias

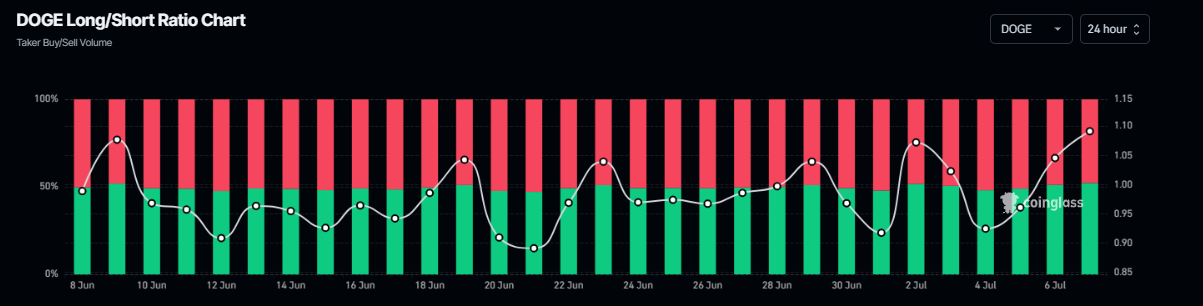

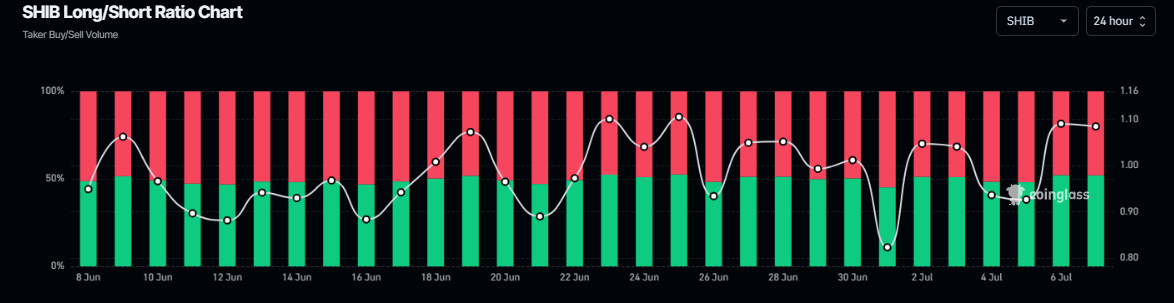

According to Coinglass’s data, the long-to-short ratio of dog-themed memecoins DOGE and SHIB reads 1.10 and 1.08, respectively. This ratio, above one, reflects bullish sentiment in the markets, as more traders are betting on the memecoinss to rally.

DOGE long-to-short ratio chart. Source: Coinglass

SHIB long-to-short ratio chart. Source: Coinglass

Santiment’s Supply Distribution shows that the number of large-wallet holders is rising for both dog-theme-based memecoins. The metric indicates that the whales holding between 100,000 and 1 million (red line) and between 1 million and 10 million (yellow line) for SHIB and DOGE tokens have been increasing since last week, further supporting the bullish outlook.

[10-1751867968164.02.37, 07 Jul, 2025].png)

Dogecoin Supply distribution chart. Source: Santiment

[11-1751867994922.09.12, 07 Jul, 2025].png)

Shiba Inu Supply distribution chart. Source: Santiment

Dogecoin Price Forecast: DOGE bulls in control of momentum

Dogecoin price rebounded after retesting its previously broken descending trendline (drawn by connecting multiple highs since May 23) around $0.15 on Wednesday and rallied 9.8% until Sunday. At the time of writing on Monday, it trades at around $0.17.

If DOGE continues its upward trend and closes above the weekly resistance at $0.18 on a daily basis, it could extend the rally to retest its June 11 high of $0.20.

The Relative Strength Index (RSI) on the daily chart stands at 51, having moved above its neutral level of 50, indicating indecision among investors. The Moving Average Convergence Divergence (MACD) indicator also displayed a bullish crossover last week. It also shows a rising green histogram bar above its neutral level, indicating bullish momentum and an upward trend.

DOGE/USDT daily chart

However, if DOGE faces a correction, it could extend the decline to retest its trendline support level at $0.15.

Shiba Inu Price Forecast: SHIB could rally if it closes above the 50-day EMA

Shiba Inu price broke above the descending trendline (drawn by connecting multiple highs since mid-May) on June 28. Still, it consolidated between the daily level at $0.0000111 and below the 50-day EMA at $0.0000123 last week. It edges slightly lower on Monday, hovering around $0.0000118 at the time of writing.

If SHIB rallies and closes above its 50-day EMA at $0.0000123 on a daily basis, it could extend the rally toward its June 11 high of $0.0000136.

The RSI on the daily chart stands at 49, hovering around its neutral level of 50, which indicates indecisiveness among traders. For the bullish momentum to be sustained, the RSI must move above its neutral level of 50. The MACD indicator displayed a bullish crossover last week. It also shows a rising green histogram bar above its neutral level, indicating bullish momentum and an upward trend.

SHIB/USDT daily chart

On the other hand, if SHIB faces a correction, it could extend the decline to find support around its daily level at $0.0000111.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.