Bitcoin Price Forecast: Bullish sentiment persists as BTC breaks above $100K mark

- International Oil Prices Retreat Rapidly; G-7 to Discuss Emergency Oil Reserve Release

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- Crypto’s Great Recovery: Is the Post-Conflict Surge a Sustainable Rally or a Sophisticated Bull Trap?

- WTI recovers to near $86.50 as Strait of Hormuz remains closed

- Gold slumps to near $5,050 on oil-driven inflation fears, stronger US Dollar

Bitcoin breaks above the $100K milestone on Thursday after a week-long consolidation.

Bitcoin reaches a market capitalization of $2 trillion, driven by the choice of a pro-crypto SEC chair, rising institutional demand, and Vladimir Putin's supportive comments.

Traders should be cautious over the move of funds from Mt.Gox as well as US government transfers.

Bitcoin (BTC) surpasses the $100K mark, reaching a $2 trillion market capitalization on Thursday, a landmark milestone widely anticipated by crypto market participants. The latest rise prompting BTC to cross the six-figure valuation was mainly driven by Donald Trump’s pro-crypto US Securities & Exchange Commission (SEC) chair nomination, but also by rising institutional demand and Russian President Vladimir Putin’s supportive comments about Bitcoin.

While sentiment among traders remains bullish, some factors such as the move of funds from defunct exchange Mt.Gox as well as US government transfers have the potential to increase the selling pressure.

Bitcoin price breaks above $100K

Bitcoin price rose to six figures during the early Asian trading session and traded around $102,700 during the European session on Thursday. Bitcoin’s historic rise has ignited excitement among investors and crypto enthusiasts, celebrating its achievement as both a validation of long-term investments and its milestone of reaching a $2 trillion market capitalization.

This rise in BTC was mostly fueled by the announcement on Wednesday that Donald Trump confirmed that he had nominated Paul Atkins, Patomak Global Partners CEO, as the next Chairman of the Securities & Exchange Commission (SEC). This announcement has positively impacted the crypto market, as Atkins is considered pro-crypto.

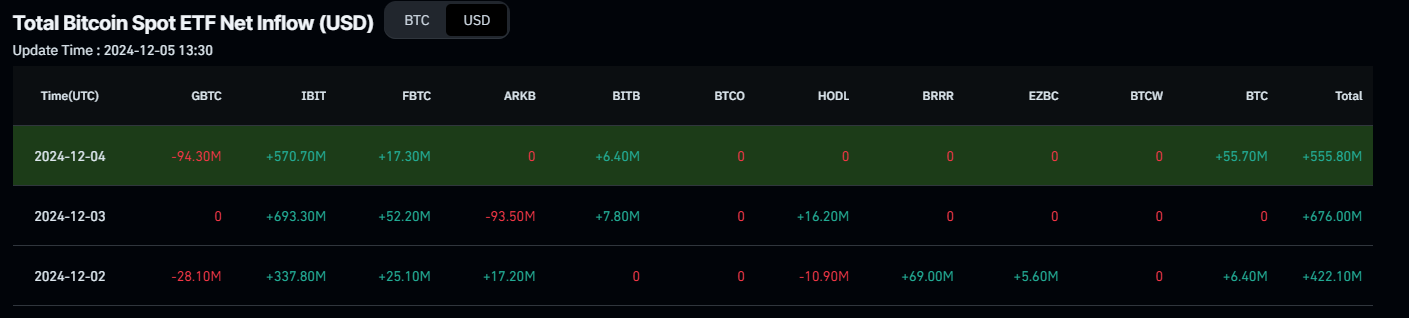

Moreover, institutional demand has supported Bitcoin’s rise so far this week. According to Coinglass Exchange Traded Funds (ETF) data, Bitcoin spot ETFs saw an inflow of $555.80 million on Wednesday, its third straight day of inflows, totaling $1.65 billion this week. If this inflow trend persists or accelerates, it could provide additional momentum to the ongoing Bitcoin price rally.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Meanwhile, Bitcoin got the endorsement of another prominent figure: Vladimir Putin.

“Who can ban Bitcoin? Nobody. And who can prohibit the use of other electronic means of payment? Nobody,” the Russian President said on Wednesday at an investment forum in Moscow, according to a Watcher.Guru Twitter post.

He continued: “Because they are new technologies. And no matter what happens to the US Dollar, these tools will develop one way or the other because everyone will strive to reduce costs and increase reliability.”

JUST IN: Russian President Putin says "who can ban #Bitcoin?"

— Watcher.Guru (@WatcherGuru) December 4, 2024

"Nobody" pic.twitter.com/woiOWko8wA

Some signs of concern

As Bitcoin prices rose to six figures, defunct exchange Mt. Gox transferred 24,052 BTC worth $2.43 billion to a new wallet, according to Lookonchain data. This transfer could later be sent to exchanges like Bitstamp, BitGo and Kraken for repayment to the creditors.

Looking at similar moves in the past, Mt. Gox’s transfer of 33,964 BTC worth $2.25 billion on July 30 could have been among the factors leading the Bitcoin price to crash from $66,700 to $54,000 in seven days.

This recent activity and the US government transfer earlier this week could generate FUD (Fear, Uncertainty, Doubt) among traders, contributing to a price pullback in the upcoming weeks.

After the $BTC price broke through $100,000, the #MtGox wallet transferred 24,052 $BTC($2.43B) to a new wallet.https://t.co/J65kXeCTQ4 pic.twitter.com/M0YSRGydzx

— Lookonchain (@lookonchain) December 5, 2024

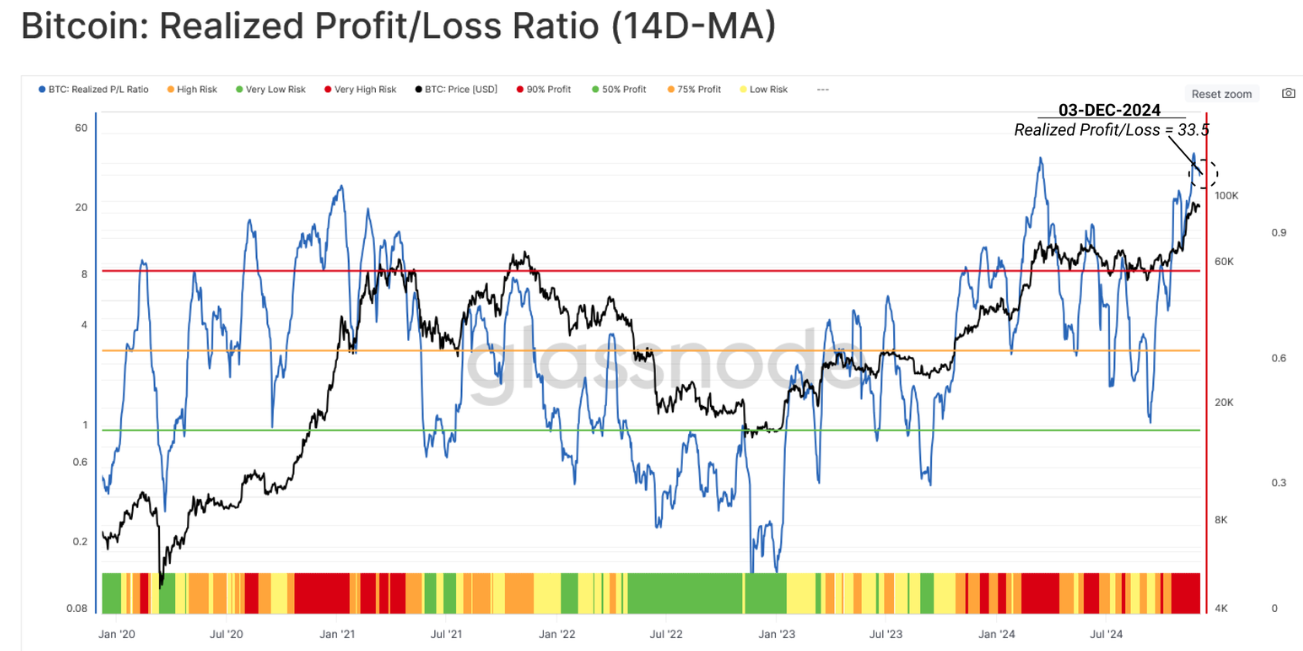

Profit-taking is another risk for Bitcoin's price outlook in the short term. Glassnode's weekly report on Wednesday highlights that risk metrics are elevated and signaling caution, while realized profits and funding rates are starting to cool down, hinting at a period of consolidation.

As shown in the graph below, the Bitcoin Realized Profit/Loss Ratio shows intense profit-taking, hinting at a potential period of near-term demand exhaustion.

Bitcoin Realized Profit/Loss Ratio chart. Source: Glassnode

In an exclusive interview, COO of Bitget Wallet, Alvin Kan told FXStreet that he expects a “healthy correction” in the near future, which will normalize funding rates. “This surge has triggered a greed index reading of 85, indicating ‘extreme greed.’ Additionally, the long position rate in the futures market has reached 0.09%,” he said.

He continued: “As market volatility could continue to increase, users should be cautious about leverage in futures contracts to avoid liquidation risks from sudden downturns. After the correction, it’s important to focus on sector rotation, as altcoin seasons are likely to continue.”

Bitcoin Price Forecast: Bulls eye for $125K mark

Bitcoin price breaks above its ATH level of $99,588, surpassing its $100K milestone on Thursday after recovering from its recent pullback since last week. At the time of writing, it trades higher above $102,500.

If BTC continues its upward trend, it could extend the rally to test its 141.40% Fibonacci extension level drawn from the November 4 low of $66,835 to the November 22 high of $99,588 at $113,147. A successful close above this level could extend an additional rally toward the psychologically important $125K level.

The Relative Strength Index (RSI) on the daily chart reads 72, trading above its overbought level of 70. Traders should be cautious when adding to their long positions because the chances of a price pullback are increasing. Still, the RSI is still pointing upwards, so there is the possibility that the rally continues and the indicator remains above the overbought level.

BTC/USDT daily chart

If BTC declines, it could extend the correction to retest its $90,000 support level.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.