We’re in the early stages of a crypto winter. Here are the signs

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

Coinbase has said what everyone’s been scared to admit: the next crypto winter has probably already started, and the signs are everywhere, according to a report released by the company on Tuesday.

The total crypto market cap without Bitcoin has dropped to $950 billion—that’s a nasty 41% drop from its December 2024 high of $1.6 trillion. It’s also 17% lower than where things stood a year ago. To be clear, this is below nearly the entire range of prices seen between August 2021 and April 2022.

At the same time, there’s been a little uptick in venture capital activity during Q1 2025, but it’s still way down—50% to 60% lower than the insane highs of 2021–2022.

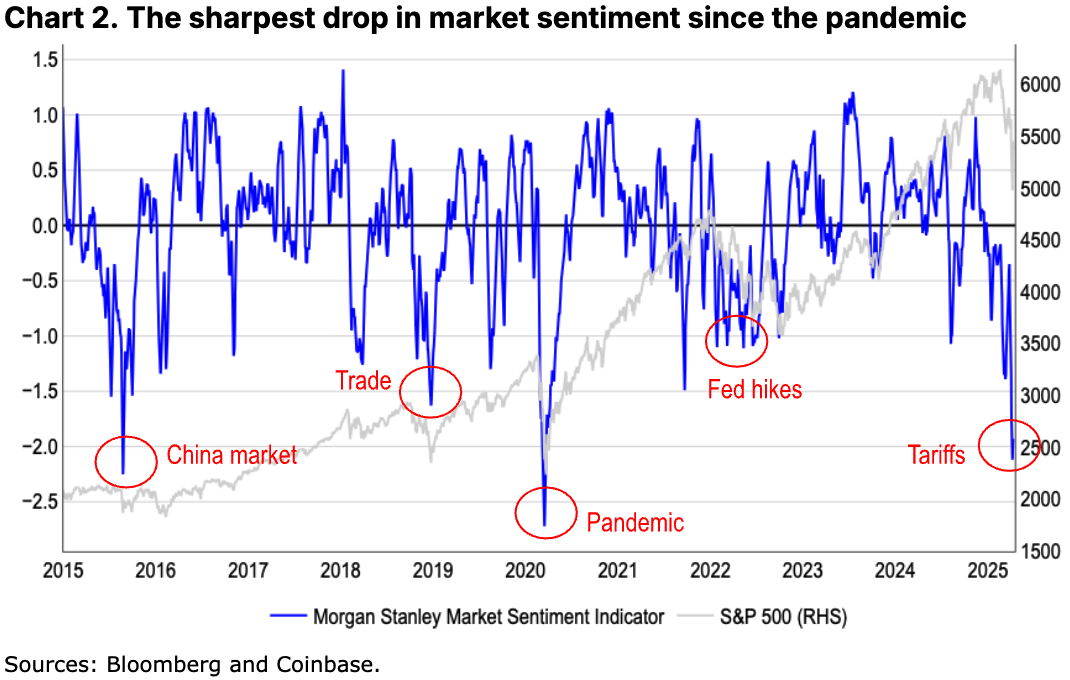

Investors cut exposure as macro pressure builds

Coinbase analysts say this bad run could last at least another 4 to 6 weeks, if not longer. According to their outlook, “the interplay of macro factors and risk sentiment still calls for short-term caution.”

But they’re also trying to play the long game. Coinbase said, “Once the mood resets, it might do so fast.” They’re still betting on a stronger second half of 2025, though right now, most traders are sitting on their hands.

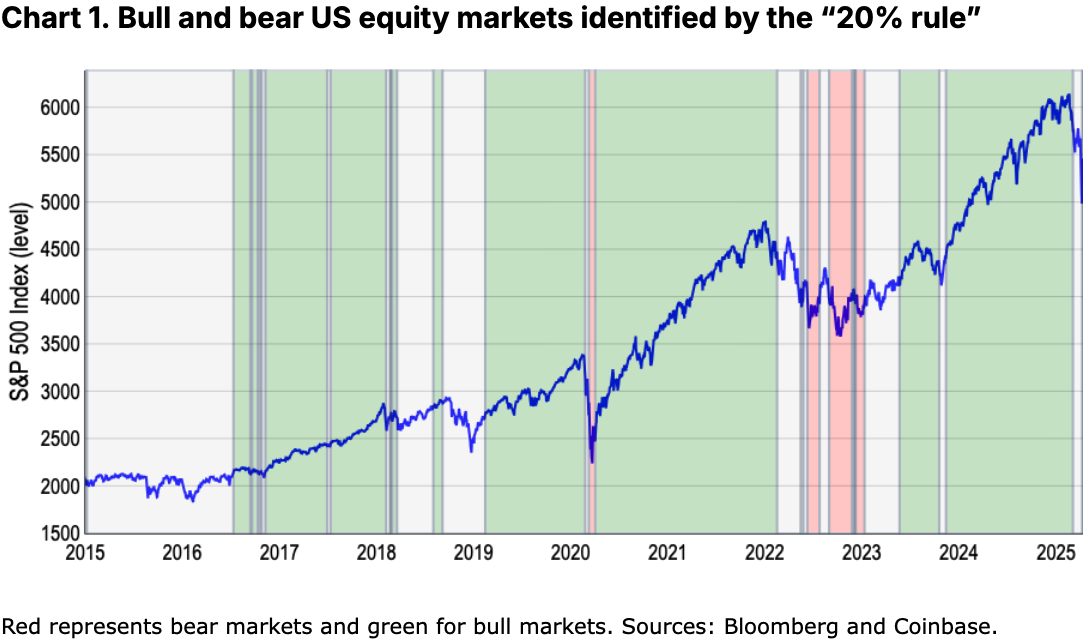

Forget the idea that a 20% swing marks a bull or bear market. That rule barely works in stocks and makes even less sense in crypto, where 20% moves happen in a weekend.

Case in point: when Bitcoin dropped 76% between November 2021 and November 2022 while the S&P 500 only fell 22% during the same window. That’s more than 3x the pain, yet both happened during the same overall macro hellscape, said Coinbase.

Because crypto never sleeps, it reacts faster and harder to global shocks. Weekends and nights—when stock markets are closed—are when a lot of the drama happens. That makes crypto a punching bag for all global sentiment changes. One trigger and everything spirals.

There’s no agreed-on definition of what actually makes a bear market. People throw out that 20% number, but it’s just tradition—not science.

As Coinbase put it, it’s more like “you know it when you see it.” They studied the S&P 500 by looking at its one-year rolling highs and lows to find real changes. That method showed four bull markets and two bear markets in the last 10 years—not counting the new dip that began around late March and early April.

But even that method missed two big panic moments: 2015, when China’s markets crashed, and 2018, when the Fed’s global trade uncertainty index spiked. Both caused deep investor fear but didn’t hit the 20% number. So clearly, it’s not about the percentage.

Alternative indicators show the market damage is deeper

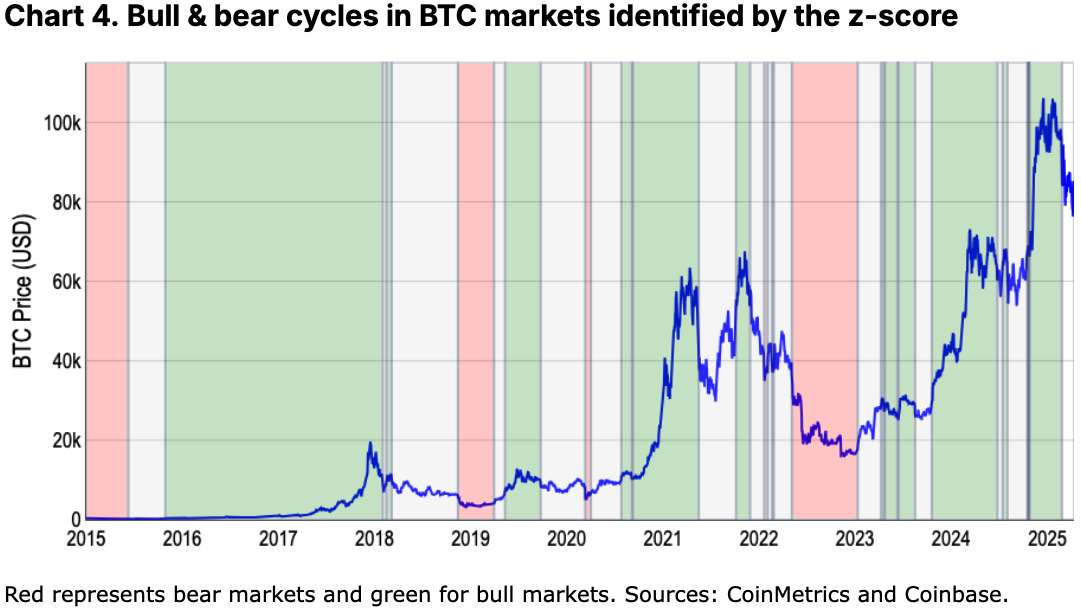

To fix that, Coinbase says they’re using new tools risk-adjusted performance—basically how far returns move from the average, measured in standard deviations.

From November 2021 to November 2022, Bitcoin dropped 1.4 standard deviations, which is dangerously close to the S&P 500’s 1.3 standard deviation decline. That shows how big the crash was, even if the raw numbers look different.

Measuring by risk lets you compare across assets, but the downside is it’s very complicated. The z-score model gives fewer signals when markets are calm and doesn’t always catch fast changes.

Their data says the most recent bull cycle ended in late February. Since then, the model has shown nothing but neutral, which means it’s late to react.

The 200-day moving average (200DMA) might be better. It’s easier to use and smooths out short-term noise. When prices fall below their 200-day average, that’s usually a real trend change.

It caught the big sell-offs in early 2020 (COVID), 2022-23 (Fed hiking), the 2018–19 crypto winter, and the mid-2021 crash caused by China’s mining ban.

So, is this a new crypto winter? Coinbase’s Tuesday report said yes, and it’s just getting started. “The 200DMA model on bitcoin does suggest that the token’s recent steep decline qualifies this as a bear market cycle starting in late March. But the same exercise performed on the COIN50 index (which includes the top 50 tokens by market capitalization) shows the asset class as a whole has been unequivocally trading in bear market territory since the end of February,” said Coinbase.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.