Big Money Bets on Bitcoin: $3.2 Billion Inflows and Whale Accumulation Hint at $106,000 Breakout

Bitcoin (BTC) is poised to reach significant price milestones in 2025, backed by optimistic forecasts from Matrixport, Willy Woo, and other institutions.

With support from ETFs and a positive market sentiment, Bitcoin is a speculative asset and a promising long-term investment option. However, if the profitable supply exceeds 90%, the market must remain cautious of potential corrections.

Numerous Positive On-Chain Metrics

The Bitcoin market is showing encouraging signs as the supply on centralized exchanges (CEX) has dropped to a 7-year low. According to data from CryptoQuant, only about 2.492 million BTC remain on exchanges. This is a sharp drop from 2.488 million BTC, recorded on the previous Friday.

Bitcoin Exchange Reserve. Source: CryptoQuant

Moreover, CryptoQuant reports that the percentage of Bitcoin’s supply in profit has surpassed 85%, a historically high figure. However, they caution that if this ratio exceeds 90%, the market may enter a “historic euphoria” phase and face a correction. This suggests that while the current metrics are favorable, vigilance is required to navigate potential volatility.

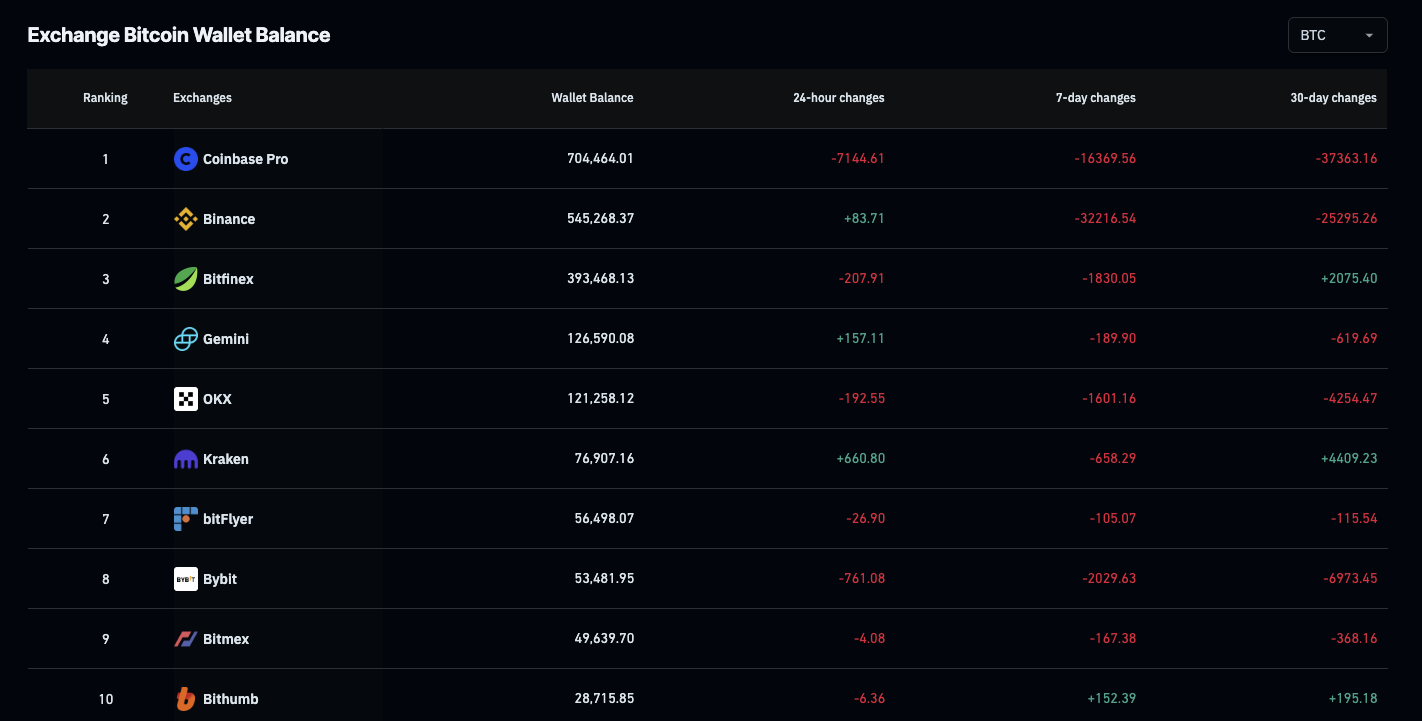

Over the past seven days, Coinglass data recorded approximately 56,164.88 BTC being withdrawn from CEX platforms. This indicates that investors are accumulating and reducing selling pressure, which is often seen as a bullish signal. A reduced supply on exchanges lowers selling pressure, paving the way for price growth.

Exchange Bitcoin Wallet Balance. Source: Coinglass

Additionally, new capital inflow into the market is rising. According to a CoinShares report, $3.2 billion poured into Bitcoin funds in the last week of April 2025. These factors are bolstering confidence that Bitcoin could soon hit significant price targets.

Experts’ Optimistic Forecasts for BTC

Amid a generally optimistic market outlook, numerous experts and organizations have expressed positivity regarding BTC’s price. Matrixport, a reputable crypto service platform, asserts that Bitcoin’s upward momentum is gaining strength.

In its latest analysis, Matrixport indicated that Bitcoin is approaching the $106,000 resistance level, with a strong likelihood of breaking through this mark soon. Previously, Matrixport had predicted that new capital inflows into the market would propel Bitcoin past the $100,000 threshold.

This analysis is further supported by whales’ subtle yet significant accumulation, extreme greed sentiment, and high optimism, which have brought BTC closer to the $100,000 mark.

Willy Woo, a renowned analyst in the crypto industry, also shared an optimistic view on X. He believes that Bitcoin’s fundamentals have shifted to a bullish state, with the market likely to either move sideways or rise slowly in the coming period.

“BTC fundamentals have turned bullish, not a bad setup to break all-time highs,” he stated.

Woo emphasized that the “bullish ascending triangle” pattern he previously mentioned is forming, signaling a potential strong upward move if Bitcoin breaks through the resistance level.

Furthermore, a Coinness report revealed that 45.4% of South Korean investors believe Bitcoin will outperform gold in the next six months. It reflects strong confidence from a key Asian market.

Additionally, as reported by BeInCrypto, ARK Invest predicts that Bitcoin’s price could reach $2.4 million by 2030, driven by the growth of Bitcoin ETFs and increasing adoption by financial institutions. These long-term forecasts further reinforce the belief that Bitcoin’s potential extends far beyond the $100,000 mark, with significant growth prospects in the future.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.