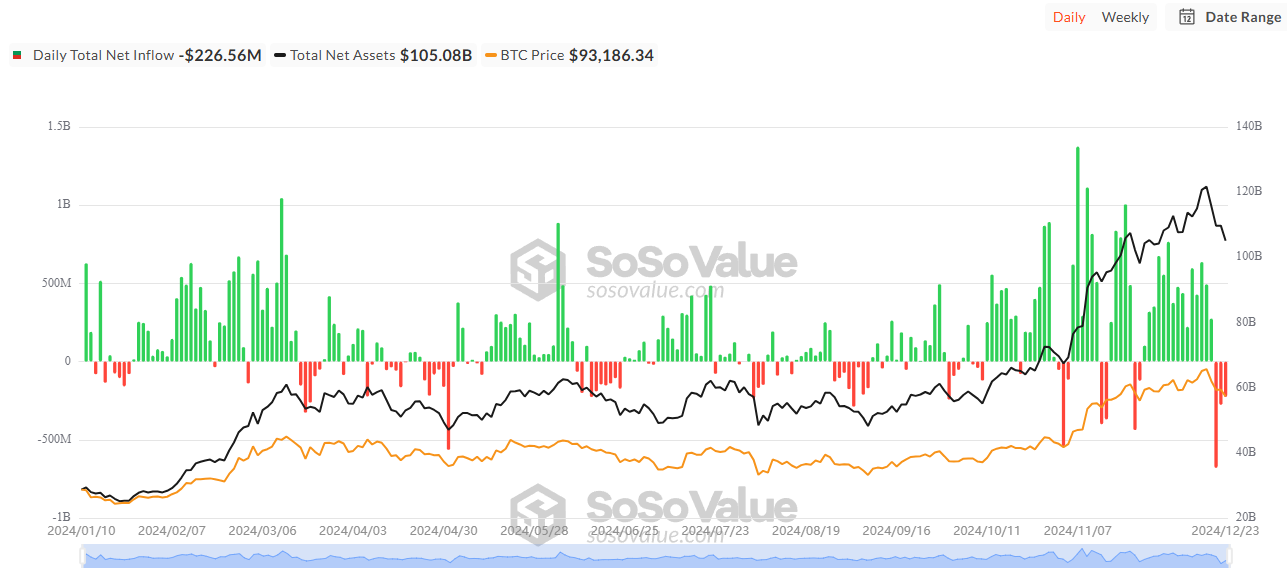

Bitcoin ETF netflows in the United States have recorded three consecutive days of outflows leading up to Christmas. Moreover, these ETFs set a new single-day outflow record, temporarily weakening Bitcoin’s upward momentum.

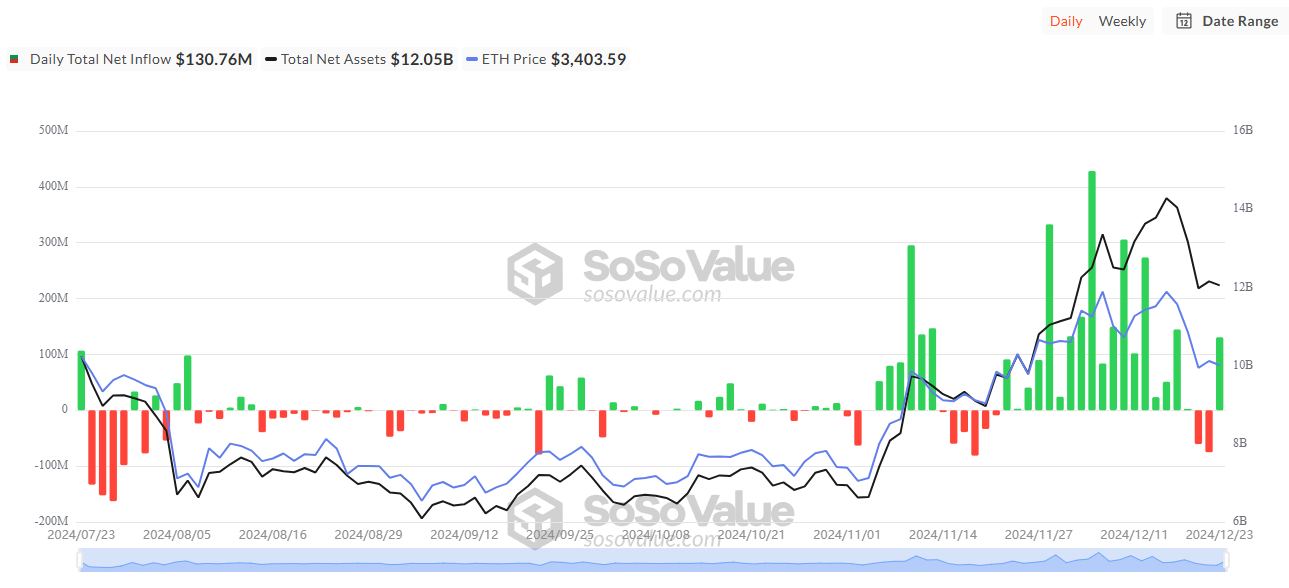

However, Ethereum ETFs in the US showed positive signs with a net inflow.

Bitcoin ETFs Witness Net Outflows for the Third Consecutive Day

Data from SoSoValue indicates that Bitcoin ETFs experienced an outflow of nearly $1.2 billion in the past three trading days. Notably, December 19 saw outflows reach $680 million, the highest single-day outflow since Bitcoin ETFs were approved.

“A significant outflow like this raises the question of whether it’s merely profit-taking or a more structural shift in capital. The most likely explanation at this stage is profit-taking, but it’s worth monitoring market sentiment and institutional moves to confirm.” Investor Antonio Zennaro commented.

Total Bitcoin Spot ETF Net Inflow. Source: SoSoValue

Total Bitcoin Spot ETF Net Inflow. Source: SoSoValue

Prior to this, Bitcoin ETFs recorded 15 consecutive days of positive netflows, pushing total net assets from $100 billion to $121 billion. However, the recent three-day outflow contributed to a drop in total net assets to $105 billion.

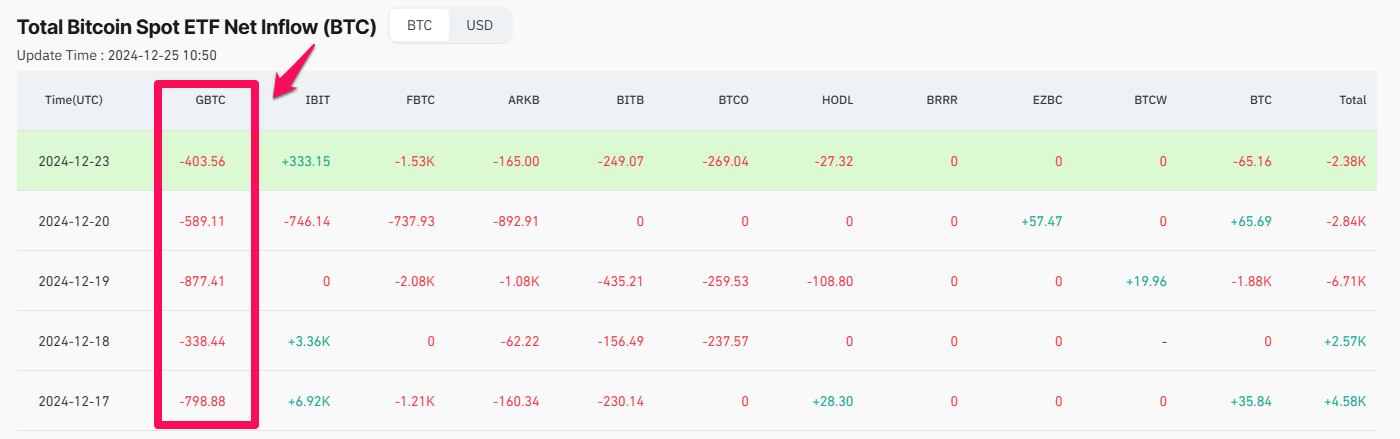

Data from Coinglass reveals that Grayscale’s GBTC was a major contributor to the outflows, having sold 1,870 BTC in the last three trading days. This significantly outweighed the buying activity from BlackRock’s IBIT during the same period.

Total Bitcoin Spot ETF Net Inflow (BTC). Source: Coinglass

Total Bitcoin Spot ETF Net Inflow (BTC). Source: Coinglass

Despite the three-day negative netflows, investor optimism toward Bitcoin remains strong. In December, Bitcoin ETFs surpassed gold ETFs in assets under management (AUM), signaling growing confidence in digital assets from both institutional and retail investors.

Interestingly, while money flowed out of Bitcoin ETFs, Ethereum ETFs saw inflows during the December 23 trading session. While Bitcoin ETFs experienced $226 million in outflows, Ethereum ETFs attracted over $130 million in inflows. Additionally, BlackRock’s Ethereum ETF now holds more than 1,000,000 ETH.

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue

Many investors believe this could signal positive momentum for Ethereum and altcoins, especially after Ethereum’s price dropped from $4,100 to nearly $3,100 in December.

“BlackRock’s Ethereum ETF now holds over 1,000,000 ETH. This data, paired with the fact that ETH is still consolidating below its all-time high, is an altcoin season indicator like we’ve never seen before.” Investor Dan Gambardello commented.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.