WTI Oil consolidates above $61.30 on easing global trade fears and geopolitical tensions

WTI Crude is trading around $61.50, supported by the de-escalation of the EU-US trade rift.

Concerns that OPEC+ will increase Oil production from July are capping gains.

Technical indicators show a lack of clear momentum.

Oil prices are standing comfortably above $61.30, supported by US President Trump’s decision to put tariffs on Eurozone imports on hold until July 9th and escalating tensions in Gaza, but oversupply worries are limiting gains.

Trump backed off on Friday’s threat to impose 50% levies on EU imports from next week, after a phone call with EU Commission President Ursula von der Leyen. The market has welcomed the news, as a trade rift between the US and the EU would significantly slash global growth and curb oil demand expectations.

On the geopolitical front, Israel keeps pounding an already devastated Gaza Strip. A recent report talks about an attack on a school killing 36, many of them Children. This news raises tensions in the area, which, coupled with the lack of advances on the US negotiations with Iran, are keeping Oil prices from falling further.

Higher supply expectations keep upside attempts limited

From a wider perspective, however, WTI prices keep moving within the last three weeks’ range, 25% below January’s highs. The OPEC+ is meeting next week, and the market is fearing a decision to increase output by 411 million barrels per day, which, in times of global trade uncertainty, might lead to an Oil glut.

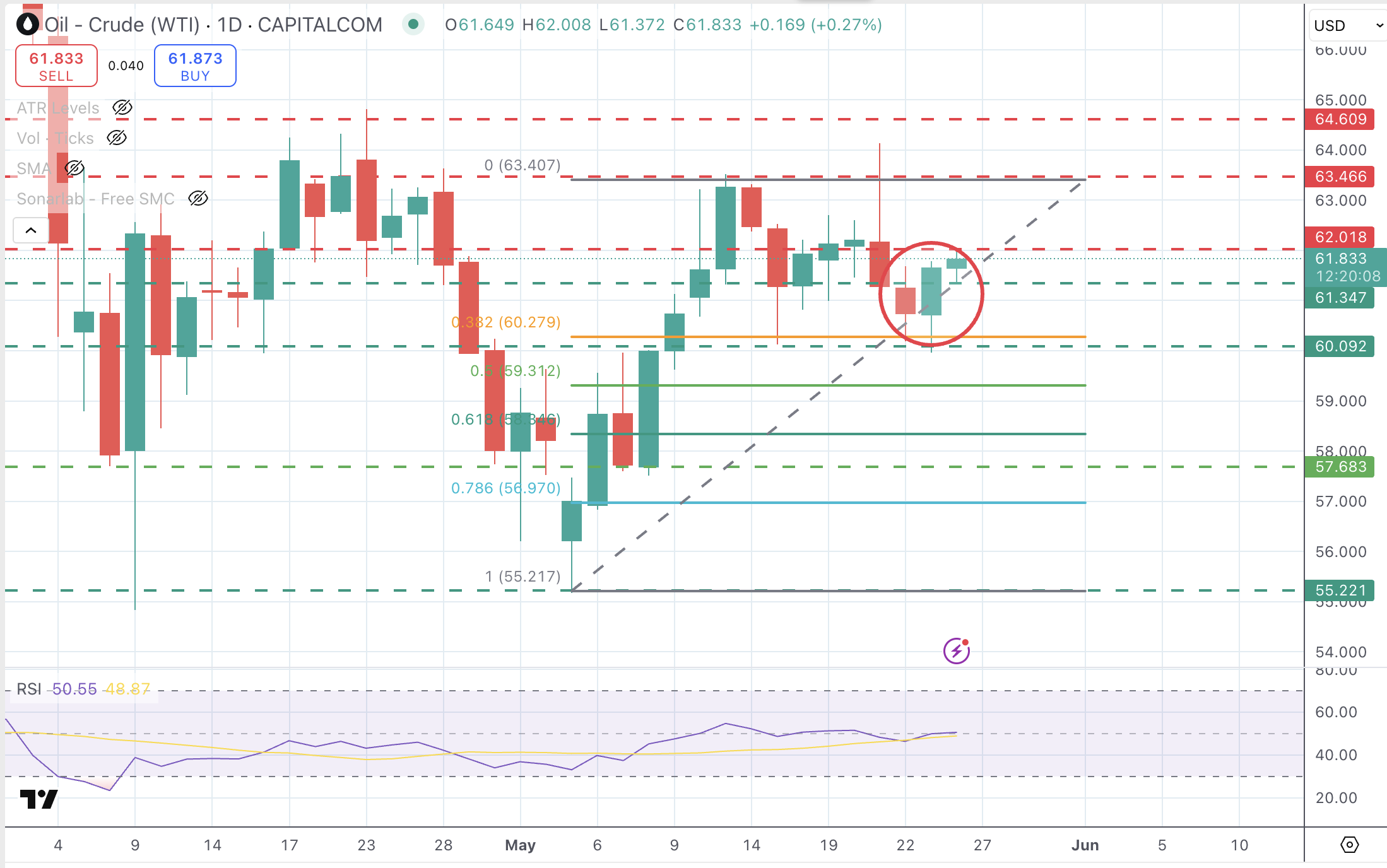

From a technical perspective, the daily chart shows a bullish engulfing candle on Friday, which is a positive sign, but the RSI remains flat around the 50 level, highlighting a lack of clear momentum. Intra-day charts are mildly positive but lacking strength.

Resistances are $62.00 and $63.45. Below $61.30, the next support is the $60.00 psychological level.

WTI Oil Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.