U.S. March Nonfarm Payroll Preview: Even If Data Aligns with Expectations, Financial Markets May Not Escape the Fate of Volatility

- Gold tumbles as traders book profits ahead of key US inflation data

- Australian Dollar remains stronger following PBoC interest rate decision

- Gold tumbles as traders book profits ahead of key US inflation data

- Forex Today: US Dollar extends slide, Gold surges past $4,300

- Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe flash bearish potential

- Japanese Yen strengthens on safe-haven flows, USD/JPY tests 150.00 amid weaker USD

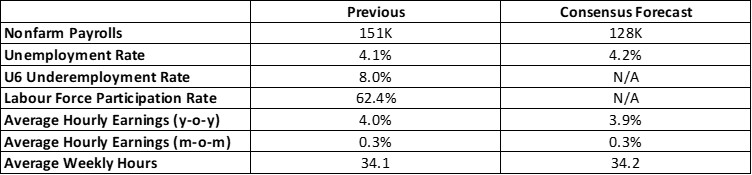

On 4 April 2025, the United States will release its March Nonfarm Payrolls (NFP) data. The market consensus currently anticipates job growth of 128,000, a decline from February’s 151,000 (Figure 1). We align with this prevailing forecast.

Figure 1: U.S. labour market forecasts

Source: Refinitiv, Tradingkey.com

Several factors suggest a weakening NFP report:

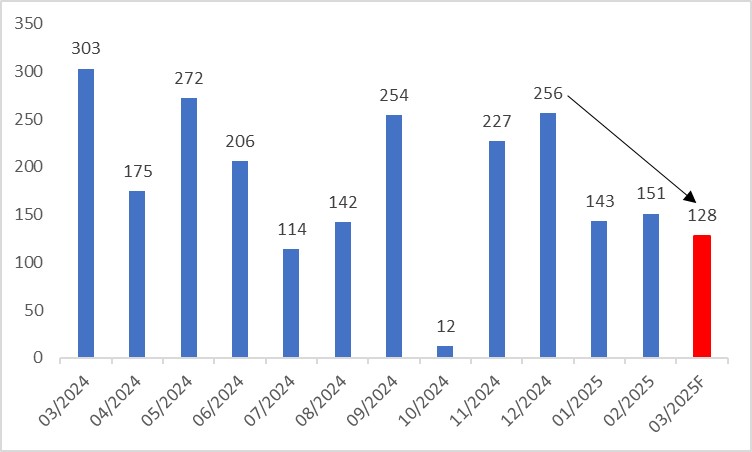

Economic Slowdown and Data Momentum: Recent months have shown a downward trend in nonfarm payrolls, driven by a broader economic slowdown. Employment growth has dropped from 256,000 in December last year to around 150,000 in January and February this year (Figure 2). Given the inherent inertia in economic data, a continued softening in March appears likely.

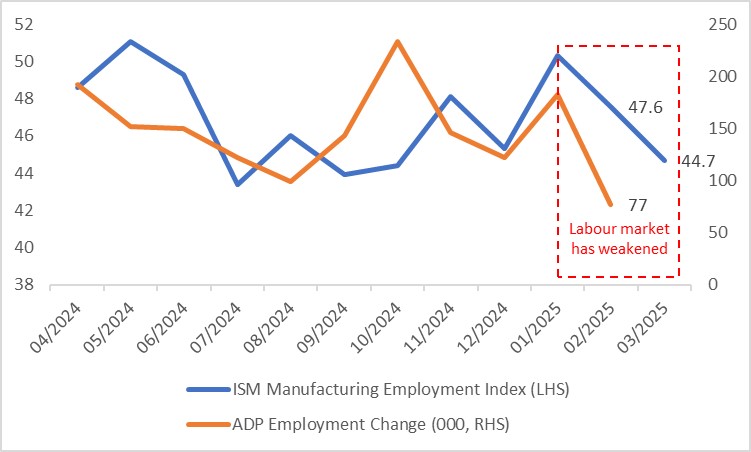

Leading Indicators Signal Weakness: The ISM Manufacturing Employment Index has declined for two consecutive months, while the ADP Employment Change—often dubbed the "mini-NFP"—has also seen a sharp drop recently (Figure 3). These two leading indicators reinforce the view that the U.S. labour market is losing steam.

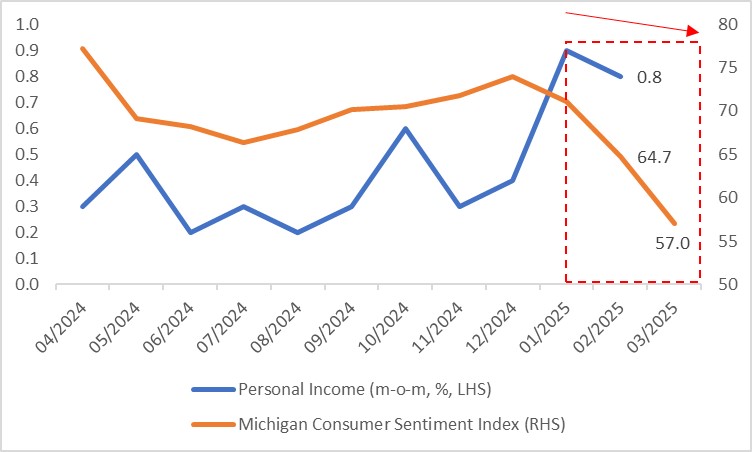

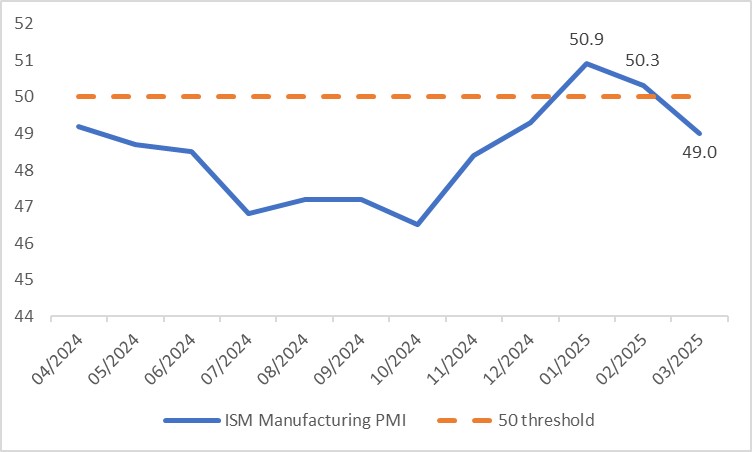

Consumption and Production Feedback Loop: On the income and consumption front, slowing Personal Income growth has dragged the Michigan Consumer Sentiment Index lower for several months, alongside a decline in Retail Sales year-over-year growth from 4.2% in January to 3.1% in February (Figure 4). This consumption weakness has spilt over to the production side, with the March ISM Manufacturing PMI slipping below the 50 expansion-contraction threshold (Figure 5). This deteriorating consumption-production cycle may be the root cause of a weaker March NFP.

Figure 2: U.S. Nonfarm Payrolls (000)

Source: Refinitiv, Tradingkey.com

Figure 3: Leading indicators of NFP

Source: Refinitiv, Tradingkey.com

Figure 4: U.S. Personal Income and Michigan Consumer Sentiment Index

Source: Refinitiv, Tradingkey.com

Figure 5: U.S. ISM Manufacturing PMI

Source: Refinitiv, Tradingkey.com

Typically, if NFP data falls below consensus expectations, the U.S. dollar, Treasury yields and equities tend to decline post-release, while exceeding expectations lifts them. When data aligns with forecasts, financial markets usually remain stable. However, this time could be different. Amid the ongoing U.S. economic slowdown, unless the March NFP significantly outperforms expectations, we anticipate a short-term downturn in U.S. financial markets—even if the data merely meets the 128,000-job forecast.

Additionally, on 2 April at 3:00 PM Eastern Time, President Trump is set to announce a "reciprocal tariff" policy. Whether this tariff is targeted or broad-based, its nature is a double-edged sword, harming both the U.S. and its trading partners. With further tariff hikes now a certainty, we expect the U.S. labour market to remain under pressure in the coming months.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.