- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

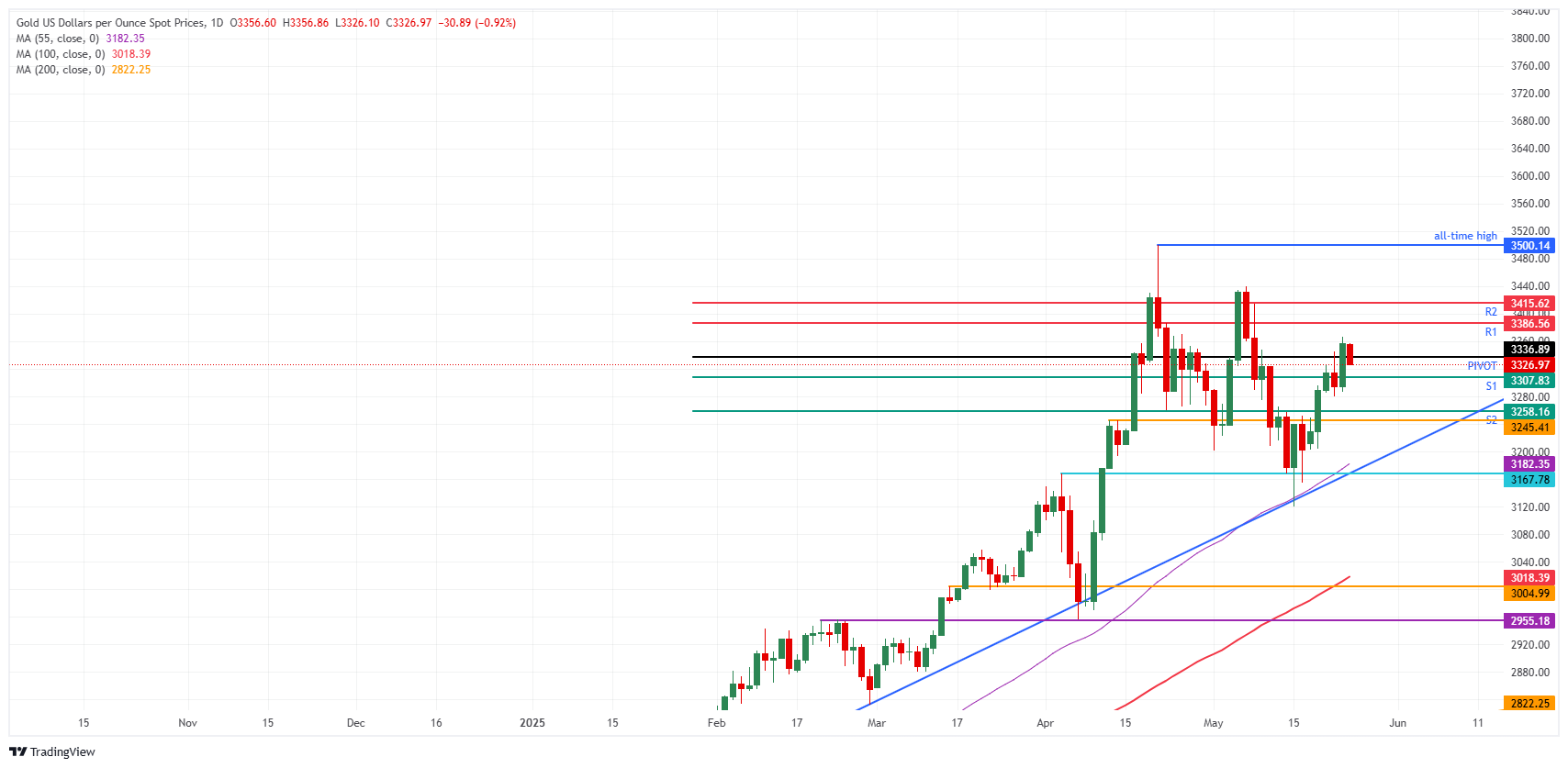

Gold price slips back below $3,340, erasing some of Friday’s gains.

Markets head into risk-on after Trump announced a delay on EU tariffs until July 9.

US debt concerns linger, capping the downside for the precious metal.

Gold (XAU/USD) price slips on Monday towards $3,325 at the time of writing, partly erasing Friday’s gains. The small dip comes after United States (US) President Donald Trump announced he would extend to July 9 the deadline for the European Union (EU) to face 50% tariffs. The decision came after a call between Trump and European Commission President Ursula Von Der Leyen on Sunday, and should help the EU broker a trade deal with the Trump administration.

While markets turned risk-on after the temporary reprieve period and Gold slipped, this does not mean the rally in the precious metal is over. A softer stance on trade weakens the safe-haven demand for Gold, but the metal’s safety appeal is still strong amid growing concerns about the fiscal position of the US government. Investors remain concerned that Trump’s tax bill, which last week passed the House and will be debated in the Senate, will further increase both the US deficit and debt.

Daily digest market movers: Small extension

US President Trump on Sunday announced that his plans to hit the EU with 50% tariffs would be delayed until July 9 to allow for time for both sides to negotiate a deal. The US leader on Friday had threatened higher-than-expected 50% levies against the bloc, while also warning Apple Inc. that it would be subject to 25% tariffs if it does not manufacture its iPhones in the US, Bloomberg reports.

Josh Gilbert, market analyst at eToro, warned that these delays aren’t bringing any structural changes to Trump’s tariff policy. “Pauses are all well and good for now, but during this time, we need to see more agreements in place to confirm Trump’s more negotiable approach,” he said, Bloomberg reports.

Vietnam’s Prime Minister Pham Minh Chinh has asked the country’s central bank, finance ministry and relevant agencies to study the establishment of a regulated Gold exchange to enable transparent public trading and prevent smuggling and manipulation, according to a statement on the government's website, Bloomberg reports.

The US Dollar also falls on Monday, extending Friday’s losses, as enthusiasm appears to have faded for the world’s reserve currency this year amid mounting fiscal concerns in the US. Speculative traders remained bearish on the dollar but trimmed their positioning to $12.4 billion in the week ending May 20 from $16.5 billion in the week prior, according to CFTC data reported Friday, Reuters reports.

Gold Price Technical Analysis: Tariff pause doesn’t mean a change

Gold takes a step back as investors flee to risk assets following the agreement between Trump and von der Leyen to continue to negotiate about trade. Still, the delay is only a minor one, by just a month, and brokering a trade agreement between the two blocs is nearly impossible to do in such a short time span.. Therefore, these headlines need to be seen as brief injections of reliefs within an overall narrative that is still supportive for Gold due to heightened uncertainty.

On the upside, the R1 resistance at $3,386 is the first level to look out for as resistance. The R2 resistance at $3,415 follows not far behind and could open the door for a return to the $3,440 round level and potentially further course to new all-time highs at $3,500.

On the other side, some thick-layered support emerges in case the Gold price declines. On the downside, the daily S1 support comes in at $3,307, safeguarding the $3,300 big figure. Some intermediary support could come from the S2 support at $3,258. Further below, there is a technical pivotal level at $3,245, roughly converging with the S2 support at $3,240.

XAU/USD: Daily Chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.