Gold price rallies 0.70% on Thursday after the US President left fresh tariff comments overnight.

Trump signed a proclamation to implement 25% tariffs on auto imports.

Gold traders keep buying as uncertainty rises, no one knows anymore which tariffs are applicable when and where.

Gold price (XAU/USD) sprints higher on Thursday, gaining around 0.70% gains, trading at $3,040 at the time of writing. The pop in the precious metal was infused by United States President Donald Trump, who issued fresh new tariffs. Trump signed a proclamation for a 25% tariff on auto imports on Wednesday.

In addition, President Trump suggested that further and mounting tariffs can be imposed on the European Union and Canada if both territories work together to “do the US economy harm”. Trump threatened with more levies on lumber, semiconductors and pharmaceutical drugs. All these new unleashed tariffs, levies and threats make the market’s assessment on what will actually come on April 2nd and 3rd, with the already announced reciprocal tariffs very unclear and full of contradictions.

Daily digest market movers: Lost track of it all, good for Gold

President Donald Trump signed a proclamation to implement a 25% tariff on auto imports and floated further duties on the EU and Canada, expanding the trade war and triggering threats of retaliation. “What we’re going to be doing is a 25% tariff on all cars that are not made in the United States,” Trump said at the White House on Wednesday as he pushed ahead with a program seeking to bring more manufacturing jobs to the US, Bloomberg reports.

Sibanye and Gold Fields are engaged in a high-stakes battle with the Rand West City Local Municipality over the valuations of the companies’ properties, setting off a tit-for-tat legal wrangle that has been raging for nearly a decade, according to an article on BusinessDay. Meanwhile, Gold Fields is still stuck in the acquisition bidding war with Australian miner Gold Road Resources.

Goldman Sachs ramped up its Gold price forecast to $3,300 by year-end, citing stronger-than-expected central bank demand and solid inflows into bullion-backed exchange traded funds (ETFs).

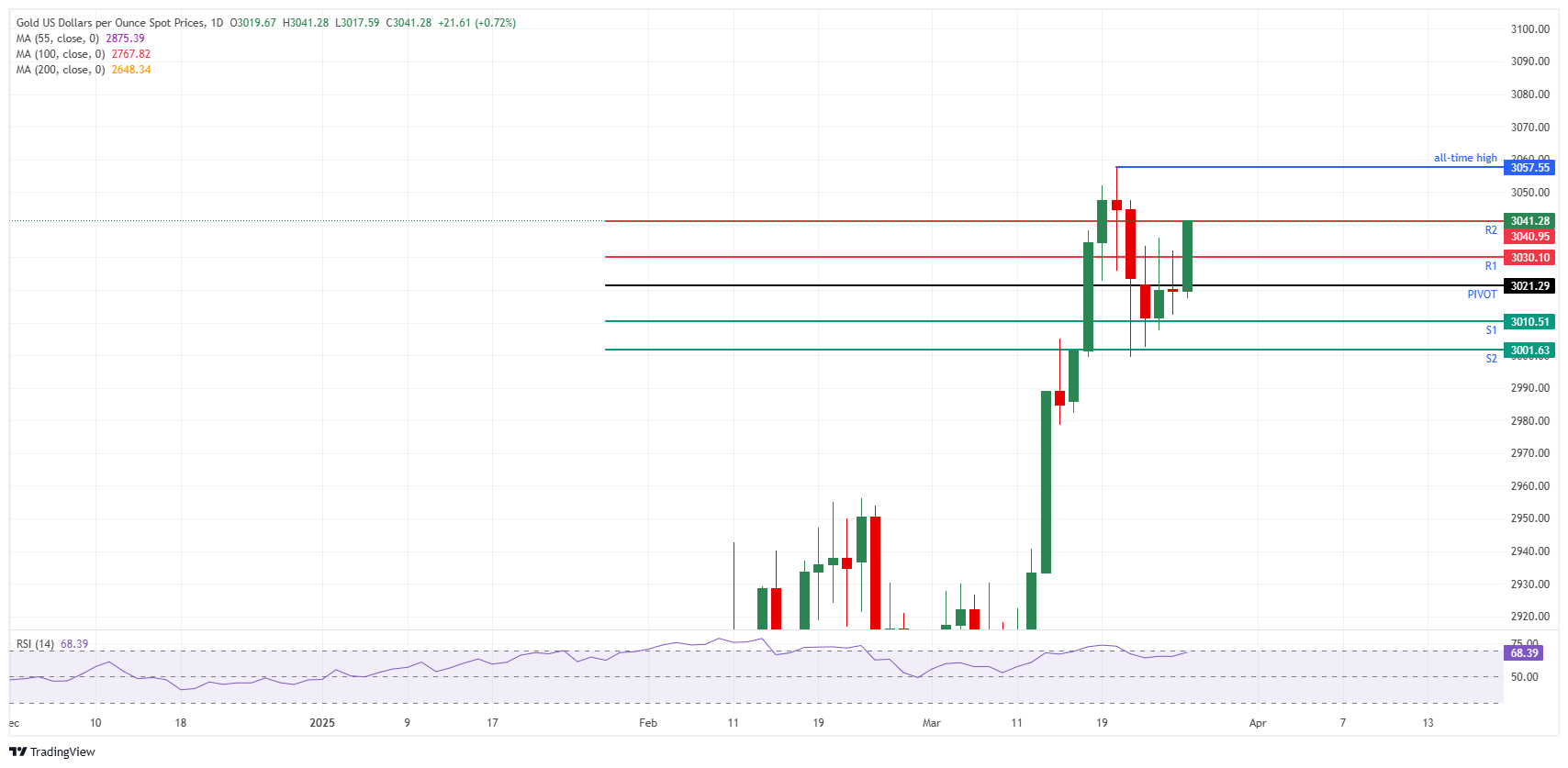

Gold Price Technical Analysis: Close to all-time highs, but not there yet

With the tariff picture for April 2nd now becoming even less clear, it makes sense for traders to reside in a safe haven spot, which is Gold, helping the bullish trend to continue.

On the upside, the daily R1 resistance for XAU/USD comes in at $3,030 and already got broken earlier this Thursday. Further up, the R2 resistance at $3,040 is just below Friday’s high. This means this level is a heavy barrier before pointing to the current all-time high of $3,057.

On the downside, the intraday S1 support for Gold price stands at $3,010, preceding the $3,000 mark, which can be perceived as a bullish sign. That means the $3,000 mark is no longer exposed and has some circuit-breaking element beforehand to slow down any downmoves. Further down, the S2 support comes in at $3,001, which coincides with the $3,000 marker psychological level.

XAU/USD: Daily Chart

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.