Gold price consolidates above $3,000; downside potential seems limited

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Gold price bulls seem reluctant amid a positive risk tone and the recent USD recovery.

Bets that the Fed will resume its rate-cutting cycle soon offer support to the bullion.

Tuesday’s US macro data and Fed speak could provide impetus to the XAU/USD pair.

Gold price (XAU/USD) struggles to gain any meaningful traction during the Asian session on Tuesday, though it holds above the $3,000 psychological mark amid mixed fundamental cues. The US Dollar (USD) preserves its recent recovery gains from a multi-month low and sits near a three-week high touched on Monday. Apart from this, the upbeat market mood, bolstered by hopes for less disruptive US trade tariffs, the Russia-Ukraine peace deal, and the optimism over China's stimulus, acts as a headwind for the safe-haven precious metal.

Meanwhile, the growing acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle soon, amid worries over a tariff-driven US economic slowdown, holds back the USD bulls from placing aggressive bets. This, in turn, is seen lending some support to the non-yielding Gold price. Hence, it will be prudent to wait for a sustained break and acceptance below the $3,000 mark before confirming that the XAU/USD has topped out in the near term and positioning for an extension of the recent pullback from the all-time peak.

Daily Digest Market Movers: Gold price remains on the defensive amid the upbeat market mood

The global risk sentiment remains well supported by hopes that US President Donald Trump's so-called reciprocal tariffs, set to take effect on April 2, will be narrower and less strict than initially feared.

Russian state media RIA reported that a joint statement from the US and Russia is expected on Tuesday after day-long talks in Saudi Arabia focused on a narrow proposal for a Black Sea maritime ceasefire deal.

According to a Financial Times report, China is considering including services in a subsidy program to stimulate consumption, further boosting investors' confidence and undermining the safe-haven Gold price.

The US Dollar preserves its recent gains to a nearly three-week high touched on Monday in reaction to the better-than-expected release of US Composite PMI, which rose to 53.5 in March from the 51.6 previous month.

The Federal Reserve last week lowered its 2025 growth forecast and hiked its inflation outlook amid uncertainty over Trump's tariffs, though signaled that it is likely to deliver two 25 basis points rate cuts in 2025.

Meanwhile, concerns about US economic growth saw traders lift bets that the Fed could resume its policy-easing cycle soon, which caps further USD gains and lends support to the non-yielding yellow metal.

Atlanta Fed President Raphael Bostic said on Monday that he anticipates slower progress on inflation in coming months and sees the central bank cut the benchmark rate only a quarter of a percentage point in 2025.

Traders now look to Tuesday's US economic docket – featuring the release of the Conference Board's Consumer Confidence Index, New Home Sales, and the Richmond Manufacturing Index – for some impetus.

Apart from this, speeches by influential FOMC members could drive the USD demand and produce short-term opportunities around the XAU/USD pair later during the North American session.

The focus, however, will remain glued to the US Personal Consumption Expenditure (PCE) Price Index on Friday, which could provide fresh cues about the Fed's future rate-cut path.

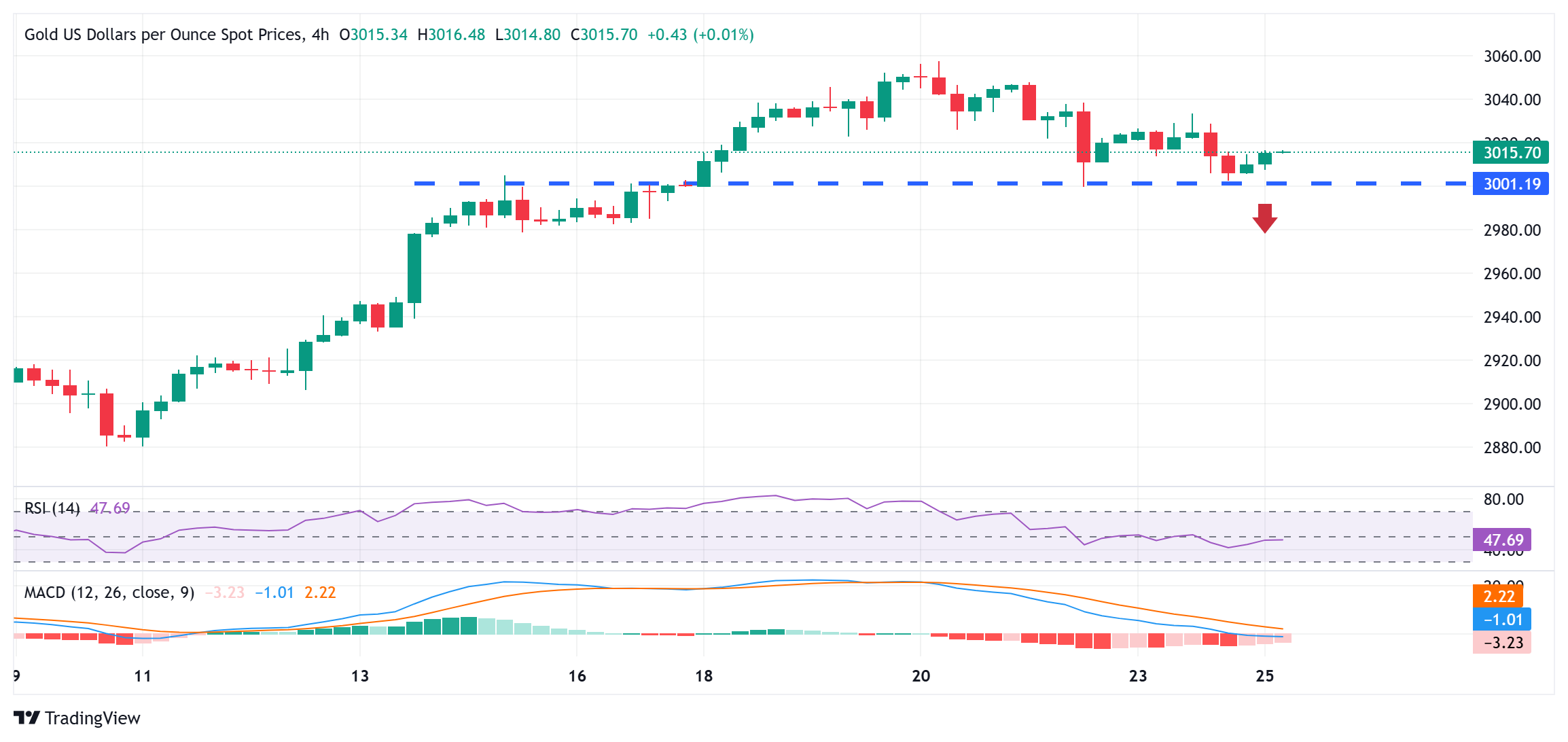

Gold price bears need to wait for a sustained break below $3,000 before placing fresh bets

From a technical perspective, the XAU/USD pair has been showing some resilience near the $3,000 mark. The said handle is likely to act as a key pivotal point, which if broken decisively might prompt some technical selling and drag the Gold price to the $2,982-2,978 region. The corrective fall could extend further towards the $2,956-2,954 resistance breakpoint, now turned support.

On the flip side, the $3,033 area, or the overnight swing high, now seems to act as an immediate hurdle ahead of the all-time peak, around the $3,057-3,058 zone touched last week. Given that oscillators on the daily chart are holding comfortably in positive territory, some follow-through buying will be seen as a fresh trigger for bulls and set the stage for an extension of a multi-month-old uptrend.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.