Gold rallies to a new all-time high in its sprint toward $3,000

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Reclaims $70,000. Cathie Wood Claims Near Potential Bottom, Will This Time Be Different?

- Gold Price Forecast: XAU/USD falls below $5,050 as traders await US jobs data

- Is the Crypto Rally Dead? Why Bernstein Still Predicts a $150K Bitcoin Peak Despite Waller’s Warnings

- WTI declines below $63.00 as US-Iran talks loom

Gold benefits from US President Donald Trump’s harsh talks on tariffs.

US yields turn lower after printing a new five-day high on Thursday.

Traders are heading back into safe-haven assets as reciprocal tariffs approach.

Gold’s price (XAU/USD) hits a fresh all-time high above the $2,990 level at the time of writing on Friday, registering a weekly gain of over 2.5% for now. The additional inflow and demand for Bullion came after United States (US) President Donald Trump fired back at European counter-tariffs, saying he would slap 200% tariffs on wine and champagne from the region.

This has spooked market participants into believing that all bets are off and that US President Trump will not step back or ease his stance on tariffs, raising even more concerns regarding growth and demand for risk assets. Meanwhile, US yields hit a fresh five-day high on Thursday before retreating.

Daily digest market movers: Concerns are growing

President Donald Trump’s aggressive tariff agenda fanned concerns about the potential hit to growth, hurting demand for risk assets and aiding flows into bullion-backed funds, Bloomberg reports.

Some Chinese jeweler stocks have risen substantially this week. On Friday, mainland-listed Zhejiang Ming Jewelry Co. surged by its 10% gain limit for a fourth day. Chow Tai Fook Jewellery Group was also up, showing that traders are looking for associated companies that can profit from a higher Gold price, Bloomberg reports.

Macquarie Group’s Commodities Strategy team lead, Marcus Garvey, pointed out on Thursday that holdings are still about 20% below its previous peak in 2020. This means there is still ample scope for inflows to increase in the precious metal, Reuters reports.

The CME Fedwatch Tool sees a 97.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. The chances of a rate cut at the May 7 meeting currently stand at 30.3%.

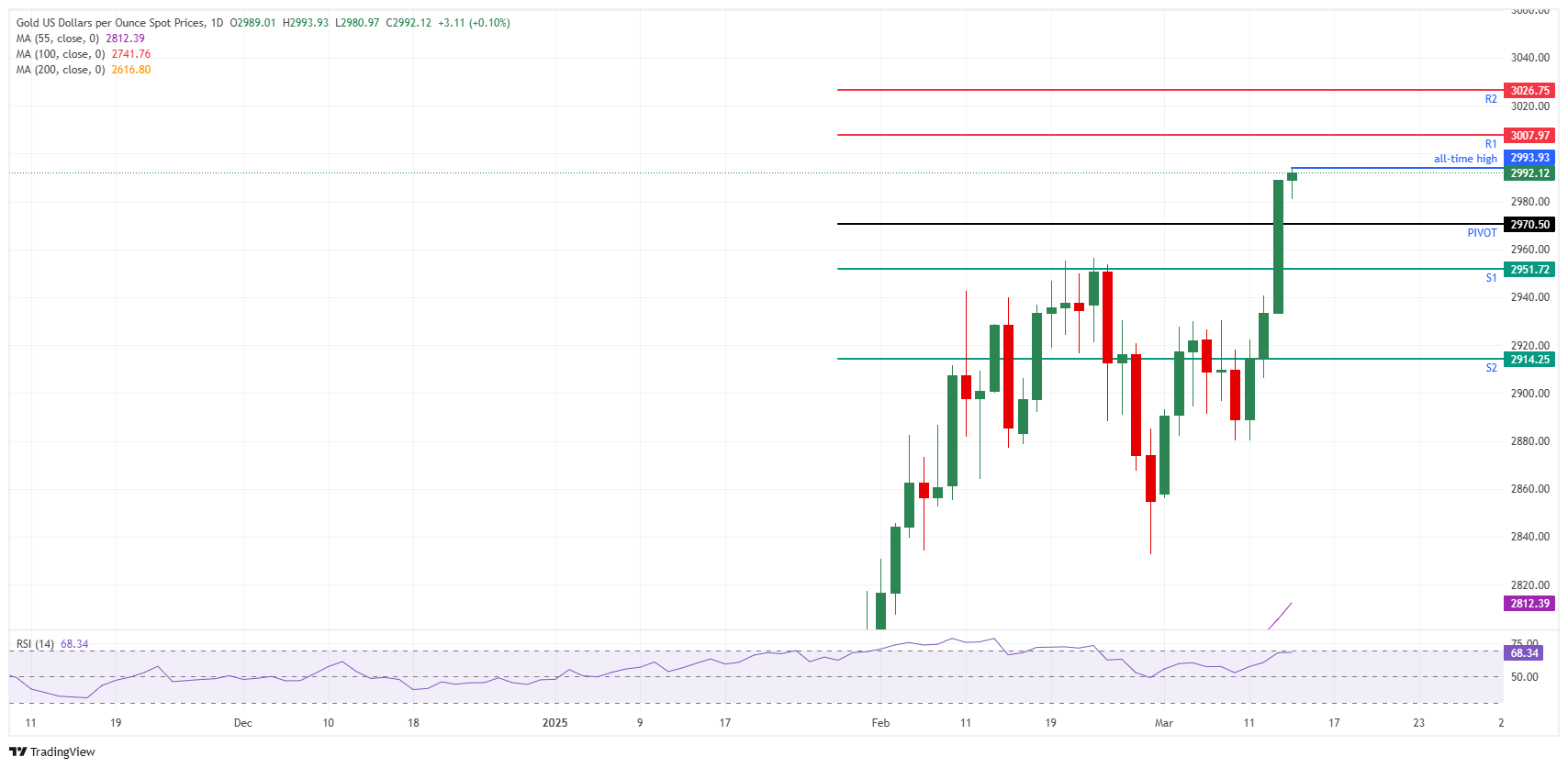

Technical Analysis: $3,000 before the closing bell

The $3,000 mark has come into play quickly just a day after the French bank BNP Paribas said $3,200 would be the target price for Gold for the second quarter. With the European and US sessions still ahead, a quick sprint higher could materialize. However, traders should refrain from entering on the break of $3,000 because this level will likely trigger some short-term profit-taking.

The new all-time high at $2,993 can easily be taken out any time now. Look for the psychological $3,000 mark on the way up. Beyond that level, it is an uncharted territory where resistances and supports from the daily Pivot Point can help guide direction. The daily R1 resistance at $3,007 and the R2 resistance at $3,026 are certainly levels to look out for.

On the downside, the daily Pivot Point stands at $2,970. In case that level breaks, look at the S1 support around $2,951. Further down, the S2 support stands at $2,914, preceding the $2,900 big figure, which should be strong enough to catch any corrections.

XAU/USD: Daily Chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.