After opening some positions, traders often need to check the status of their trading account. This is important to ensure they can adjust their trading account in time and capture profits, while avoiding unnecessary losses.

In this article, I will discuss what a trading account status is and how to make sense of it in different situations.

1. What is the trading account status?

A trading account status is a snapshot of the current condition of a trading account, highlighting its financial activities, balances, and overall health. It provides insights into transactions, holdings, and performance, essential for traders to manage their investments effectively.

Several components make up a trading account status, providing a comprehensive overview:

Open Positions: Trades executed but not yet closed are known as open positions. Open positions reveal the current market exposure and potential risk.

Transaction History: The system maintains a detailed record of all financial transactions, including deposits, withdrawals, and executed trades.. This history is crucial for tracking performance and financial management.

Profit and Loss (P&L) Statement: A summary of realized and unrealized gains or losses. The P&L statement provides insight into the account’s performance over time.

Account Balance: This is the total amount of funds available, including both cash and securities. It reflects the account’s financial capacity to execute trades.

Margin Details: Learn about the margin utilized, the available margin, and the margin requirements. For accounts that engage in leveraged trading, understanding margin details is critical.

To clarify what we should do during real trading, I will provide more details in the next sections.

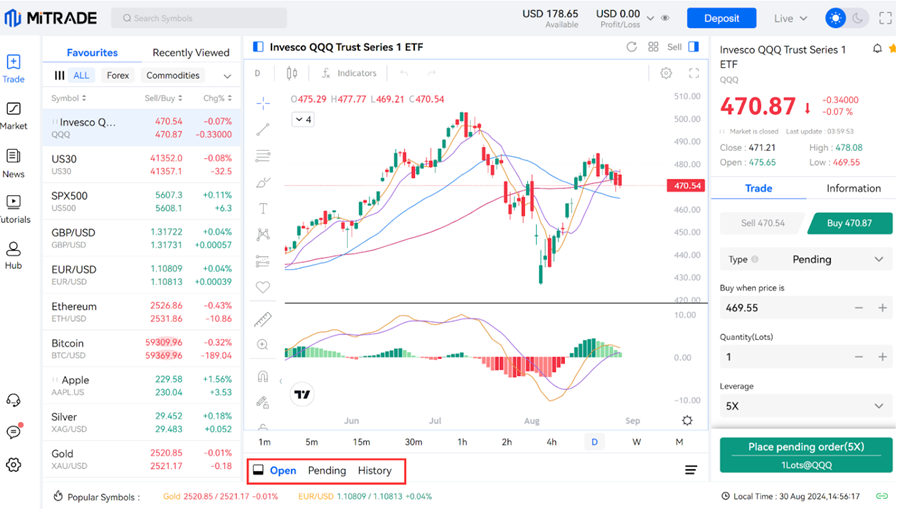

2. How to check Open Positions and Transaction History

Brokers always provide details on their platforms. To check your positions and transaction information, you need to sign in to your trading account and navigate to the dashboard. Look for a tab or section labeled "Open Positions," "Current Positions," "Pending Positions," or "Transaction History." This will display all of your active trades or trading history.

For each open position, you should see details such as:

Asset Name: The security or asset you’re trading.

Quantity: The number of shares or units held.

Entry Price: The price at which you bought the asset.

Current Price: The current market price of the asset.

Unrealized P/L: The profit or loss that has not yet been realized.

In the transaction history, you’ll typically find:

Date of Transaction: When the trade was executed.

Asset Traded: The name of the security.

Transaction Type: Whether it was a buy or sell.

Quantity: The number of shares traded.

Price: The price at which the asset was traded.

Fees: Any associated transaction fees.

Reviewing these details allows you to evaluate your trading performance, understand your current risk exposure, and make informed decisions about future trades.

You can enhance your trading strategy and maintain better control over your investments by implementing the following effective monitoring tips:

Regular Checks: Make it a habit to regularly check your open positions and transaction history to stay informed about your trading performance.

Use Alerts: To stay informed of significant market movements, set up price alerts for your open positions.

Download Reports: Many platforms offer options to download transaction reports for further analysis.

In the next section, we will explain more details about 'My Assets' in your account, so you can easily understand what you own, what you pay, what you lose, and what you gain.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

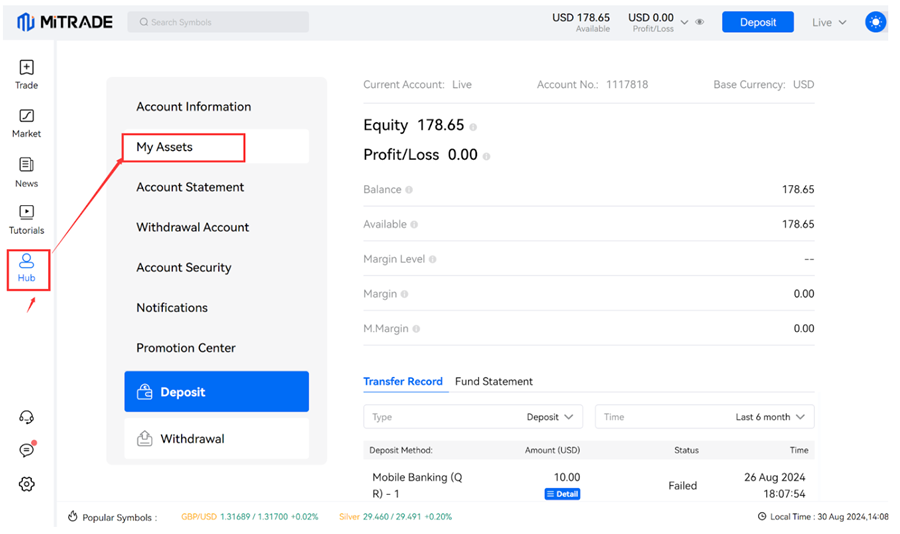

3. How to check my assets

3.1 What is Profit and Loss (P&L) Statement

Whenever you’re trading, you will encounter these terms and information about your trading performance.

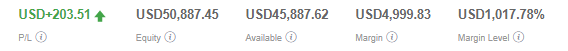

some terms you’ll encounter in your trading journey

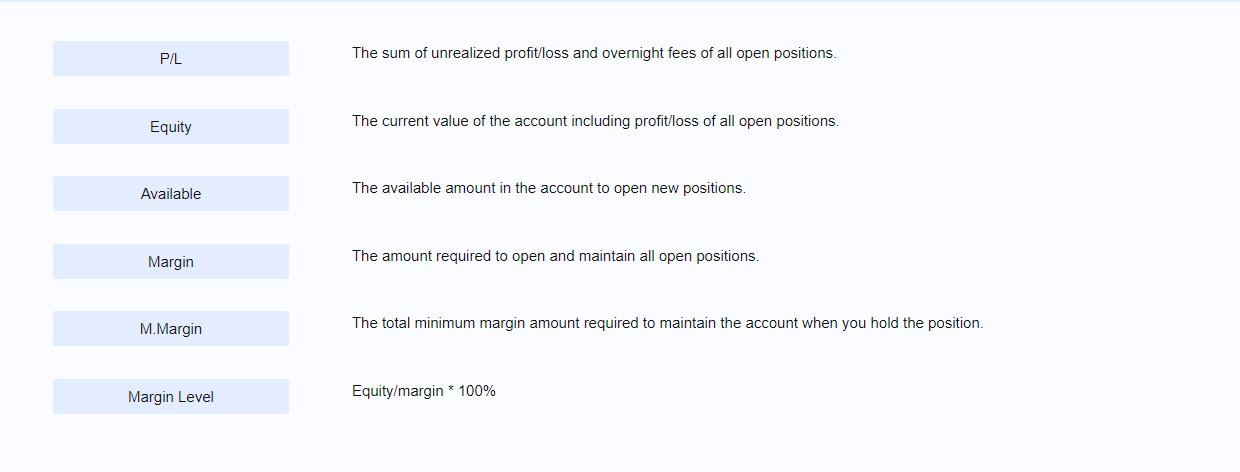

Net P&L: The profit and loss for all open positions.

How to calculate: the total of P&L of all open trades + (daily Overnight Funding rate x number of days).

3.2 What is Account Balance

Balance: The amount after the last closed trade.

How to calculate: Deposits – Withdrawals + Realised Total P&L of closed positions (does not include the unrealised P&Ls on the open positions)

Equity: the current value of the account including profit/loss of all open positions.

How to calculate: Balance + Net P&L

The difference between Balance and Equity;

Balance reflects your profit/loss from closed positions.

Equity reflects the real-time calculation of your profit/loss. Equity takes into account both open AND closed positions.

3.3 What is Margin Details

Margin: the amount required to open and maintain all trade positions.

How to calculate: The percentage (%) of the notional value (learn more at Margin)

Maintenance Margin: The total minimum margin amount required to maintain the account when you hold a trade position

How to calculate: Real-time contract value * maintenance margin ratio (%).

Maintenance margin ratio (%) = margin ratio (%) * 50%

Available Balance: amount available to be used for new positions or to withdraw.

How to calculate: Equity – Margin

Margin Level: percentage (%) value based on the amount of Equity versus Used Margin. The higher the Margin Level, the more Free Margin you have available to trade.

How to calculate: (Equity / Margin) x 100%

Your ‘Available Balance’, ‘Net P&L’ and ‘Equity’ are constantly calculated in-line with the market movements. If the ‘Equity’ touches or falls below the total of Maintenance Margin requirements your positions are at immediate risk of being liquidated.

4. Summary

A trading account status reflects the current condition and activity level of an investor's trading account. It typically includes details such as account balance, margin used, open positions, and any pending orders.

Understanding this status is crucial for managing investments effectively, as it helps investors track performance, assess risk exposure, and make informed trading decisions. Regularly monitoring trading account status can lead to better financial outcomes and adherence to trading strategies.

5. FAQs

#How can I check my trading account status?

You can check your trading account status by logging into your brokerage platform or using their mobile app, which allows you to view real-time account updates.

#Why is it important to monitor my trading account status?

Monitoring your trading account status helps you manage risk, track your investment performance, and make informed decisions about buying or selling securities.

#What should I do if my trading account status shows unexpected changes?

If you notice unexpected changes in your trading account status, contact your broker immediately for clarification and investigate any potential issues, such as unauthorized transactions.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.