How to read a Forex Quote?

Introduction to Forex Quotes

Forex trading is speculating the rise and fall of the exchange rates. All forex currency pairs have two countries involved, an example EUR/USD or USD/JPY. In each forex transaction, what you’re doing is, you buy one currency and at the same time you sell the other. This applies to very closely to our daily lives too!

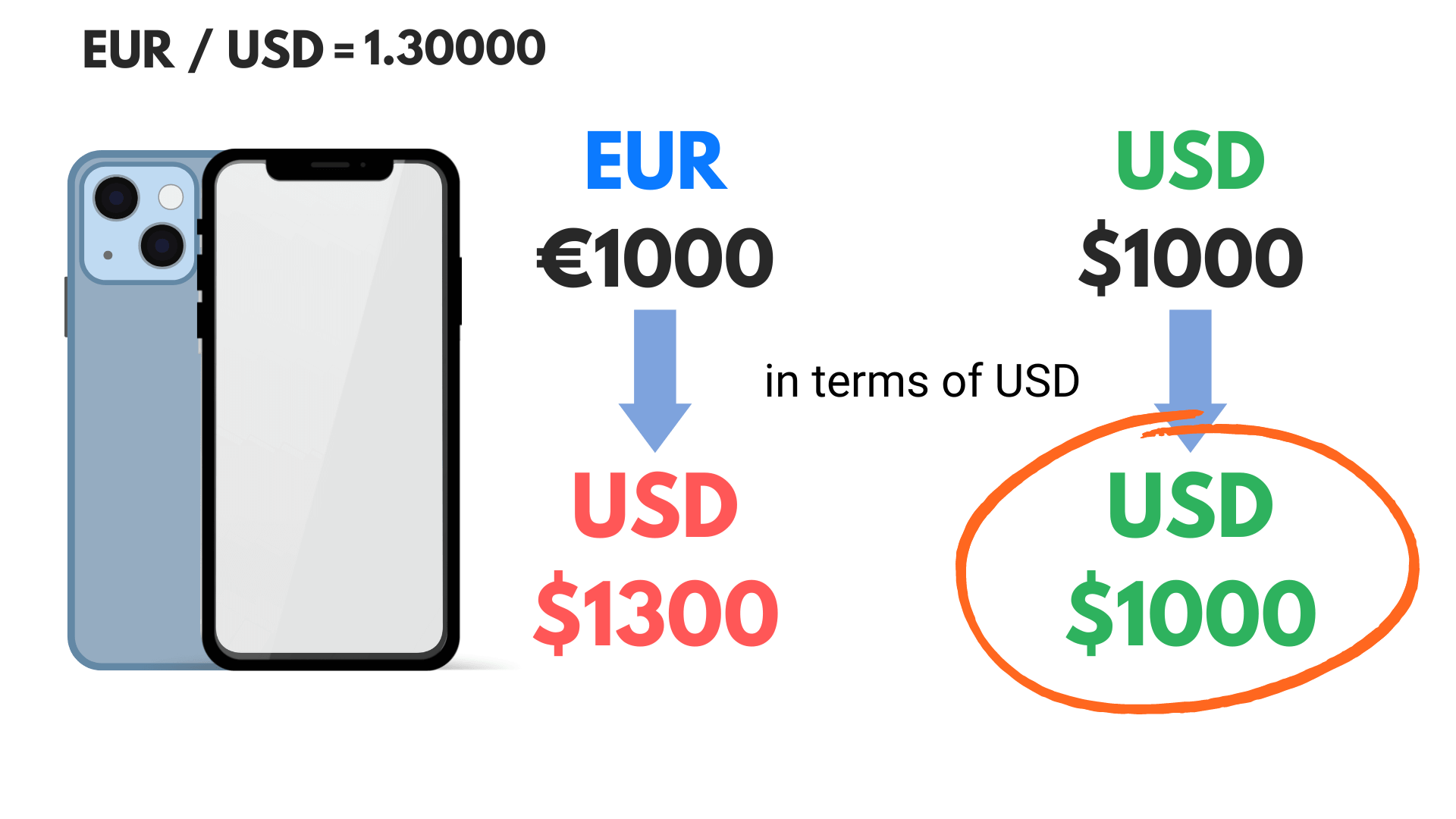

An example;

Imagine buying an iPhone from an online retailer that allows you to choose from two currencies (USD1000 or 1000Euro) when making your purchase. Although both options maybe a thousand units in currency, but are they really worth the same value? What option would you choose?

Base and Quote Currency

In every currency pairing, there will be two country currencies involved and you’re exchanging one currency for the other.

Here is an example of this;

The currency to the left of the slash (“/”) is called the base currency (the euro, EUR in the example), and the currency to the right is the counter (or quote) currency (the US dollar in the example).

The base currency is the “basis” on which you buy and sell currencies.

If you buy EUR/USD, that means you buy the base currency (EUR) and sell the quote currency (USD), that is, you “buy euros and sell dollars.” In the example, you need to pay 1.30000 USD in order to buy 1 Euro.

If you believe the base currency will appreciate relative to the quote currency (the exchange rate rises), then you should buy it. Conversely, if you believe that the base currency will depreciate relative to the quote currency (the exchange rate drops), then you should sell it.

And now back to the iPhone problem; to buy it with US dollars or euros?

If the current rate of the EUR/USD pair is 1.30000, this means that every 1 euro is worth 1.30000USD.

In this instance, it is more affordable to purchase the iPhone with US dollars!

However, it is important to remember that currency prices will fluctuate (rise and fall). Today, it may be a better choice to opt for the US dollar option, but it can change when the price changes!

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.