Altcoin season is loading as US Federal rate cut bets fuel optimism

- Altcoins' market capitalization holds strength above $1.50 trillion as Bitcoin's dominance drops below 60%.

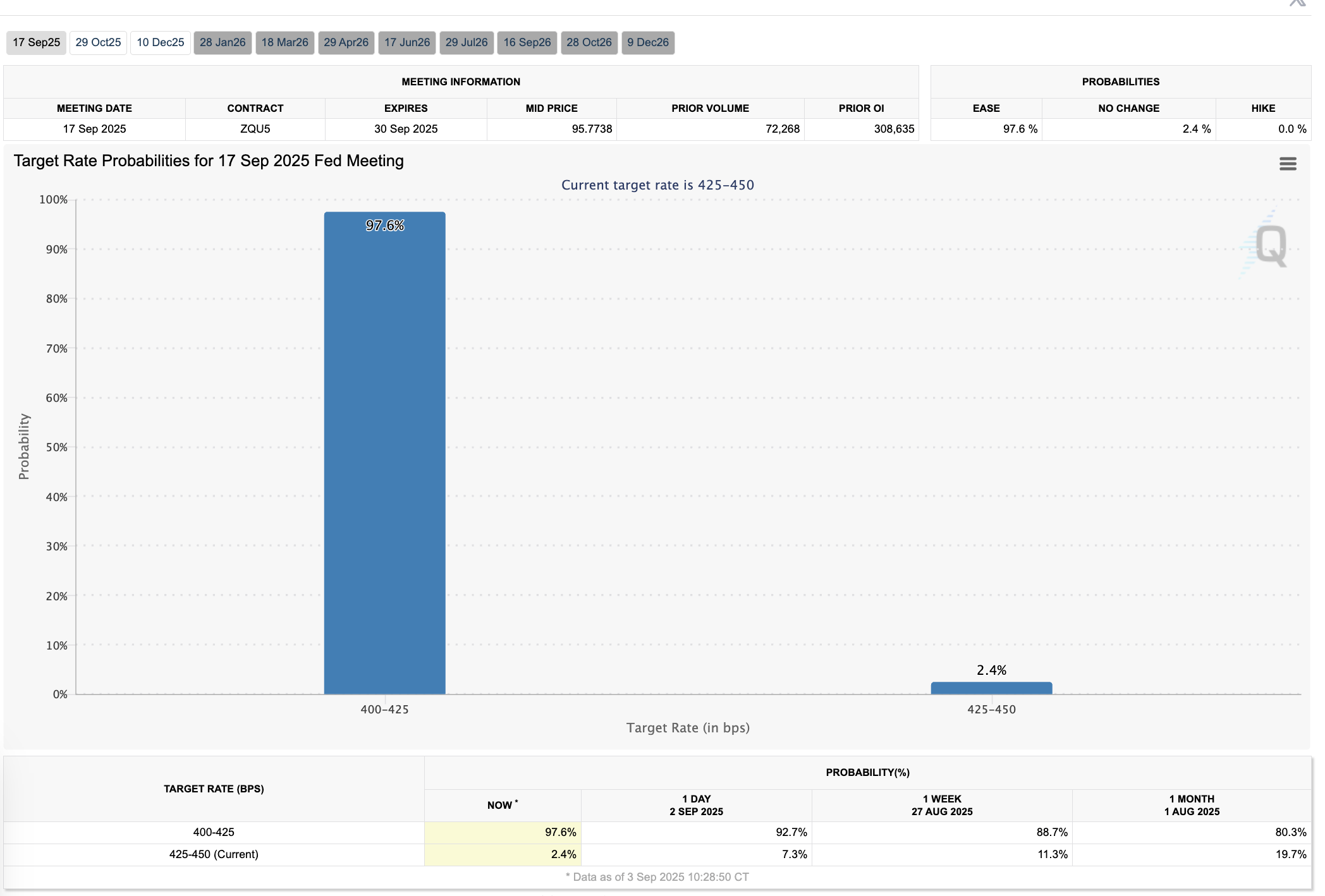

- FedWatchTool indicates a higher anticipation of the US Fed reducing rates by 25 basis points in September.

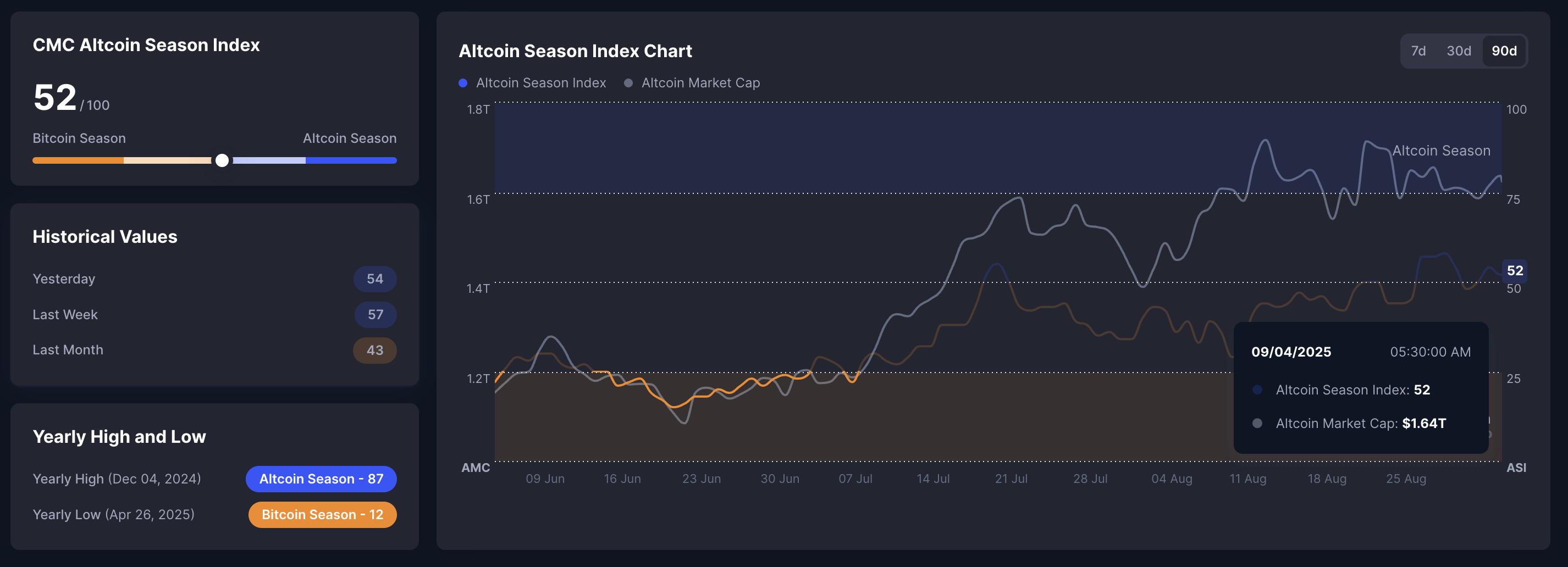

- Altcoin Season Index indicates elevated scores as market sentiment remains mixed.

The altcoins market upholds the reclaimed levels above $1.50 trillion as Bitcoin (BTC) loses its grip over the market. The growing anticipation of the US Federal Reserve reducing interest rates aligns with capital rotation in the crypto market, boosting the Altcoin Season chances. Still, the sudden drop in institutional interest in Bitcoin and mixed market sentiments could delay the potential Altseason.

Chances of US Federal Reserve rate cuts skyrocket

FedWatchTool, an aggregator tool of market expectation, based on 30-day Fed Funds Futures, anticipates a 97.6% likelihood of a 25 basis point (bps) reduction at the 17 September Fed meeting. Last month, the US producer prices jumped by 0.9%, reflecting the effect on domestic prices from the tariffs imposed by US President Donald Trump on major countries.

FedWatchTool

The August US Producer Price Index (PPI) will be released on September 10, days after the Nonfarm Payrolls and Unemployment Rate on Friday. These data could help predict the stance of the Fed in the upcoming meeting on September 17. A rate cut could help control inflation in the short term and potentially increase capital inflows in risk assets such as cryptocurrencies.

Declining Bitcoin dominance teases a potential Altcoin Season

Bitcoin dominance refers to the percentage of the crypto market capitalization dominated by BTC. A shift in capital from BTC to altcoins would decrease BTC dominance, increasing the possibility of an altcoin season.

As of Thursday, the Bitcoin dominance is down at 58.47%, from the annual high of 65.91% on June 26.

Adding to the altseason chances, the total market capitalization of the crypto market excluding Bitcoin (TOTAL 2) chart displays a symmetrical triangle pattern forming on the daily timeframe. The Total2 is down by nearly 1% at press time on Thursday; even so, the price action shows an upcycle intact within the triangle pattern.

A potential upside breakout could drive the rally into price discovery mode, beyond the all-time high of $1.69 trillion recorded on August 14.

Total crypto market excluding Bitcoin.

Looking down, a slip below the $1.50 trillion would invalidate the triangle pattern and the altcoin season chances.

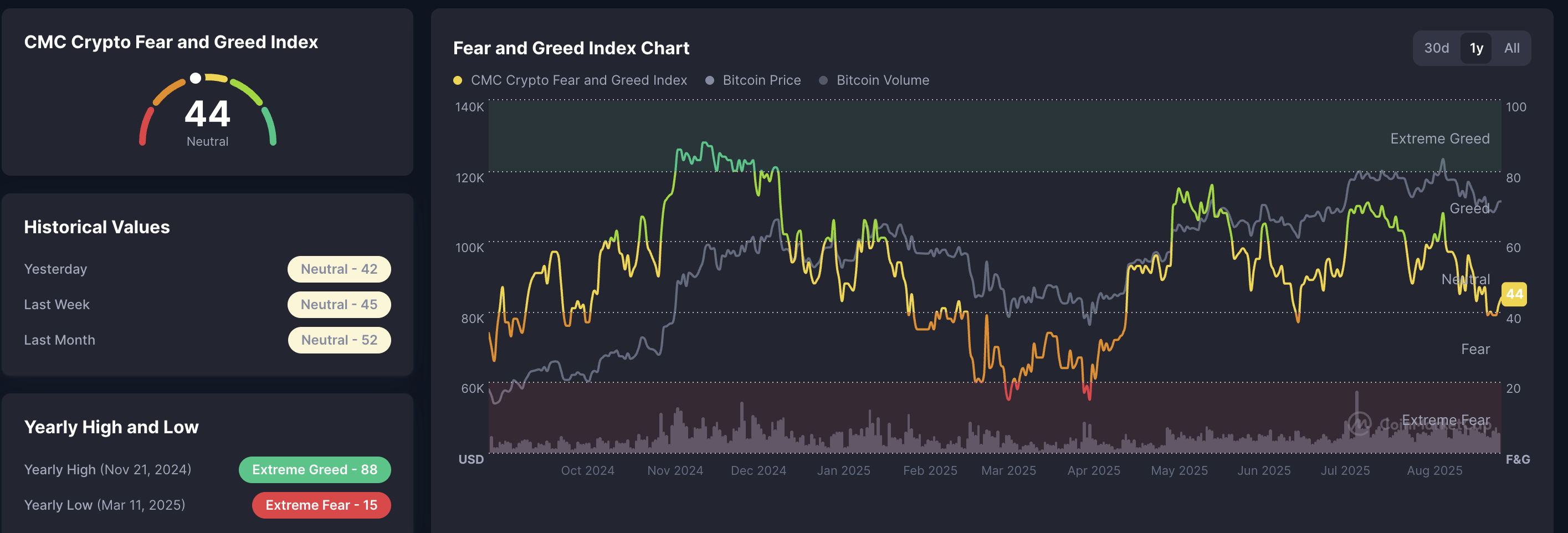

Market sentiment remains mixed

CoinMarketCap’s Altcoin Season Index is based on the performance of the top 100 altcoins relative to Bitcoin over the last 30 days. As of Thursday, 53 altcoins outperform Bitcoin, while an official altseason requires a score of 75 altcoins beating Bitcoin’s performance. This indicates the altcoin season is halfway here as Bitcoin loses dominance.

CMC Altcoin Season Index.

Furthermore, the Fear and Greed Index stands at 44, indicating that the market sentiment remains neutral as volatility returns to the market. Typically, elevated market sentiments are necessary for investors to shift capital to altcoins.

CMC Crypto Fear and Greed Index.

A potential rate cut decision from the US Federal Reserve could align key catalysts, such as market sentiment and easier access to capital for risky assets, kickstarting a potential altcoin season.