Crypto Today: USDC approved in Dubai, SOL, ETH and BTC in turmoil, as Trump tariffs trigger $200B losses

- Cryptocurrency markets declined 7% on Monday, as cascading $208 billion liquidations shaved $80 billion off the sector’s aggregate valuation.

- Bitcoin price plunged 4.7 to hit 40-day lows around $91,000 with technical indicators signaling further downside risks.

- Hedera (HBAR) and Bittesor (TAO) were the only two assets posting intraday gains among the top 50 crypto assets.

Bitcoin market updates:

US President Donald Trump’s decision to move ahead with tariffs on Mexico and Canada in March has sparked bearish sentiment across global financial markets including Bitcoin (BTC).

Bitcoin price declined by another 4.7% on Monday bringing its losses since the Bybit hack to 7% as it traded as low as $93,000 within the intra-day session.

Bitcoin price action | BTCUSDT

- Bitcoin ETFs bled another $76 million, shedding $700 million in 5 consecutive days of outflows.

Bitcoin Liquidation Map | Source: Coinglass

- In the derivatives markets, Bitcoin traders lost $243 million which accounted for more than 20% of the $943 total market liquidation on the day, according to Coinglass charts.

- Michael Saylor, CEO of Strategy (formerly Microstrategy) announced another 20,356 BTC purchase worth $1.99 billion on Monday.

Altcoin market updates: HBAR, TAO in green, despite ETH and SOL turbulence

- Solana (SOL) ecosystem in turmoil:

SOL price traded as low as $140 on Monday, its lowest in 4 months dating back to October 2024.

Solana price action, Feb 25, 2025

Zooming out, Solana has now registered losses in each of the last 6 weeks, declining by 51%, from the year-to-date peak of $295 to hit $142 at press time. Based on recent market reports Solana’s current downtrend is driven by two major bearish catalysts.

Why Solana price going down

First, Solana’s popular memecoin generator platform Pump.Fun has announced a decision to launch its own Automated Market Making tool to capture swapping fees and re-distribute value to investors.

This move has sparked bearish sentiment for existing decentralized exchanges like Raydium which earns a significant chunk of its revenue from the flurry memecoins minted on Pump.fun daily. In response, Raydium’s native RAY token price plunged by 25% on the daily chart.

Second, the defunct FTX exchange Estate is expected to unlock 11.2 million SOL worth approximately $2 billion on March 1 to refund to creditors.

Less than 5 days away, investors have begun reducing their exposure to Solana, anticipating the FTX repayments could dilute the short-term SOL market supply and put downward pressure on prices, especially amid market uncertainty surrounding the recent Bybit hack.

Ethereum (ETH) price plunges 6% despite Bybit assurances

Ethereum also suffered considerable losses on Monday, hampered by the fallout from the over 400,000 stolen during the Bybit exploit on Friday.

Despite the exchange announcing that it had fully remediated lost customer funds from its bottom line, ETH price tumbled to a new 20-day lows around the $2,470 level.

Ethereum price action | Feb 25, 2025

Ethereum’s downtrend began on Saturday, when an on-chain analytics platform revealed wallets linked to the Bybit hacker began to launder the stolen funds through Solana memes generated on Pump.fun.

This suggests that the hacker may successfully dump the stolen funds on the market.

With Ethereum developers having rejected the feasibility of a network rollback, to undo the exploit.

Notably the stolen 400,000 ETH accounts for above 3% of Ethereum’s 120 million ETH total supply in circulation.

This explains why investors are rapidly cutting down on their ETH positions to reduce exposure to downside risks from the hackers’ imminent sell-offs.

- Hedera (HBAR) and Bittensor (TAO) prices in green

Hedera (HBAR) and Bittesor (TAO) were the only assets that posted gains on Monday among the top 50 cryptocurrencies ranked by market capitalization.

Hedera’s price gains were lifted by Nasdaq’s ETF filing.

Meanwhile Bittensor (TAO) rallied on bullish tailwinds from the global AI sector.

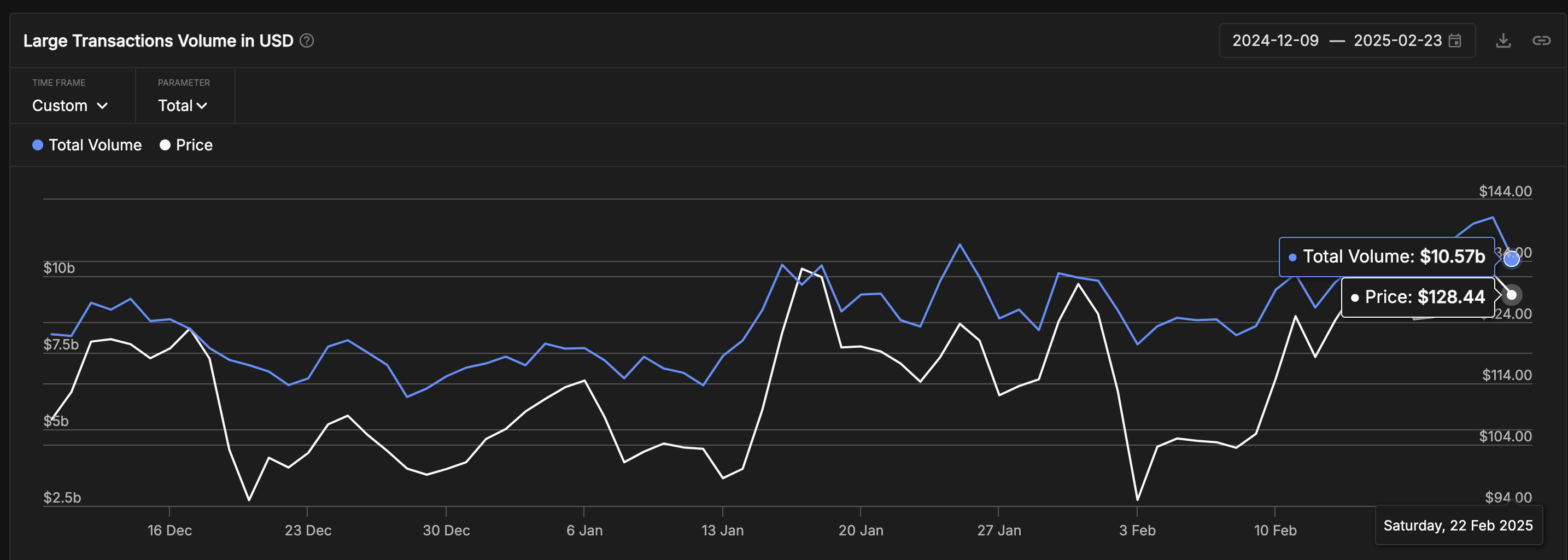

Chart of the day: Litecoin whales maintain steady demand above $10.5 billion despite market dip

Litecoin (LTC) price tumbled 7% from its opening price for $126 to hit intraday lows of $112 on Monday, extending its losses since the Bybit hack into double-digits at 14%.

However, on-chain data trends show that whale investors continue to acquire large amounts of LTC, ignoring the ongoing $208 billion market turmoil.

Supporting this stance, IntoTheBlock's Large Transactions chart below represents the aggregate value of all transactions that exceed $100,000 in face value.

This provides real-time insights into the activities of whale investors active on the Litecoin network.

Litecoin (LTC) Daily Large Transactions, Feb 2025 | Source: IntoTheBlock

Based on the latest data, LTC whale transactions remain above the $10.5 billion mark, trending nearing last month's peak of $11 billion.

With analysts and market watchers pricing in a 90% chance of an LTC ETF approval, the steady spikes in daily whale transactions suggests institutional investors are capitalizing on the market dip to acquire large units of LTC, upside from the growing ETF optimism.

This positions LTC for a major breakout phase when bearish market sentiment subside.

Crypto news updates:

- PancakeSwap goes live on Monad testnet, promising lower fees and faster transactions

PancakeSwap has launched on the Monad testnet, bringing ultra-low trading fees, enhanced liquidity, and improved capital efficiency to decentralized finance (DeFi).

The integration allows traders to benefit from fees as low as 0.01% while leveraging Monad’s high-speed blockchain infrastructure. Both PancakeSwap v2 and v3 are now available, giving liquidity providers the option to choose between a fixed-fee model or concentrated liquidity for greater capital efficiency.

Monad’s blockchain is designed to handle thousands of transactions per second with near-instant finality, reducing network congestion and ensuring consistent performance even during peak market activity.

The testnet phase allows users to experience the upgraded trading environment with test tokens ahead of the official mainnet launch.

However, currently, all transactions and liquidity pools on the testnet are for testing purposes only and do not yield rewards or burns.

- USDC and EURC become first legally recognized stablecoins in Dubai

The Dubai Financial Services Authority (DFSA) has approved Circle’s USD Coin (USDC) and EURC as the first stablecoins recognized under its regulatory regime.

This approval allows businesses within the Dubai International Financial Centre (DIFC) to integrate these stablecoins into digital asset applications, including payments and treasury management.

This milestone strengthens regulatory clarity for stablecoins in the United Arab Emirates (UAE) and aligns with the country’s broader efforts to establish a structured framework for digital assets.

The approval follows Dubai’s ongoing development of licensing systems and legal infrastructure for stablecoin adoption, reinforcing the city's position as a global crypto hub.

- SEC drops charges against Robinhood Crypto with ‘no action’

The U.S. Securities and Exchange Commission (SEC) has closed its investigation into Robinhood Crypto (RHC) without taking enforcement action.

The decision, communicated in a letter from the SEC’s Enforcement Division on February 21, 2025, follows a Wells Notice issued to RHC in May 2024.

Robinhood welcomed the closure, with Chief Legal Officer Dan Gallagher stating the investigation “never should have been opened.”

He reiterated that Robinhood Crypto has always complied with federal securities laws and never facilitated securities transactions.

The SEC’s decision marks the end of a nearly year-long inquiry into the firm’s crypto operations.