GBP/USD soars as speculation over Hassett fuels Fed-pivot bets

- GBP/USD jumps above 1.3300 as Trump hints Hassett could replace Powell, boosting expectations for deeper Fed easing.

- ADP shows 32K job losses, reinforcing dovish shift as markets price 85% odds of a December Fed cut.

- OECD upgrades UK outlook as markets assign 90% probability of a BoE cut on December 18.

GBP/USD rallies on Wednesday during the North American session, surpasses the 1.3300 figure as market participants priced in a more dovish Federal Reserve as rumors grow that the White House economic adviser Kevin Hasset could become the next Chair taking Powell’s rein.

Sterling jumps as Dollar weakens on talk of a new Fed Chair and soft US labor data

The Dollar continues to weaken following remarks by US President Donald Trump on Tuesday, who said that a “potential” Fed Chair was around in his press conference at noon.

The US ISM Services PMI revealed that activity remained steady in November, coming at 52.6 up from 52.4, exceeding forecasts of 52.1. Although expanded, orders slowed, the employment sub-component is still subdued, and input prices are tilted to the upside.

Earlier jobs data showed that private companies slashed -32K people from the workforce, according to the ADP National Employment Change report. The print missed estimates of 10K, and November’s 42K increase.

Central banks’ convergence, boosts Sterling

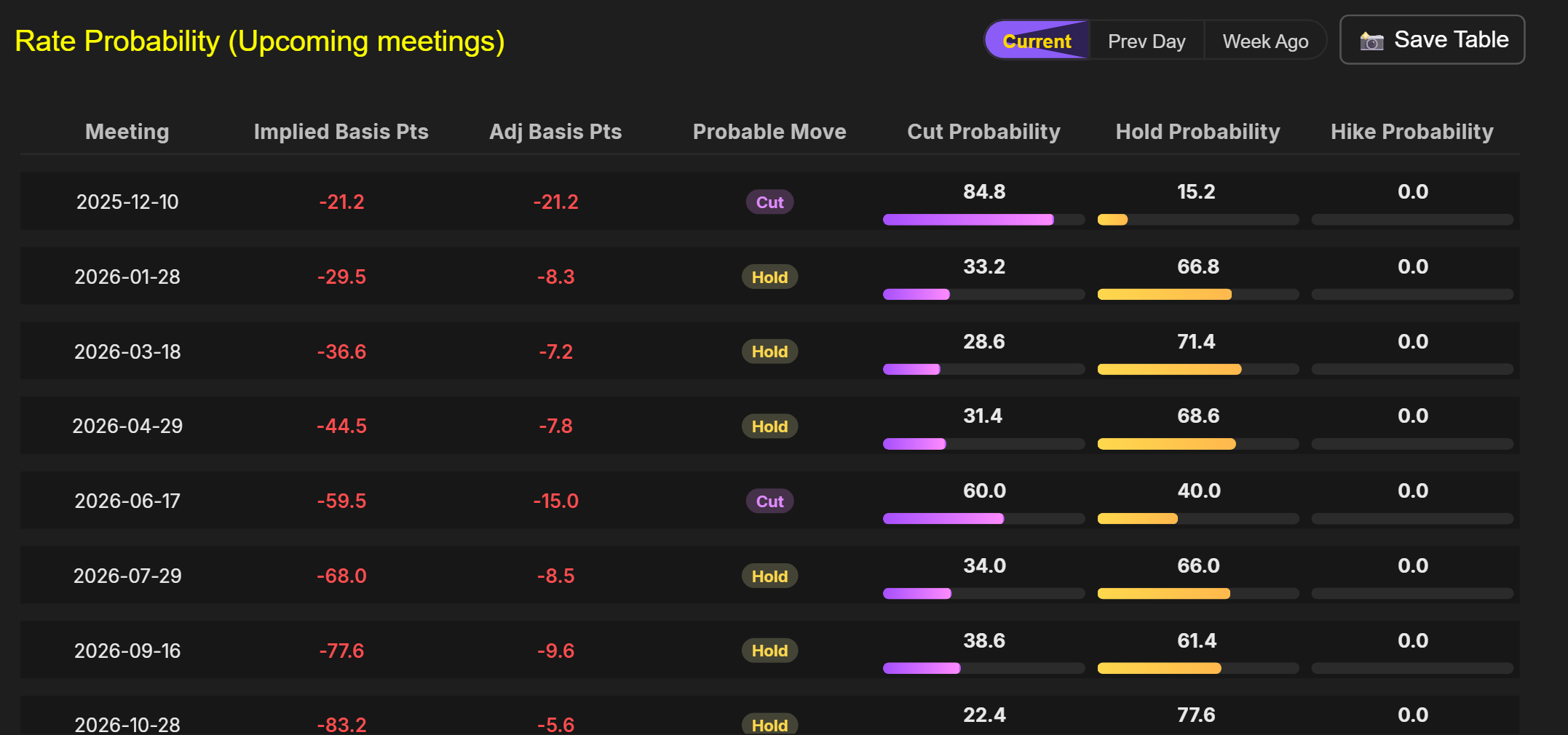

Data from Capital Edge showed that money markets had priced in a nearly 85% chance for a 25 basis points rate cut, as the curve implied 21.2 bps of cuts as of writing. For 2026, investors had priced in 88.5 bps, implying that the fed funds rate could end at 2.99%.

Across the pond, the OECD revealed that Britain’s economy is projected to fare better than expected and added that the Bank of England could slow its monetary easing path.

The swaps market had priced in a 90% chance of the BoE cutting rates 25 bps at the December 18 meeting.

With the current interest rate gap, GBP/USD is likely to rise unless unexpected news causes risk aversion in financial markets.

GBP/USD Price Forecast: Technical outlook

At the time of writing, GBP/USD tests the 200-day SMA at 1.3318, which if decisively broken, could push the exchange rate higher. The RSI shows that bulls are gaining steam, meaning that at test of the 100-day SMA At 1.3360 is on the cards, ahead of 1.3400.

Conversely, a daily close below 1.3300, could keep the pair range-trading at around the 50-day SMA at 1.3265-1.3318, where the 200-day SMA lies.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.59% | -0.64% | -0.56% | -0.20% | -0.74% | -0.52% | -0.38% | |

| EUR | 0.59% | -0.05% | 0.05% | 0.39% | -0.14% | 0.07% | 0.21% | |

| GBP | 0.64% | 0.05% | 0.37% | 0.44% | -0.09% | 0.12% | 0.26% | |

| JPY | 0.56% | -0.05% | -0.37% | 0.33% | -0.22% | 0.00% | 0.14% | |

| CAD | 0.20% | -0.39% | -0.44% | -0.33% | -0.59% | -0.31% | -0.18% | |

| AUD | 0.74% | 0.14% | 0.09% | 0.22% | 0.59% | 0.22% | 0.36% | |

| NZD | 0.52% | -0.07% | -0.12% | -0.00% | 0.31% | -0.22% | 0.14% | |

| CHF | 0.38% | -0.21% | -0.26% | -0.14% | 0.18% | -0.36% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).