Bitcoin Price Forecast: BTC extends recovery above $111,000 despite heavy ETF outflows

- Bitcoin price trades in green above $111,000 on Monday, extending its weekend recovery.

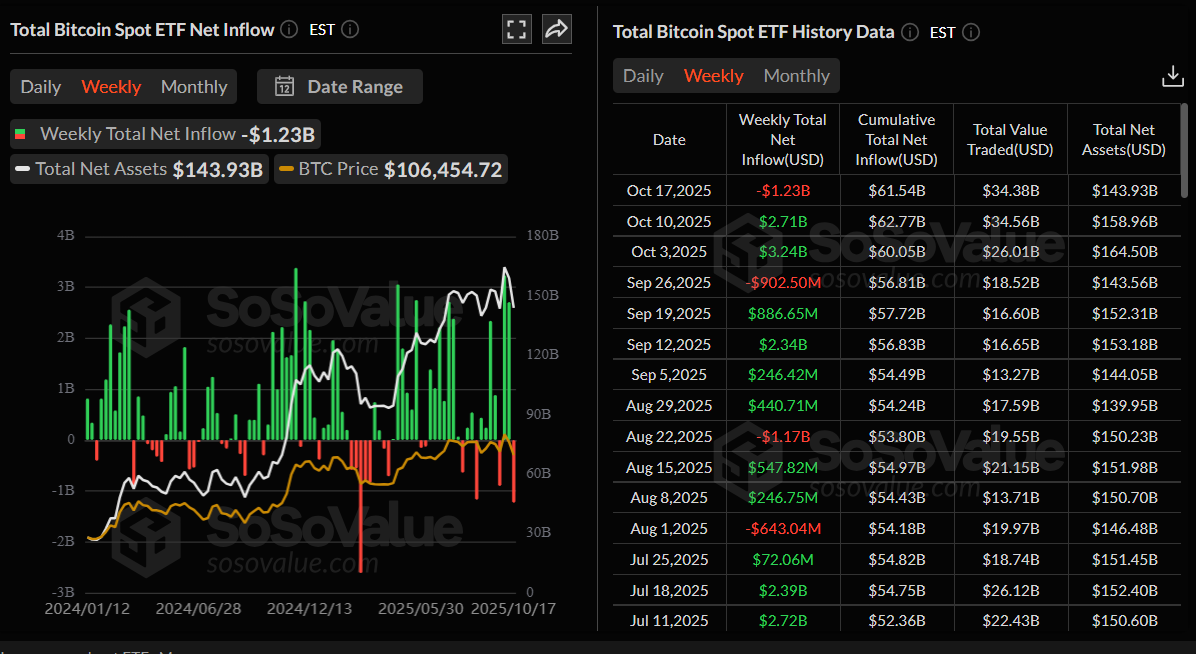

- US-listed spot Bitcoin ETFs recorded an outflow of $1.23 billion last week, the second-largest weekly outflow since launch.

- On-chain data reveals whales are accumulating BTC on dips, while retail traders continue to sell their holdings.

Bitcoin (BTC) reclaims $111,000 on Monday, extending its weekend recovery after falling nearly 6% in the previous week. Spot Exchange Traded Funds(ETFs) recorded an outflow of over $1.2 billion, marking the second-largest weekly outflow since their launch. Despite the recent price dip, whale wallets continue to accumulate BTC while retail traders trim their exposure, reflecting a divergence between the two cohorts of traders.

Bitcoin records the second-largest weekly outflow since launch

Bitcoin kicks off the week with modest gains, trading above $111,000 at the time of writing and extending its weekend recovery. However, the institutional demand weakened last week as SoSoValue data shows that spot Bitcoin ETFs recorded a total of $1.23 billion in weekly outflows.

These withdrawals broke the two-week streak of inflows since early October and marked the second-largest weekly outflow since their launch, reflecting cautious investor sentiment.

Total Bitcoin Spot ETF net inflow weekly chart. Source: SoSoValue

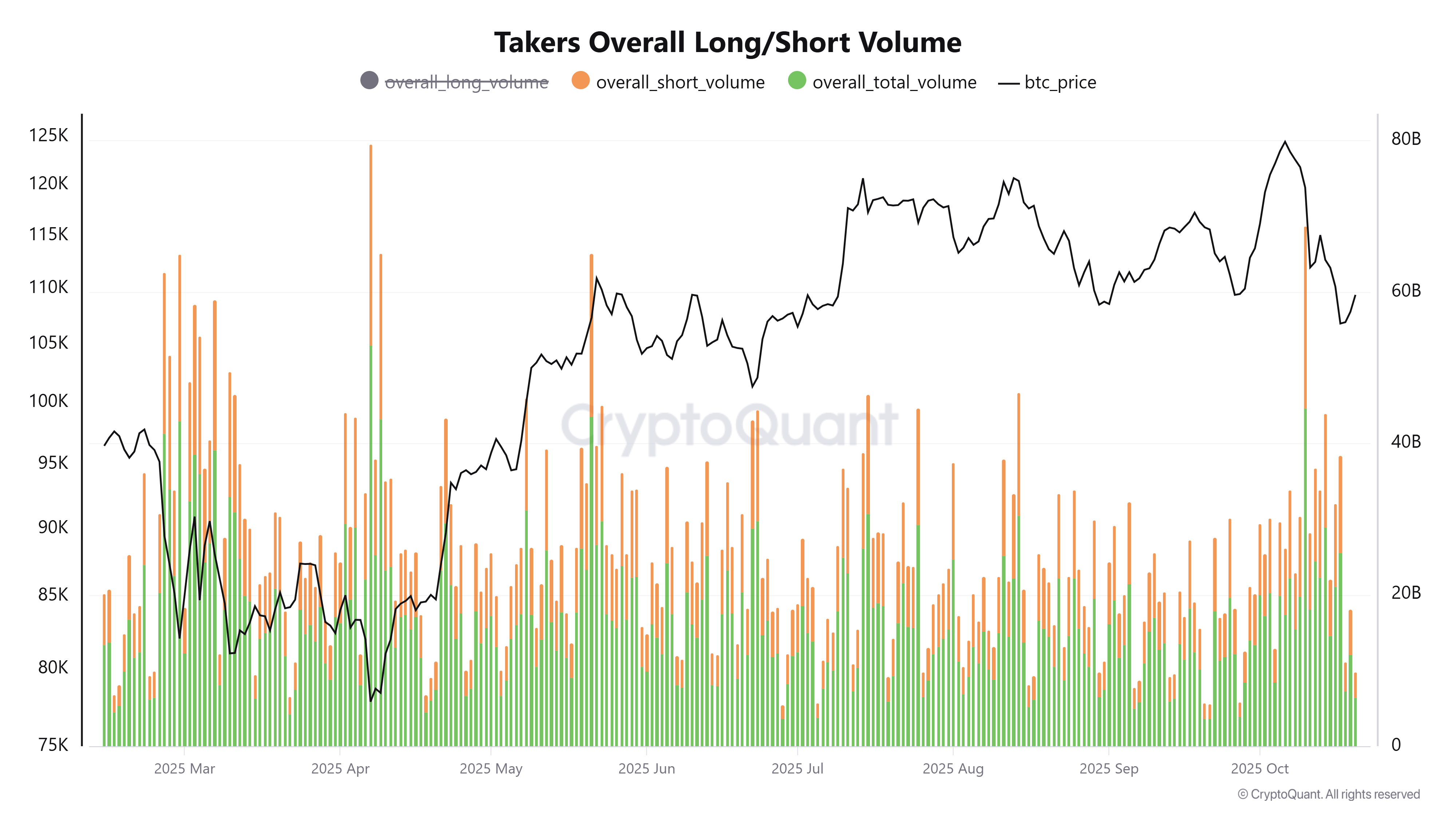

On-chain data shows divergence between ‘smart money’ and retail traders

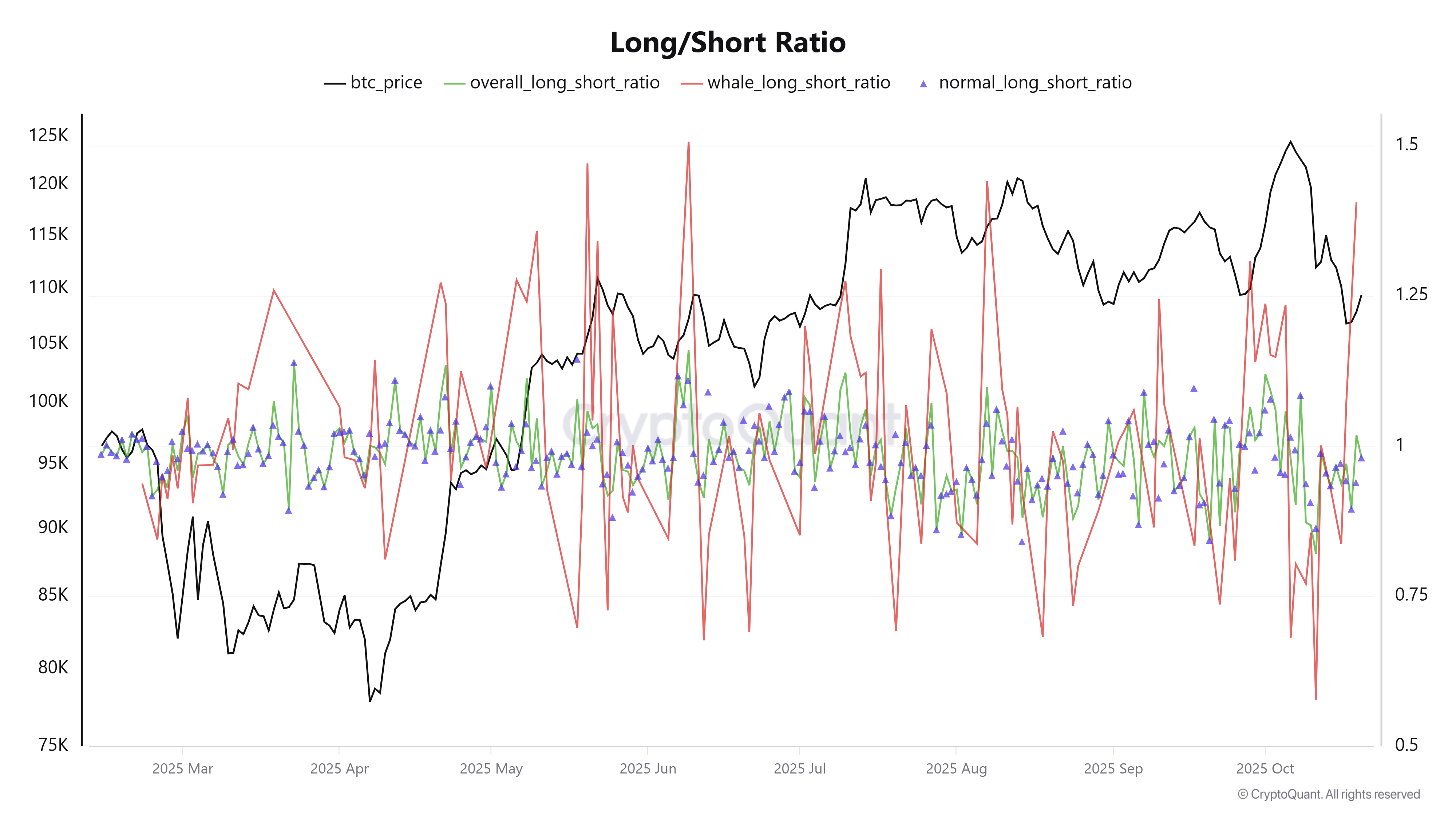

CryptoQuant’s Binance BTC data shows divergence between large-scale players, also called whales or ‘smart money’, and retail traders.

Smart money investors have been actively accumulating Bitcoin while retail traders continue to sell, as reflected in the chart below. Whale wallets now account for a substantial 46.7% of total daily volume, underscoring strong institutional participation.

The long/short ratio reads 1.41, indicating that large players remain confidently positioned for higher BTC prices, reinforcing the bullish market sentiment.

Fed’s payments innovation conference

The US Federal Reserve (Fed) will host a conference on payments innovation on Tuesday, which brings together leading industry experts to share perspectives on the evolving landscape of money and payments.

“The conference will feature panel discussions on several aspects of payments innovation, including the convergence of traditional and decentralized finance; emerging stablecoin use cases and business models; the intersection of artificial intelligence and payments; and the tokenization of financial products and services,” says the Fed in its press release.

Governor Christopher J. Waller said, “I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments.”

This conference could shed light on the Federal Reserve’s stance toward digital assets and financial technology innovation, potentially offering greater regulatory clarity and triggering volatility in cryptocurrencies such as Bitcoin.

Bitcoin Price Forecast: BTC reclaims the $111,000 mark

Bitcoin price faced rejection from the 50-day Exponential Moving Average (EMA), currently at $114,063, on Tuesday and declined 7.36% by Friday. However, BTC found support around the 61.8% Fibonacci retracement at $106,453 (drawn from the April low of $74,508 to the record high of $126,199) on Saturday and recovered by 2.22% the next day. At the time of writing on Monday, BTC extends its recovery, reclaiming the previously broken trendline at around $111,000.

If BTC continues its recovery, it could extend the recovery toward the 50-day EMA at $114,063.

The Relative Strength Index (RSI) on the daily chart reads 44, pointing upward toward the neutral level of 50, indicating signs of fading bearish momentum. For the recovery to be sustained, the RSI must move above the neutral level.

BTC/USDT daily chart

On the other hand, if BTC faces a correction, it could decline toward the 61.8% Fibonacci retracement at $106,453.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.