Canadian Dollar extends declines as Loonie flows dry up

- The Canadian Dollar fell across the board on Tuesday.

- New Canadian housing prices fell even faster than expected in August.

- Every segment of the Canadian economy is facing ongoing challenges as tariffs bite.

The Canadian Dollar (CAD) pared back further on Tuesday, driven down across the FX board and shedding more weight against the US Dollar (USD) as Loonie buyers evaporate into the ether. The Loonie has lost ground against the Greenback for four of the last five straight sessions, backsliding over 0.85% top-to-bottom over that period.

Housing has gone from quiet balance sheet fodder for the Canadian economy to a drag on growth metrics, which have relied on accelerating housing prices to keep the books in the black. The Canadian New Housing Price Index contracted in August, reversing an expected thin recovery in monthly figures. Declines in newly constructed housing projects highlight a steepening decline in real estate transactions as the Canadian housing affordability crisis delivers its own painful solutions following years of no meaningful policy answers from planners and lawmakers alike.

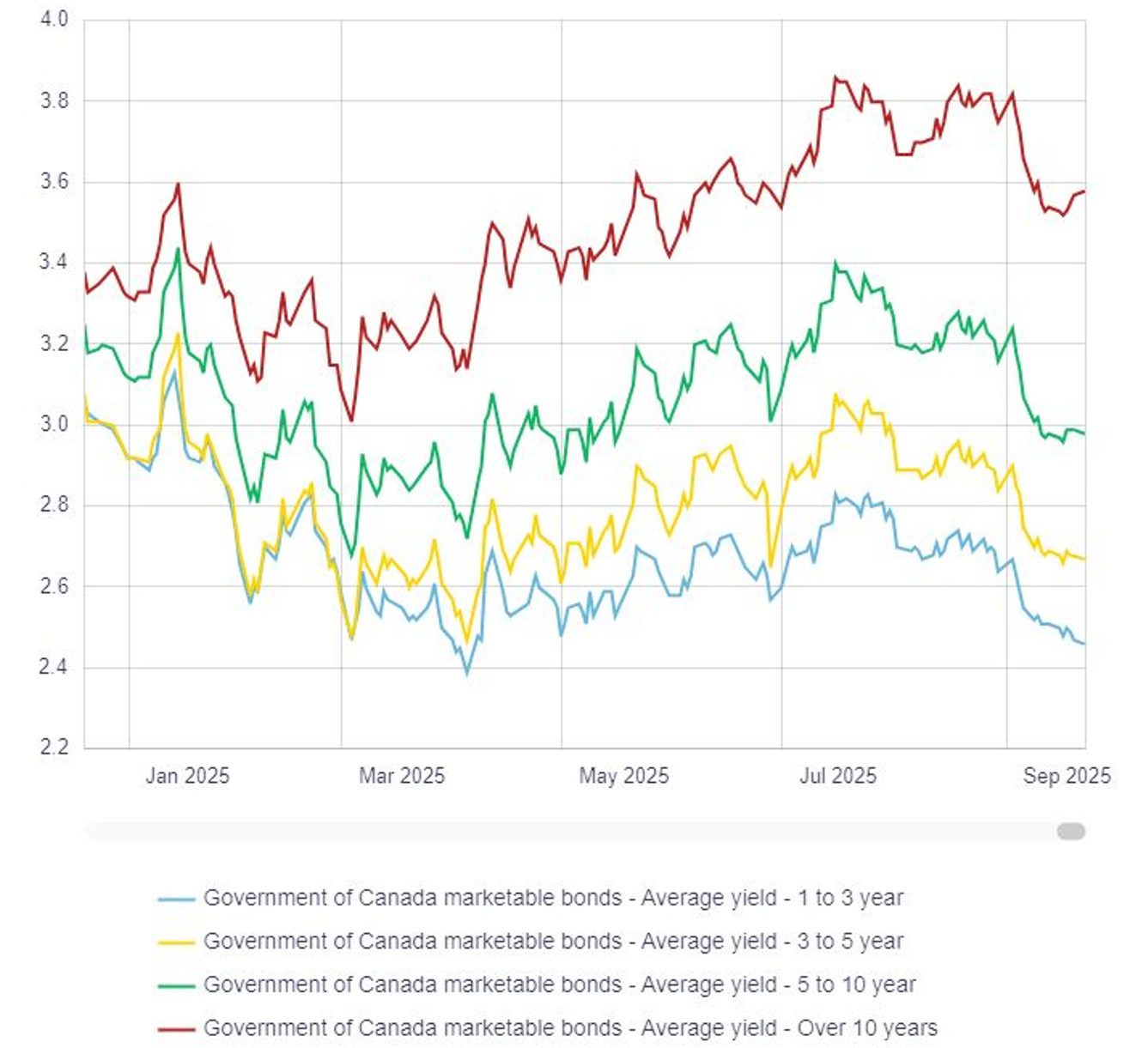

The Bank of Canada’s (BoC) latest interest rate cuts have exacerbated the wobbly end of fiscal policy impacts: even as interest rates decline, Canadian bond yields, and by extension mortgage rates, have continued to climb as investors grow increasingly apprehensive about the Canadian government’s ability to continue its current spending trajectory. Highlighting the Canadian bond market revolt, short-dated average bond yields (one to ten years) are relatively lower than where they started 2025, however, long-dated yields (ten years or greater) have risen from where they started January.

Selected Bond Yields, via Bank of Canada

Daily digest market movers: Canadian Dollar lacks reasons to buy

- The Canadian Dollar fell against all of its major currency peers on Tuesday.

- USD/CAD continues to grind its way higher despite recent Greenback weakness as Loonie losses pile up.

- The Canadian New Housing Price Index (NHPI) contracted 0.3% in August, falling below the flat 0.0% forecast and adding onto the previous month’s -0.1% print.

- Annualized new home prices also fell, with the NHPI falling 1.7% YoY, accelerating from the previous period’s -1.3%.

- Key US Personal Consumption Expenditures Price Index (PCE) inflation data is due later this week, slated for Friday. US inflation data continues to rule the roost as investors look for signs that the Federal Reserve (Fed) will deliver further interest rate cuts through the remainder of the calendar year.

Canadian Dollar price forecast

A fresh bout of weakness in the Canadian Dollar has pushed the USD/CAD pair back above the 50-day Exponential Moving Average (EMA) near 1.3790. Despite near-term losses, the Canadian Dollar is still firmly entrenched in back-and-forth chart chop on daily candlesticks, with the 200-day EMA weighing down on further topside momentum in the USD/CAD pair from 1.3865.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.