Bitcoin Weekly Forecast: BTC slips below $105,000 as macro headwinds weigh on sentiment

- Bitcoin price dips below $105,000 after falling nearly 9% so far this week.

- US-China trade tensions and the ongoing US government shutdown weigh on investors' sentiment.

- Report suggests the coming weeks could offer a favorable accumulation window as funding dynamics and perpetual markets begin to normalize.

Bitcoin (BTC) price continues to trade in red, below $105,000 at the time of writing on Friday, having corrected nearly 9% so far this week. Renewed geopolitical tensions fueled the pullback in BTC, and the US government shutdown pressured risk assets. Despite the pullback, analysts believe the correction could present a medium-term buying opportunity as market conditions stabilize and funding rates normalize.

Ongoing trade tensions between the US and China weigh on investors' mood

Bitcoin price started the week on a positive note, continuing its weekend recovery on Monday after BTC faced a massive correction last week. However, the recovery slowed down on Tuesday, with BTC sliding below $112,000 as US-China trade tensions escalated.

These trade disputes between the two largest economies in the world kept escalating during the week. US President Donald Trump threatened to terminate trade business with China in cooking oil and other products in response to the latter's decision not to purchase US soybeans. Meanwhile, the Asian country also announced new special port fees for US ships arriving in Chinese ports and enhanced restrictions on the export of rare earths.

The coming and going of news sank the markets, with riskier assets such as Bitcoin declining nearly 9% so far this week and continuing to trade red below $105,000 when writing on Friday.

In addition to the prevailing bearish sentiment, escalating geopolitical tensions between Russia and Ukraine also fueled risk-off sentiment among traders. On Thursday, Russia launched hundreds of drones and dozens of missiles, as well as glide bombs, hitting gas facilities in eastern Ukraine. Meanwhile, US President Donald Trump said on that same day that he will meet Russian President Vladimir Putin in Budapest, Hungary, to work toward ending the three-and-a-half-year war in Ukraine.

US government shutdown continues

The ongoing US government shutdown, which began on October 1, remained this week and the situation deepened. On Thursday, for the tenth time, the US Senate rejected a House Republican’s short-term funding bill aimed at ending the government closure, underscoring a deadlock in Congress. This signaled that the deadlock extended into a third week with no resolution in sight.

The shutdown is limiting economic data releases, and the interest rate outlook by the Federal Reserve (Fed) for October remains clouded. Furthermore, Fed Chair Jerome Powell did not provide specific guidance on interest rates on Tuesday, though comments about weakness in the US labor market suggested that further easing is firmly on the table. Moreover, other Fed officials have pointed to the likelihood of further cuts moving ahead.

Additionally, the current government shutdown has delayed the approval of several pending altcoin ETF applications, which were expected to launch in October. This delay potentially postpones a key catalyst that could have shifted overall crypto market sentiment.

Weakening institutional demand

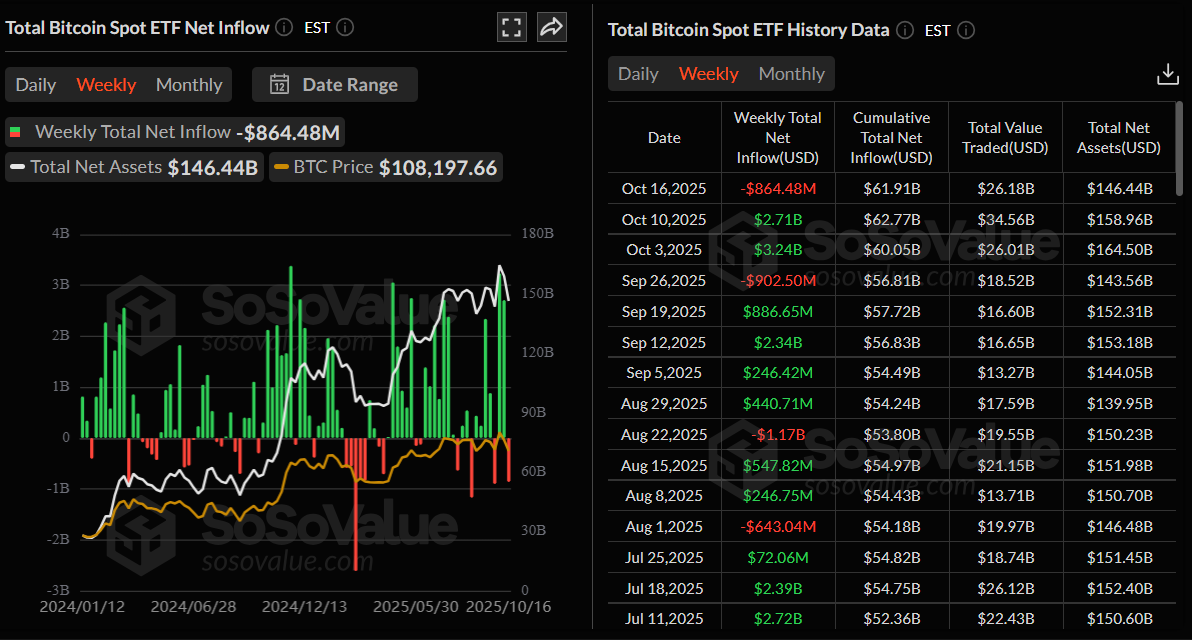

Bitcoin institutional demand weakens as of this week. According to SoSoValue data (chart below), Bitcoin spot ETFs recorded a total of $864.48 million outflows as of Thursday, breaking the two-week streak of inflows since early October.

Total Bitcoin Spot ETF net inflow weekly chart. Source: SoSoValue

Some signs of optimism

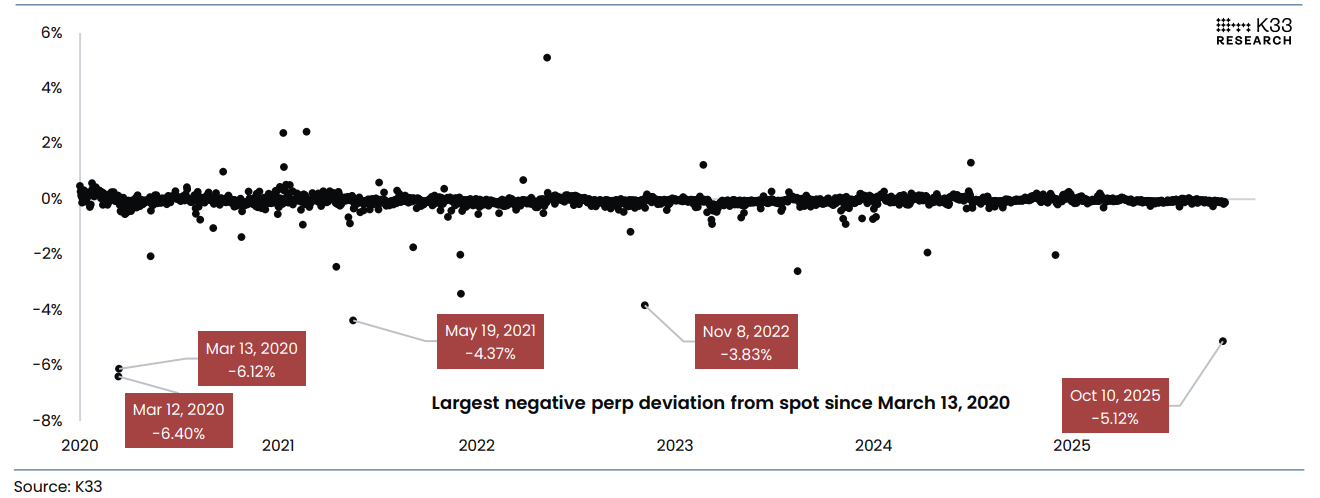

Following the massive liquidity flush and deleveraging event last week on Friday, when Bitcoin plunged from a daily high of $122,550 to a low of $102,000, a K33 report released this week suggests that the coming weeks could present an opportune window for capital deployment into BTC, as the reset in perpetual markets and normalization of funding dynamics may lay the groundwork for renewed upside momentum.

The graph below shows that Binance’s BTC/USDT perpetual contract was trading at a record 5.1% discount to spot by October 10, the widest deviation since March 13, 2020. Last Friday's crash wiped out four months of built-up perpetual leverage, with open interest plunging over 50,000 BTC to Q2 lows and funding rates turning deeply negative.

“While sentiment flipped sharply bearish, this broad deleveraging is healthy, reducing the risk of further long squeezes and setting a cleaner base for recovery,” said K33 analyst.

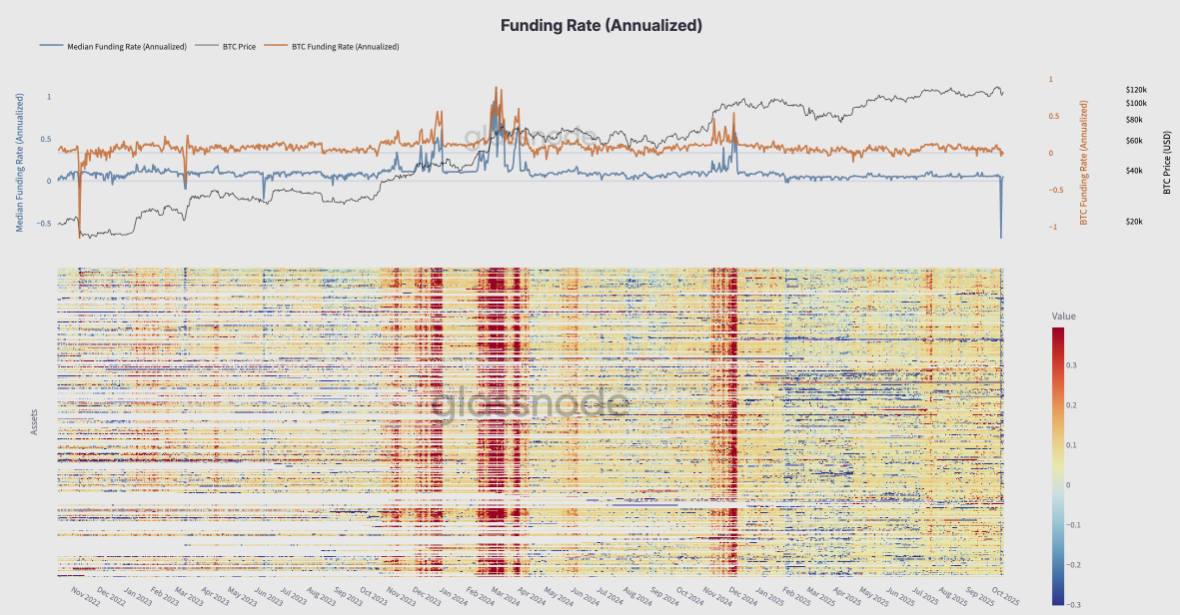

Apart from this, the historic leverage flush pushed futures market stress to extremes, with funding rates plunging to levels not seen since the FTX collapse in late 2022, as shown in the next graph below.

Across perpetual futures, annualized funding briefly turned sharply negative, indicating that traders were paying a premium to stay short after bullish leverage was wiped out. This marks a complete sentiment reversal, with participants rapidly de-risking amid forced liquidations.

Historically, such extreme funding resets have coincided with peak fear and the final stages of deleveraging, often cleansing excess leverage and restoring balance for a healthier recovery phase in the mid-term.

Expert's comments:

To gain more insights into Bitcoin price action this week, FXStreet interviewed Karim AbdelMawla, a senior digital asset researcher at 21Shares, regarding his view on current market conditions.

Q1: How significant are the renewed US-China trade tensions in influencing Bitcoin’s current price behavior?

Very significant. The tariff escalation on October 10 and 11 triggered a sharp shift to risk-off sentiment. Within hours, Bitcoin saw its largest ever deleveraging, wiping out about $19B and dropping from around $126K to about $104K.

This was a macro-driven move rather than a crypto-specific event, showing that Bitcoin still trades like a risk asset when global markets are under stress. Gold, by contrast, rose above $4.1K as investors sought safety. The sell off also exposed structural weaknesses in the crypto market, such as high leverage (about $70B in open interest) and thin liquidity.

In the short term, Bitcoin remains highly sensitive to global headlines, but over the longer term, its rising correlation with Gold (now about 0.85) suggests it is gradually developing some safe-haven qualities.

Q2: Following last Friday’s sharp deleveraging event, do you see this as a healthy reset that could pave the way for a more sustainable BTC recovery?

Yes, but it is too early to assume the reset is complete. The wipeout that cut Bitcoin’s Open Interest from around $50B to $35B shows controlled risk management rather than panic selling. Offshore traders were hit hardest, while CME and ETF flows remained stable. Funding normalized and leverage reset, creating a healthier market structure.

However, risks remain. ETF flows have been inconsistent, and while the supply held by addresses with 100 to 1K BTC increased slightly from 5.12M BTC to 5.127M BTC, the supply held by large holders with more than 1K BTC saw a more significant reduction, dropping from 4.273M BTC to 4.24M BTC. Meanwhile, Bitcoin is still trading below the key resistance level at $105K. It is possible that BTC could revisit the $100K level to fill the wick before rebounding, while still maintaining its broader market structure.

The flush was a necessary reset, but a sustained recovery will depend on macroeconomic stability and renewed ETF demand.

Q: 3 With several altcoin ETF approvals delayed due to the US government shutdown, could this slow institutional momentum across the crypto space?

Yes, most likely for altcoins, but not for Bitcoin and Ethereum. Since October 1, the SEC has paused most operations due to the US government shutdown, halting reviews of 16 crypto ETFs, including those for Solana and XRP. This removes an important near-term catalyst for altcoins and channels institutional money into existing products focused on Bitcoin and Ethereum.

Bitcoin’s institutional growth remains strong. Spot ETFs saw about $338M in inflows on October 14, BlackRock’s IBIT exceeded $100B in assets, and total ETF inflows for 2025 have reached about $6.96B. Bitcoin dominance is now around 58.9%, the highest level in this cycle.

The shutdown narrows institutional focus to Bitcoin for now, but also builds pent-up demand. Once approvals resume, altcoin products could spark new capital inflows and broaden institutional participation.

Will BTC drop toward $102,000?

Bitcoin price faced rejection from the 50-day Exponential Moving Average (EMA) at $114,667 on Tuesday and declined by nearly 6% until Thursday, closing below the ascending trendline. At the time of writing on Friday, BTC continues to trade below $105,000.

If BTC continues its correction and closes below the 200-day EMA at $108,030 on a daily basis, it could extend the decline toward the October 10 low of $102,000.

The Relative Strength Index (RSI) indicator at 33 on the daily chart suggests strong bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, which remains in effect, further supporting the bearish view.

BTC/USDT daily chart

On the other side, if BTC recovers, it could extend the advance toward the 50-day EMA at $114,667.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.