Bitcoin Price Forecast: BTC consolidates as traders eye potential catalysts from US legislative action

- Bitcoin price trades sideways between $115,000 and $120,000, reflecting market indecision ahead of a potential catalyst.

- US House lawmakers passed a procedural motion to advance crypto bills to the floor for formal debate, following hours of discussion on Wednesday.

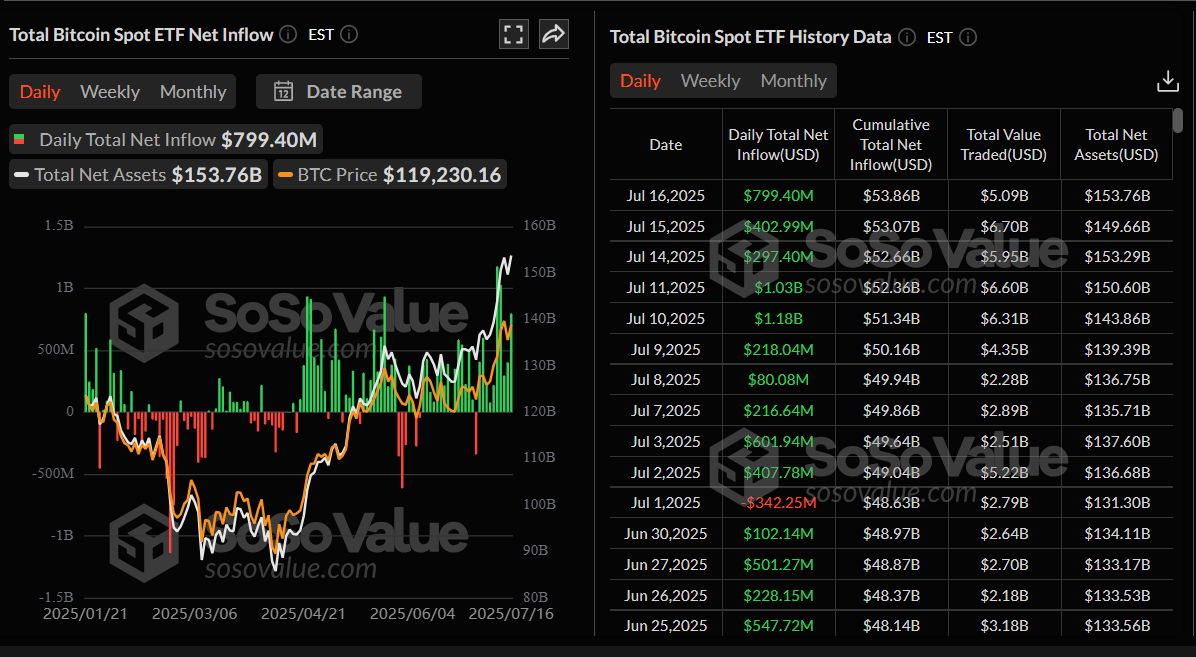

- US-listed spot Bitcoin ETFs recorded nearly $800 million in inflow on Wednesday, continuing the streak of inflow since July 2.

Bitcoin (BTC) hovers around $118,400 at the time of writing on Thursday, trading sideways between $115,000 and $120,000 as market participants await fresh catalysts. Traders are now focused on developments from the US legislative “Crypto Week”, where the lawmakers passed a procedural motion to advance crypto bills for deliberation. Meanwhile, institutional demand remains strong, with US-listed spot Bitcoin Exchange Traded Funds (ETFs) recording nearly $800 million in inflows on Wednesday, extending their positive streak since July 2.

Crypto bills move for final vote after record standoff in US House

The US lawmakers passed a procedural motion that would allow the GENIUS, CLARITY, and Anti-CBDC Surveillance bills to move forward on Wednesday. With 217–212 votes, the three bills passed after a record-breaking procedural standoff that stretched nearly 10 hours.

The development shook the crypto community, which had anticipated swift engagement from lawmakers after US President Donald Trump’s announcement to strike a deal to unblock crypto bills in the House early on Wednesday, following their failure on Tuesday.

Two bills, GENIUS and CLARITY, could be set for a floor vote as early as Thursday for final passage, while the Anti-CBDC bill will be added to the National Defense Authorization Act (NDAA).

Traders eye potential catalysts from US legislative action as the bill heads toward the final vote, with the largest cryptocurrency by market capitalization continuing to trade sideways between $115,000 and $120,000.

Bitcoin spot ETFs record nearly $1.5 billion in inflows so far this week

The demand from institutional investors for Bitcoin remains robust. SoSoValue data show that spot Bitcoin ETFs recorded an inflow of $799.40 million on Wednesday and a total of nearly $1.5 billion so far this week. Moreover, this inflow continued its 10-day streak of positive flow since July 2, highlighting BTC’s robust institutional demand.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

Apart from the rising demand from institutions, another bullish sign is that Thailand’s Securities and Exchange Commission (SEC) and the Bank of Thailand (BOT) plan to launch a national crypto sandbox, allowing foreign tourists to use digital assets in Thailand, according to a report by the Bangkok Post on Thursday.

“This crypto sandbox builds directly upon former premier Thaksin Shinawatra’s Phuket sandbox proposal from late last year. Both share the core concept of allowing Bitcoin and cryptocurrencies as payment methods in tourist areas to drive adoption,” said Nirun Fuwattananukul, chief executive of Gulf Binance.

Bitcoin Price Forecast: BTC trades in a range-bound pattern

The Bitcoin price dipped, reaching a low of $115,736 on Tuesday after hitting a new all-time high of $123,218 the previous day. Bitcoin has rallied for three consecutive weeks, gaining nearly 18% since June 23 to the first week of July. Such a massive surge has a high chance of mild price dips or price consolidation before resuming its upward momentum. At the time of writing on Thursday, BTC is around $118,900, within a consolidation range between $115,222 and $120,000.

If BTC recaptures and closes above the $120,000 mark on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218 and beyond.

The Relative Strength Index (RSI) indicator reads 69 on the daily chart, flattening around its overbought level of 70 after reaching a peak of 75 on Monday, indicating a pause in bullish momentum and growing indecision among traders. For the bullish momentum to be sustained, the RSI must continue to move upward, supporting the rally. However, traders should still be cautious, as the chances of a pullback remain high around the current levels.

BTC/USDT daily chart

On the contrary, if BTC faces a correction, it could extend the decline to find support around its lower consolidation boundary at $115,222.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.