Bitcoin Price Forecast: BTC rebounds as Trump steps in to revive momentum for crypto legislation

- Bitcoin price recovers, trading around $119,000 on Wednesday after falling 1.74% the previous day.

- US President Donald Trump announced that the GENIUS Act is ready to pass through the House of Representatives during the legislative “Crypto Week.”

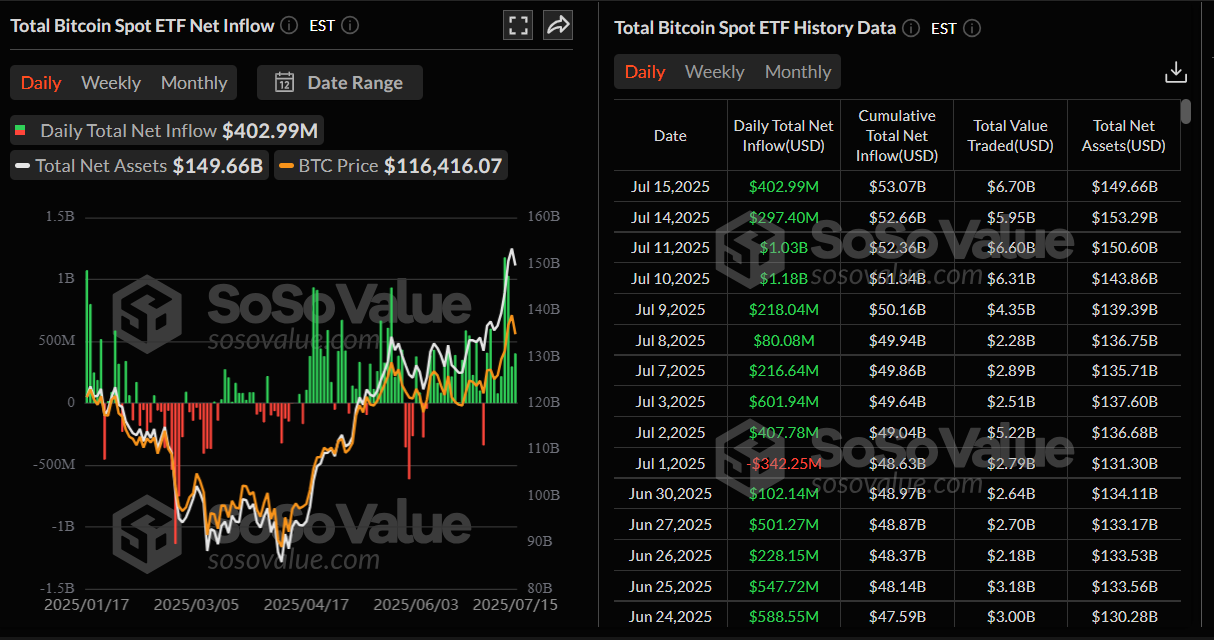

- US-listed spot Bitcoin ETFs recorded over $400 million in inflow on Tuesday, continuing the streak of inflow since July 2.

Bitcoin (BTC) price recovers slightly, trading near $119,000 at the time of writing on Wednesday after falling nearly 2% the previous day. This recovery comes following the announcement by the US President Donald Trump early on Wednesday that the GENIUS Act is ready to pass through the House of Representatives during the legislative “Crypto Week”, fueling optimism in the crypto markets. Moreover, institutional demand continues to strengthen, as the spot Bitcoin Exchange Traded Funds (ETFs) recorded over $400 million in inflows on Tuesday, continuing the streak of inflows since July 2.

Trump strikes deal to unblock crypto bills in House

President Trump announced on a Truth Social post on early Wednesday that the GENIUS Act is ready to pass through the House of Representatives during the legislative “Crypto Week.”

Trump said, “I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act and, after a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule.”

He continued, “Speaker of the House Mike Johnson was at the meeting via telephone, and looks forward to taking the vote as early as possible. I want to thank the Congressmen/women for their quick and positive response.”

This announcement comes after lawmakers failed to pass a procedural motion that would have allowed the three bills — GENIUS, CLARITY, and Anti-CBDC — to move forward for deliberation on Tuesday. The motion was defeated by a vote of 196 to 223, as several Republican members joined Democrats in voting against it.

This news supports the recovery in the Bitcoin price, as it trades above $119,000 during the European session on Wednesday. Moreover, the “Crypto Week,” in which US lawmakers will discuss the GENIUS Act, the CLARITY bill, and the Anti-CBDC Surveillance State Act, all in the same week, boosts expectations that crypto regulations will reach President Trump’s desk before the August recess.

James Smith, Co-Founder of Elliptic, told FXStreet that "This is a pivotal week for the digital asset industry. The three landmark pieces of legislation show promising momentum for a future where there are clear and enforceable frameworks for all market participants to promote innovation, safeguard consumers, and maintain orderly market operations."

Bitcoin’s institutional demand continues to strengthen

The demand from institutional investors for Bitcoin remains robust. SoSoValue data show that spot Bitcoin ETFs recorded an inflow of $402.99 million on Tuesday, continuing its nine-day streak of inflow since July 2.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

According to Bitcoin For Corporations X's post on Wednesday, Cantor Fitzgerald is nearing a $4 billion SPAC deal with Adam Back and Blockstream to acquire 30,000+ BTC. Earlier this week, Standard Chartered launched spot trading services for Bitcoin and Ethereum, targeting institutional clients, which further supports the wider adoption and acceptance of BTC.

What's next for BTC?

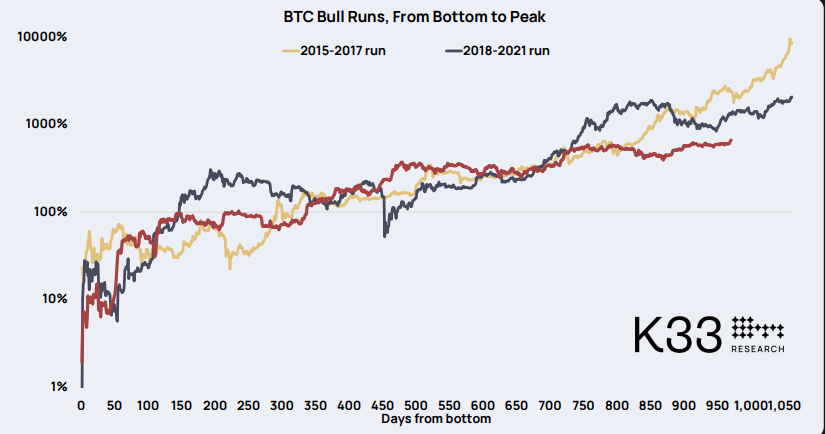

A K33 Research report released on Tuesday highlighted that in the past bull runs of 2021 and 2017, BTC went from cycle bottom to cycle peak in 1,062 days in 2021 and 1,069 days in 2017. The analyst reported that if the pattern repeats, a cycle top could occur between October 15 and October 30.

However, the analyst does not expect the four-year cycle to repeat, as the impact of halving is materially smaller today than it was in the past. Furthermore, the momentum surrounding nation-state adoption and simplified, regulated access favors a departure from past cycle precedent.

“We believe BTC has moved from a speculative reflexive asset to a more established reactionary store of value in a world with tenser global trade and enhanced inflationary pressures,” said K33 analyst.

Bitcoin Price Forecast: BTC recovers above $118,000

Bitcoin price dipped, reaching a low of $115,736 on Tuesday after hitting a new all-time high of $123,218 on Monday. At the time of writing on Wednesday, it recovers slightly, trading above $118,790.

Bitcoin has rallied for three consecutive weeks, gaining nearly 18% since June 23, to the first week of July. Such a massive surge has a high chance of mild price dips or price consolidation before resuming its upward momentum.

In the event of a pullback, BTC could dip toward its prior all-time high of $111,980, set on May 22.

However, for a period of consolidation, BTC could trade in a range-bound pattern between $111,980 and $120,000.

For the bullish case, if BTC recaptures and closes above the $120,000 mark on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218 and beyond.

The Relative Strength Index (RSI) stands at 69 and is pointing upwards, indicating that bulls still have room to push the price higher, which supports the bullish case as discussed above. However, if the RSI moves downward toward its neutral level of 50 and below, the price could dip, supporting the pullback event.

BTC/USDT daily chart

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.