Ripple Price Prediction: How tokenized treasuries could accelerate XRP to $10 by end-2025

- Ondo Finance launched tokenized treasuries on the XRP Ledger in June, paving the way for seamless institutional adoption.

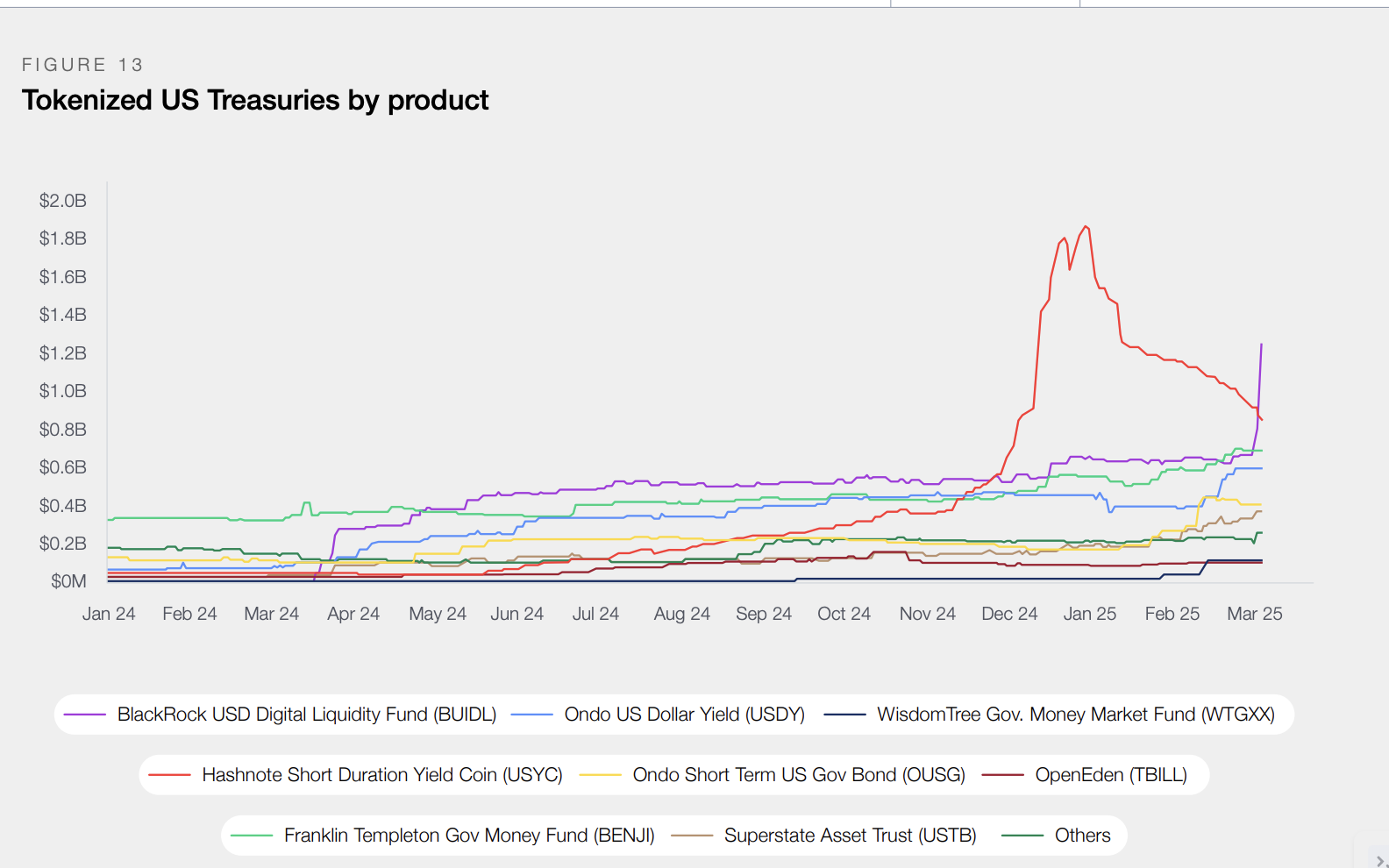

- The market capitalization of tokenized treasuries has grown to $5.9 billion despite market uncertainty over US tariffs.

- Institutional interest and adoption, including tokenized treasuries and potential spot ETF approval, could boost XRP price to $10.00.

The adoption of cryptocurrency-related financial products, including tokenized treasuries, is on overdrive globally, with the focus now shifting to robust networks such as Ripple's XRP Ledger (XRPL). Investors are persistently demanding speed, efficiency and seamless connectivity, particularly with the rise of distributed ledger technology (DLT).

Tokenization creates a digital representation of an asset on a blockchain. According to InvestaX, "tokenization doesn't change what Treasuries are. It improves how they're accessed, held, and transacted."

What are tokenized treasuries?

Tokenized treasuries refer to traditional debt instruments, such as short-term Treasury Bills, medium-term notes and long-term bonds. The tokenization of treasuries accords them a digital representation on the blockchain.

United States (US) Treasuries are recognized and valued as some of the world's safest and most liquid assets. Investors see tokenized Treasuries as key pillars of stability in capital markets. They offer reliable income and a benchmark for risk-free returns.

Most stakeholders are in the early stages of adoption, with a few notable public and private entities stand providing access to different forms of treasuries on the blockchain.

The report "Digital Assets and the Treasury Market," published by the Department of the Treasury, mentions that BlackRock's BUIDL Fund and Franklin Templeton's OnChain US Government Money Fund are among the most notable Treasury funds.

Other entities offering access to Treasury funds in the US include Ondo Finance, Hashnote and CoinShares. There are other niche offerings, such as tokenized Treasury repo projects, which support around-the-clock settlement and trading. JP Morgan's Onyx platform is an example of this asset class, utilizing blockchain technology to offer tokenized treasuries backed by repo solutions.

Tokenized US Treasuries by product | Source: WEF

Issuers of tokenized treasuries use smart contracts to enable clearing and settlement. Tokenization supports unrivalled transparency and accountability. Key drivers of this asset class include innovation, inclusion and increased liquidity.

The World Economic Forum (WEF) estimates the tokenized treasuries market to be valued at $5 billion, following meteoric growth from approximately $104 million in 2023.

Ondo Finance US tokenized treasuries on Ripple's XRL Ledger

Ondo Finance made headlines in early June when it launched the "Ondo Short-Term US Government Treasuries (OUSG)" on the XRP Ledger. The offering stood out for its seamless redemption functionality via Ripple's stablecoin, RLUSD.

"This launch brings OUSG to the XRPL's broad institutional user base, introducing a composable and compliance-first asset to a blockchain built for financial institutions," Ondo Finance said in a statement.

Ondo Finance explained that the rollout provides a platform for institutional Decentralized Finance (DeFi) and advanced fund management solutions while merging traditional finance and the fast-growing DeFi industry.

How Ripple is building institutional-grade finance

Ripple's contribution to institutional-grade finance has remained notable, with the launch and development of flagship products such as On-Demand Liquidity (ODL) and Ripple Payments, which was formerly referred to as RippleNet.

Ripple Payments boasts over 300 financial institutions, comprising banks, payment providers and other operators in the cross-border remittance sector. Some notable partners include Bank of America, Western Union, American Express, Santander and Amazon Web Services (AWS).

The XRP Ledger's suitability for tokenized treasuries is inherent in its unique technical and operational features, which are easily customizable to meet the needs of institutional-grade finance.

XRPL is known for supporting fast and low-cost transactions, which average between three and five seconds. The low transaction fees and fast transaction throughput enable real-time minting, redemption and token transfers.

The XRP Ledger's ability to scale its transaction capacity without compromising speed and cost has enticed several institutions, including Ondo Finance and NASDAQ, to launch highly scalable financial products.

Ripple's Institutional DeFi roadmap emphasizes the XRP Ledger's robust infrastructure, which currently supports the issuance of stablecoins such as the RLUSD. The stablecoin serves as a bridge asset for tokenized assets, including stocks and treasuries, by providing liquidity and interoperability with other blockchains, such as Ethereum.

The XRP Ledger is a compliance-ready platform that supports Decentralized Identifiers (DIDs) and XLS-70 Credentials, which back self-sovereign identity and permissioned access. By utilizing these features, tokenized treasury operators can ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

"Multi-Purpose Token (MPT) introduces a more flexible, efficient, and metadata-rich token standard that allows institutions to tokenize and trade bonds, RWAs, and structured financial products with enhanced functionality," Ripple said in its 2025 institutional-DeFi focused update.

Guggenheim's Digital Commercial Paper (DCP) has already leveraged these features.

The XRP Ledger uniquely enables and supports the creation of complex tokenized assets through programmable features, such as fractionalized treasuries and yield-bearing instruments.

Demand for tokenized treasuries and stocks is expected to grow, especially with the market anticipated to reach $600 billion by 2030, according to a Boston Consulting Group (BCG) whitepaper in collaboration with Aptos Lab and Invesco.

The XRP Ledger's 2025 roadmap focused on institutional Decentralized Finance (DeFi) and compliance upgrades, highlighting Ripple's commitment to building compatible and robust networks to support the tokenization of real-world assets.

As institutional adoption and demand for tokenized assets grow, Ripple could capture the tokenized treasuries market, expanding the utility of the XRP token and the RLUSDT stablecoin.

The XRP Ledger, RLUSDT, and XRP adoption could receive a significant boost with the conclusion of the Securities and Exchange Commission (SEC) lawsuit. Ripple and the SEC have filed a joint motion requesting an indicative ruling to settle the case and stop the ongoing appeals.

XRP Price Prediction: XRP eyes technical breakout amid hopes for $10 by year-end

XRP's price is trading at $2.16 at the time of writing on Thursday. The token's technical outlook reflects subdued sentiment in the broader cryptocurrency market, likely due to uncertainty over tensions in the Middle East and the Federal Reserve's (Fed) hawkish stance on the direction of the economy.

The central bank left interest rates unchanged on Wednesday in the range of 4.25% to 4.50%, meeting market expectations. However, Fed Chair Jerome Powell cited near-term inflation expectations, with tariffs standing out as a key catalyst.

Technically, attention could shift to the microenvironment, with the XRP price trading broadly sideways between support at $2.09, provided by the 200-day Exponential Moving Average (EMA), and a confluence resistance at $2.24, established by the 50-day EMA and the 100-day EMA.

XRP/USDT daily chart

The downward-facing Relative Strength Index (RSI), currently below the 50 midline, backs bearish momentum. A continued movement toward oversold territory would maintain the bearish bias and increase the probability of XRP extending the decline below the 200-day EMA at $2.09.

On the contrary, institutional interest in XRP remains elevated, especially after the Canadian securities regulatory okayed the launch of spot Exchange Traded Funds (ETFs). The focus is now on the US SEC, which is deliberating on multiple XRP spot ETFs, with the potential of a nod before the end of 2025.

Adoption through company treasury funds, tokenized Treasuries and stocks could position XRP for a major rally over the coming months.

A sustained breakout above the descending trend line, as shown on the daily chart, could have a positive impact on retail risk appetite and trader confidence, potentially positioning XRP for a prolonged bull run toward $10.00 by the end of 2025.

Key milestones include a return above the psychological round number of $3.00 and the record high of $3.40. The price discovery beyond this level would be ruled by euphoria, greed and widespread XRP adoption.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.