How to invest in Solana-based meme coins in 2025: A beginner’s guide

- The Solana meme coin space has grown constantly since its inception, posting a market capitalization of $11.5 billion.

- Investors could reduce the risk of rug pulls and find promising Solana-based meme coins by following key safety steps before trading.

- Meme coin trading is even more volatile, but there are tools and strategies that could help post gains.

- Traders should exercise caution, as meme coin trading is highly speculative and involves significant risk.

Solana (SOL) blockchain’s meme coin sector has been consistently growing in popularity, with tens of thousands of tokens launched and a total market capitalization of billions of dollars. Traders could benefit from the growing sector of meme coins – there have been successful projects such as Dogwifhat (WIF) or Official Trump (TRUMP) – but trading meme coins also involves huge risks, including potential rug pulls or simply losing the entire amount invested due to the little inherent value in some of these tokens.

To reduce the chances and minimize the risk of rug pulls and scams, investors can follow key safety steps before trading these highly speculative assets.

Solana meme coin space is growing

Solana’s meme coin sector has been consistently growing in popularity, particularly since mid-2024, due to its fast transactions, ultra-low fees, and high throughput, which enable instant, low-cost trading and rapid token launches.

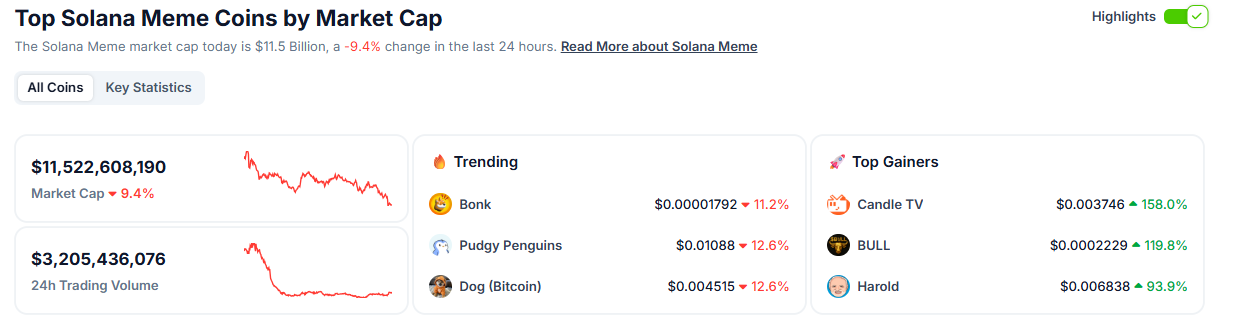

According to data from CoinGecko, the Solana meme market capitalization stands at $11.5 billion as of June 2025, signaling its growing and robust presence in the meme coin space.

Some top memecoin projects on the SOL blockchain are Official Trump (TRUMP), Bonk (BONK), Fartcoin (FARTCOIN), Dogwifhat (WIF), and Gigachad (GIGA).

Top Solana meme coins by market cap chart (June 2025). Source: CoinGecko

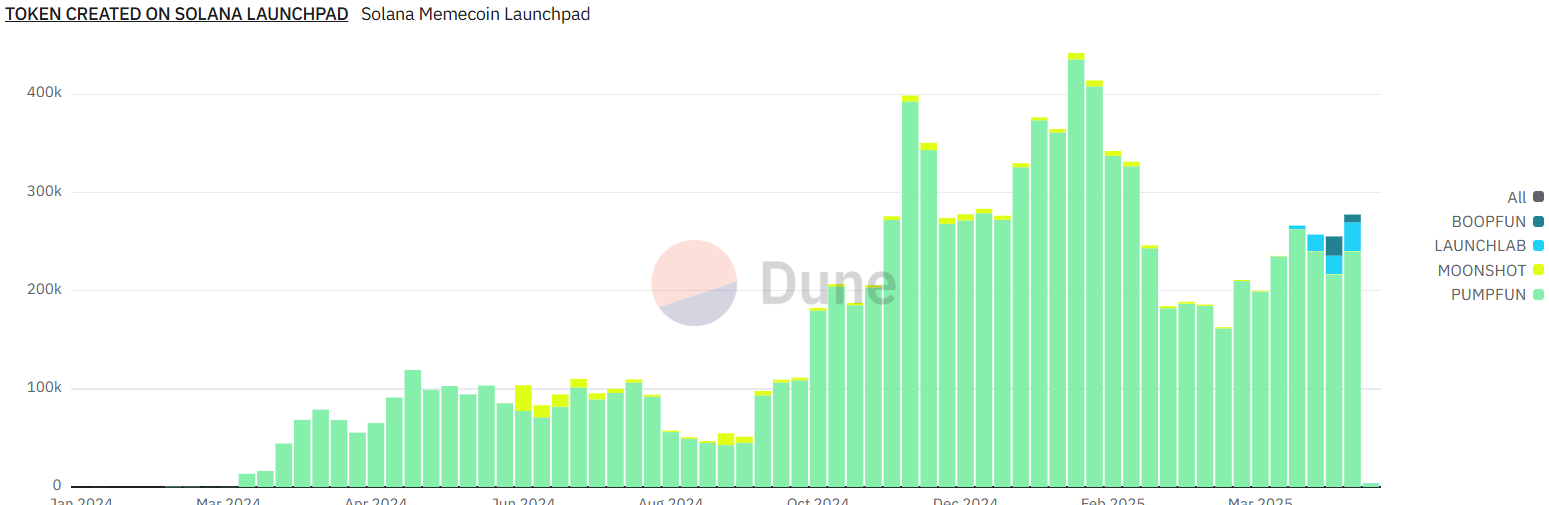

The number of meme coins created on SOL’s launchpad has been constantly increasing. Around 280,000 tokens are launched every week on the blockchain, according to data from Dune Analytics, easing from the more than 400,000 seen earlier in 2025, but still a significant amount. While the vast majority of them are launched through the Pump.fun platform, the recent release of others like BOOPFUN and LaunchLab (by Raydium) could fuel the ongoing token launches on the Solana blockchain.

Token created on the Solana launchpad chart. Source: Dune Analytics

Understanding the meme coin cycle

Let’s consider Pump.fun as a case study. A typical Solana meme coin lifecycle on Pump.fun begins with the launch phase, when the memecoin is created, and the smart contract establishes a bonding curve, allowing buyers to purchase tokens instantly. The token starts with zero liquidity and is only tradable via Pump.fun’s internal system.

New meme coins launched on the Pump.fun dashboard

The second phase is the hype-building phase, when the tokens and their blockchain addresses are shared across various social media platforms, including X, Reddit, Discord, and Telegram. This is generally the period during which the community is built through viral marketing and a unique narrative, such as dog-themed (Dogwifhat) or other animal-themed (Moondeng) or pop-culture-inspired tokens.

Some healthy signs of a strong community are constant chat activity, developer Q&As, regular updates and memes, transparent project roadmaps, and hashtags used on social media platforms.

PNUT twitter handle page.

Sometimes, a crypto influencer, celebrity, or famous person posts about a coin on their social media feed, which can lead to its rapid increase in value. However, traders should be cautious as this celebrity-driven memecoin could also result in a rug pull.

Elon Musk’s post about PNUT on his Twitter page

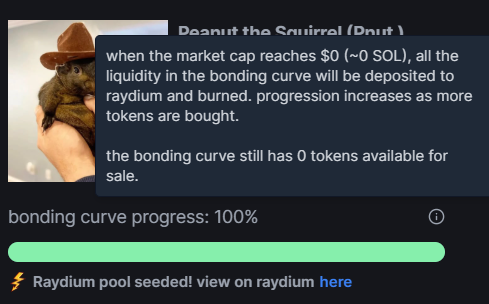

The third phase begins with the token migration to a decentralized exchange (Radium). Once the project gains traction, the developer (dev) or community migrates the meme coin to a decentralized exchange, such as Raydium, to enable open trading.

The key steps that occur during this phase are burning liquidity on Pump.fun (ending the bonding curve) and creating a liquidity pool (LP) on Raydium using the token and SOL. Ideally, the dev burns LP tokens (locks liquidity) and revokes mint authority (can’t mint more tokens). After the process, the token is tradable like any other coin on Solana DEXs.

PNUT completes the bonding curve.

Generally, most rug pulls occur during this migration phase. Safety indicators to watch for include the number of LP tokens being burned (as a form of rug protection), the mint authority being revoked, and a verified Twitter or X account.

During the final phase, the token is live on the DEX, and trading activity begins. If the memecoin gains traction, it could also be listed on a centralized exchange (CEX), such as Binance, as shown below.

Things to keep in mind while finding the right meme coin

To safely evaluate and trade Solana meme coins, investors can follow these steps to minimize the risk of a rug pull and identify the right meme coin.

- Investors should examine the meme coin’s fundamentals, which include a transparent team or a well-known developer in the space. Projects that have pseudonymous names behind them should be treated with caution at the very least. Other things traders should look for include an active social media presence, clear communication in a Telegram group or on X, and a clear message or goals outlined in the project's whitepapers and roadmaps.

- After the fundamentals, investors should assess the tokenomics of the meme coin. Here, traders should consider fair distribution and sustainable supply without excessive insider allocations. Smart contract audits from trusted firms such as Certik or PeckShield are crucial to avoid scams.

- Following this, traders should monitor community hype on platforms like X, Telegram, and Discord for engagement, influencer mentions, and creative marketing efforts. Traders should be cautious of red flags such as anonymous teams, aggressive shilling (artificially inflating the price of a meme coin through promotion and positive messaging), and unrealistic promises.

- Finally, mitigate risks by verifying tokens on blockchain explorers like Solscan, using secure wallets like Phantom or Solflare, and diversifying across multiple meme coins to reduce the impact of potential losses.

Apart from these steps, investors should set realistic expectations and understand that gains of 100 times or 1,000 times are rare. The risk tolerance and exit strategy should always be prepared before investing in any meme coin.

Tools and strategies that could help when investing in meme coins

Certain tools and strategies can help traders identify meme coins and mitigate associated risks.

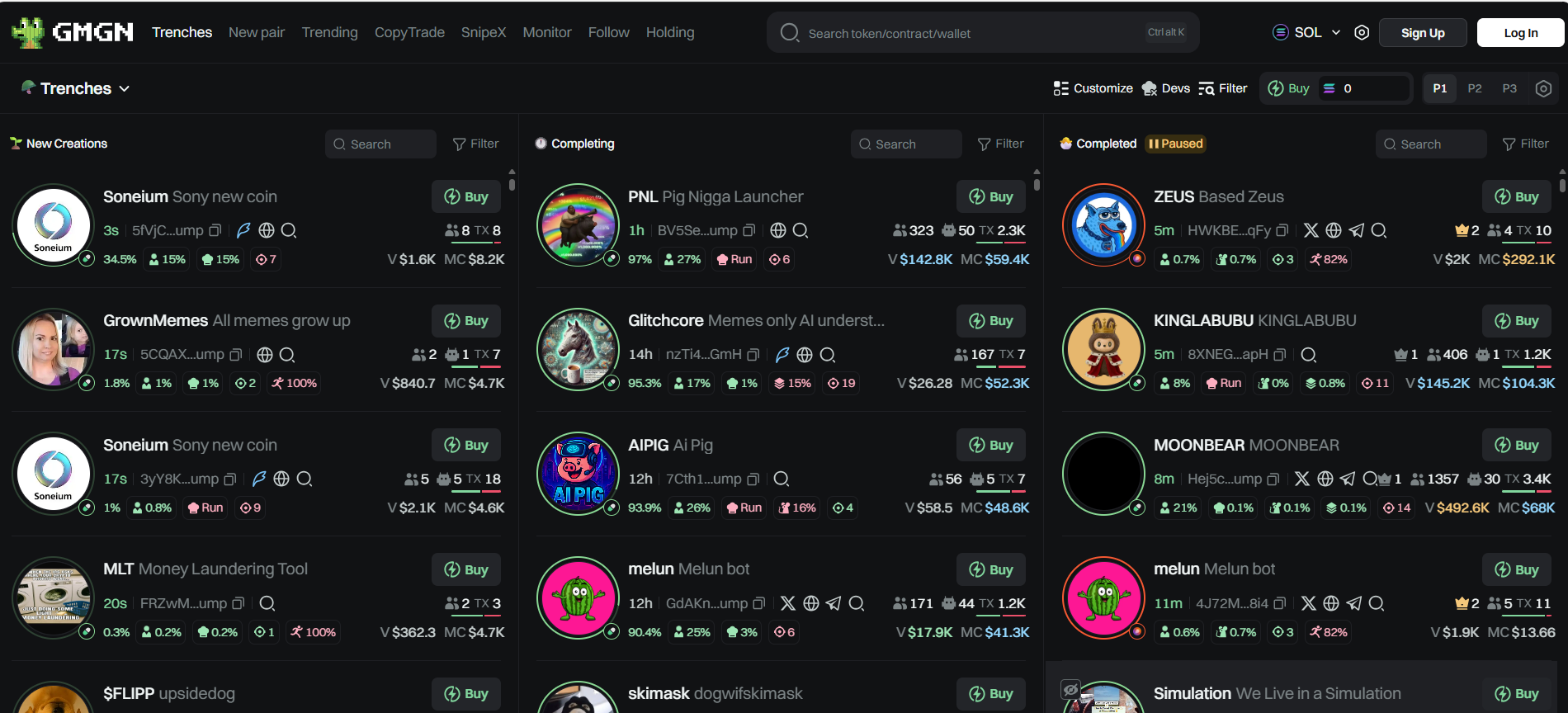

GMGN.ai is a cryptocurrency analytics platform built on Solana that helps traders discover new tokens early and manage risks effectively. It's popular for its fast data delivery, security tools, and automation features.

The key features of this platform include copy trading, automation, and quick buy and sell capabilities. It also helps track the wallets of experienced traders or those with a proven track record of profitable trades, allowing investors to follow the so-called smart money.

GMGN dashboard

Another platform traders could use is BullX NEO, a fast, AI-powered trading platform built for Solana meme coins. The key feature of this platform includes its Maximal Extractable Value (MEV) protection, which helps traders safely snipe new coins without getting front-run by bots.

Other platforms include Bubble maps, which provide visual aids to identify top holders and internal transfers for the token. Traders can also utilize Dextools, Dex Screener, and SOLSCAN to trade and analyze meme coins.

High-risk environment: Signs of concern

Trading a Solana-based meme coin involves high speculation and significant risk. The chances of finding a promising meme coin and investing in it early are slim. Proper research and due diligence should be conducted before investing in a meme coin. These include analyzing the team involved, community hype, tokenomics, and roadmaps. Using the tools and strategies mentioned above could help traders identify meme coins and mitigate associated risks.

Investors should set realistic expectations and understand that gains of 100 times or 1,000 times are extremely rare. The risk tolerance and exit strategy should always be prepared before investing in any meme coins. Readers should only invest what they can afford to lose.