Three ways Bitcoin could enhance your income as BTC hits new all-time high

- Bitcoin doesn't support staking natively, but firms like Strategy and KULR have announced their yields from BTC holdings in their treasuries.

- BTC holders can boost their income through staking on centralized or decentralized platforms and by DeFi lending.

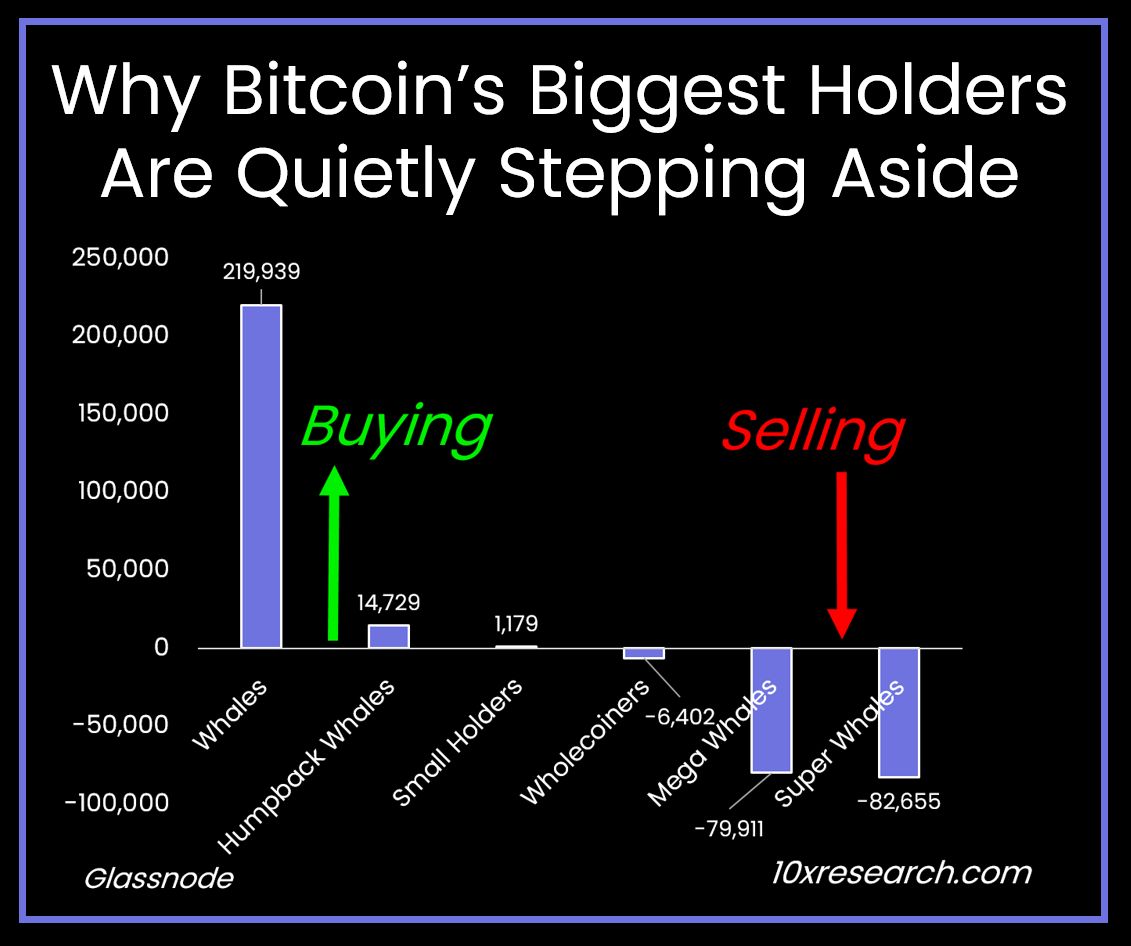

- A recent report from 10x Research reveals that some of Bitcoin’s largest holders are distributing their BTC, likely reallocating capital as prices nears all-time highs.

- Bitcoin hit a new all-time high in the USDT market on Binance with Tuesday's price crossing $109,800.

Bitcoin (BTC) is making headlines as the largest crypto hits a new all-time high in the BTC/USDT and USD markets on Binance. At the time of writing, BTC trades above $109,300.

Bitcoin does not support staking natively on its blockchain. However, Layer-2 chains and centralized/decentralized platforms offer opportunities for retail and institutional investors to earn yield on their BTC holdings.

Bitcoin can be staked and lent or traders can choose to invest in a Bitcoin yield fund powered by an exchange like Coinbase to earn an income through their BTC holdings.

Earn a yield on Bitcoin in these three ways

The top three ways to boost your income with your Bitcoin holdings are as follows:

- Depositing Bitcoin to a centralized lending platform like Binance Earn, Nexo and Ledn (for retail traders)

- Locking BTC holdings in Layer-2 platforms like Stacks or Babylon (for retail traders)

- Depositing Bitcoin in exchange investment products like Coinbase Bitcoin Yield Fund (CBYF) for institutional investors

While traders await Bitcoin’s re-test of its previous all-time high or a continuation of BTC’s upward trend, there are other opportunities to earn an income through the holdings, with or without trading.

Centralized lending platforms facilitate transactions between lenders and borrowers and offer a yield to those who deposit BTC to lend to other users. Binance Earn, Nexo and Ledn are the top three lending platforms, but there are others like Wirex and Youhodler.

Bitcoin holders can start by comparing different platforms for fees, yield and payout schedule to gather an idea of the potential earnings and the associated costs. The timing of payouts and fee structure is critical as it varies across platforms, and some may require traders to lock their BTC for a fixed period of time.

Locking your Bitcoin holdings on a lending platform may influence the liquidity of your portfolio and keep you from realizing gains based on the price swings day-to-day.

Different platforms may or may not be compliant with local laws, and confirming compliance with local regulations is essential to keep your Bitcoin holdings safe.

Binance earn explained

Investors with BTC holdings in their Binance account can check out a list of available investment products on Earn. Users can pick an Earn product based on estimated APR and duration and subscribe to it.

The next step is to select the amount of funds to use and confirm the investment. Flexible investments can be redeemed at any time, however, there are fixed options that require a lock-in of the funds for a fixed period of time.

It is important to note that depositing BTC into centralized lending platforms entails risks and investors are expected to do their own research before picking a product to earn BTC yield.

Layer-2 chains that support Bitcoin staking like Stacks and Babylonchain offer liquid staking mechanisms for holders looking to earn a yield through BTC deposits. Typically, it was the norm for Bitcoin staking mechanisms to restrict capital efficiency and reduce liquidity, however, liquid staking through Layer-2 chains removes these constraints and introduces users to tokens against the staked BTC.

Investors can maintain asset liquidity while holding the staked tokens, deriving security from Bitcoin’s blockchain infrastructure, and are likely to maintain resilience against vulnerabilities and hacks.

Stacks explained

Bitcoin Layer-2 chains like Stacks offer investors the opportunity to exchange their BTC for a token, like sBTC, an SIP-010 token on the blockchain that has a 1:1 with Bitcoin. Traders can participate in the DeFi ecosystem while holding sBTC tokens pegged to BTC.

Investors start by bridging Bitcoin to DeFi through the Stacks blockchain and gain access to DeFi apps within the Stacks ecosystem. Without selling Bitcoin, investors can switch between BTC and sBTC relatively fast. Stacks maintains its decentralized platform using 15 community-chosen signers that maintain the peg wallet, and the community is involved in key decisions to ensure security.

Coinbase Bitcoin Yield Fund is one of the ways for institutional investors to earn through their BTC holdings without directly offering it as loans to others (a mistake that BlockFi made previously and was accused of unregistered securities sale).

Coinbase explains that the platform combines existing trading methods and works within the limits of the Bitcoin ecosystem rather than lending BTC to borrowers and passing on yield. The fund is not open for retail investors and accepts institutional investors only at the time of writing.

Strategy and KULR boast Bitcoin yields on BTC held in treasury

In a May 20 announcement, KULR revealed that the firm added an additional $9 million in BTC to its treasury. The firm says in a press release that year-to-date KULR has achieved a BTC yield of 220.2% by leveraging surplus cash and its At-The-Market (ATM) equity program to fund the purchase of more Bitcoin.

KULR now holds nearly $80 million in Bitcoin after deploying 90% of its surplus cash reserves to buy BTC for its treasury.

Strategy missed its first-quarter earnings estimates, however, the firm reported a year-to-date yield of 13.7% on its BTC holdings in a May 1 earnings statement. Strategy gained nearly $6 billion in the form of yield on its Bitcoin.

Bitcoin’s oldest investors are likely taking profits, rotating capital

Analysts at crypto firm 10x Research identified a surge in Bitcoin’s old wallets distributing their BTC holdings as the crypto rallied closer to its previous all-time high. Markus Thielen, founder and head of research at 10x Research, identifies $120,000 as the next target for Bitcoin price.

Thielen says that his on-chain analysis shows that early Bitcoin investors, miners and exchanges have been “steadily distributing in 2025.” The executive says these actions aren’t panic selling, they are likely disciplined profit rotation, and whale exchange deposits to exchanges are still relatively low, unlike previous cycles in 2017 and 2021.

Bitcoin holders are distributing BTC holdings | Source: 10xResearch

Thielen says, “Bitcoin’s historical pattern shows that the real risk isn’t when long-term holders start selling—it’s when their selling stops. That’s when demand falters, absorption fails, and early adopters turn into forced holders once again. We saw it in March 2024. We saw it again in January 2025. The signal was clear both times—and we turned bearish accordingly.

Right now, long-term holder supply is still rising, which suggests this cycle isn’t over yet. We’ve called the breakout above $84,500, then the move to $95,000 and $106,000. Our next target is $122,000—driven by the same macro-cycle and behavioral flow analysis that’s helped us call major turning points.”