Crypto Today: BTC holds $85k, XRP and Solana prices stall as SEC delays Ethereum ETFs staking

- The cryptocurrency market capitalization holds firm around the $2.7 trillion mark on Friday.

- The US SEC pushed back its April 17 deadline on whether Grayscale can permit staking to its Ethereum ETFs.

- Bitcoin price consolidates near $85,000, while XRP and Solana prices stalled below $2.10 and $135, respectively.

Cryptocurrency markets continued to move sideways on Friday, with Bitcoin price stagnation below $85,000, leading to traders hesitating to enter larger altcoin positions. Regarding news, fresh developments around ETFs, cryptocurrency regulations and adoption dominate media discourse.

Bitcoin market updates:

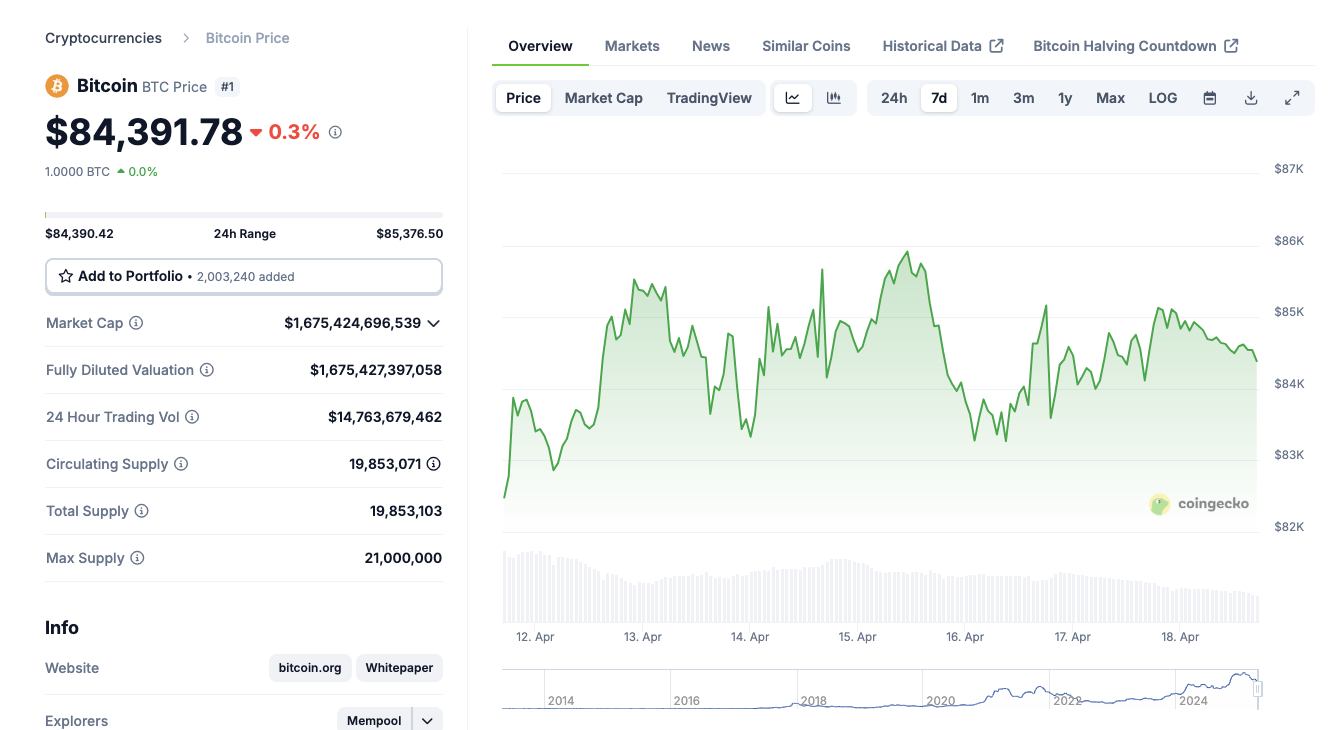

Bitcoin price has stabilized within a 2% narrow range between $83,000 and $85,000 for the better part of this week.

The calming trend comes after volatile reactions to Trump’s tariffs announcements in early April triggered intense turbulence, driving BTC to multi-month lows below $75,000.

Bitcoin price performance, April 18, 2025 | Source: Coingecko

Bitcoin is trading at $84,600 at press time, according to Coingecko data. Notably, BTC has managed to avoid a detour below the $80,000 level this week, signaling that weak hands may have been shaken out of the market recently.

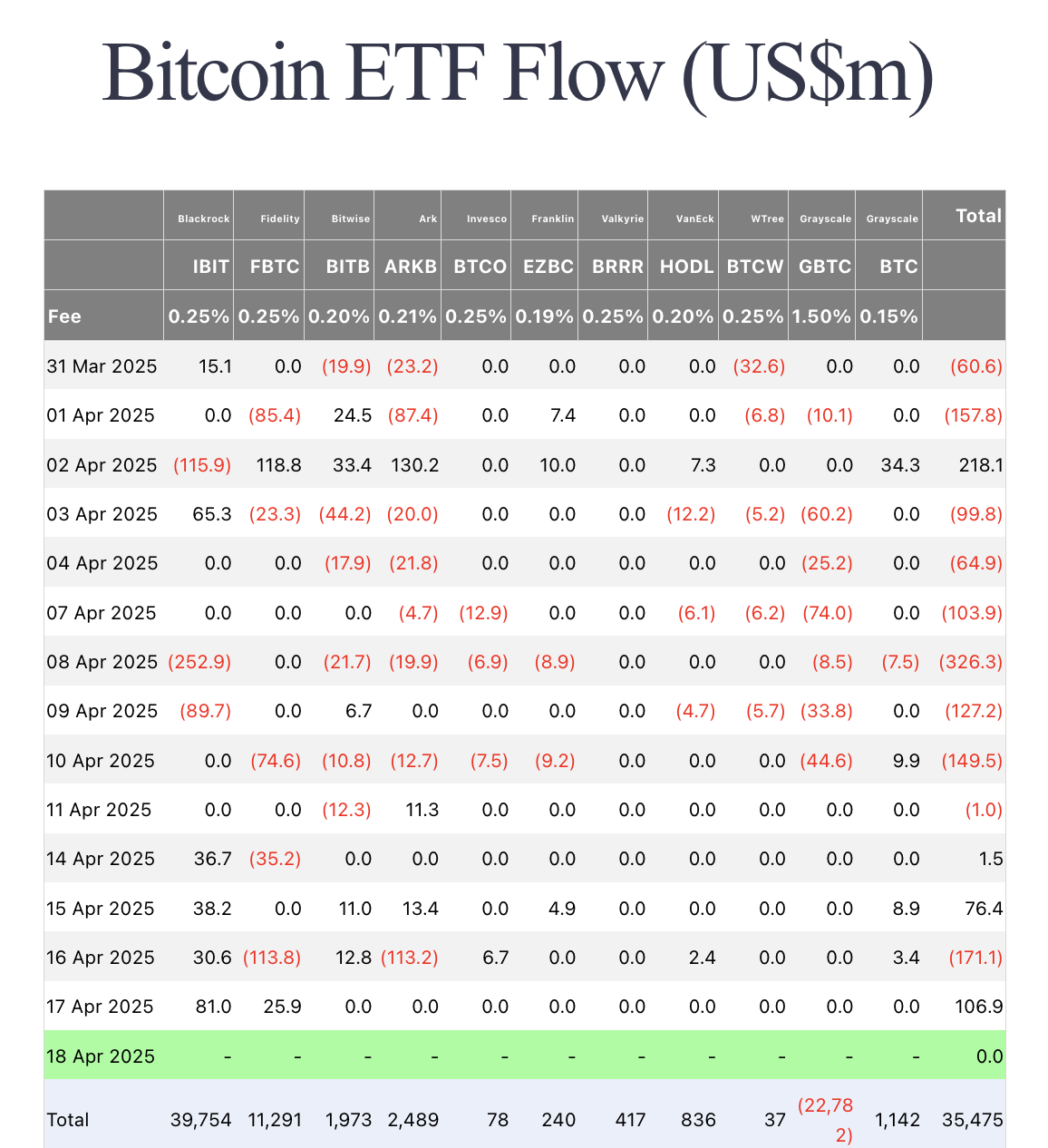

Chart of the day: Bitcoin ETFs flipped back into buying mode

Bitcoin ETF demand emerges as one of the key factors anchoring Bitcoin prices over the last 24 hours. On Thursday, Bitcoin ETFs flipped into buying mode, acquiring $106.9 million, according to Farside data.

Bitcoin ETFs flows, April 18 | Source: Farside

BlackRock’s IBIT and Fidelity’s FBTC took in $81 million and $25.9 million apiece, while the other funds remained muted on the data, per Farside data.

Altcoin Market: XRP and Solana stall as ETF verdict deadline elapses

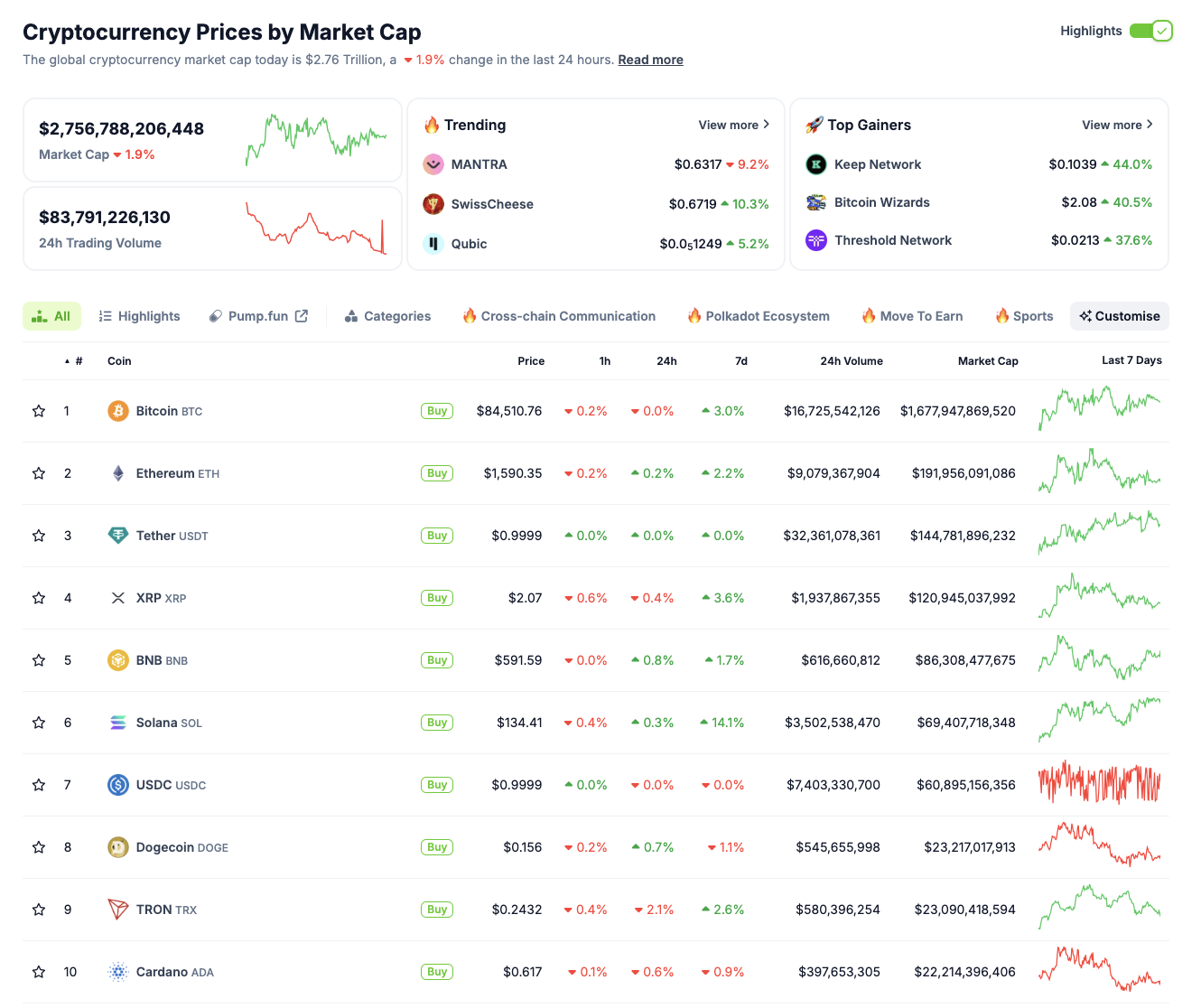

The global crypto market slid 1.9% over the past 24 hours, pulling total capitalization to $2.76 trillion. Daily trading volume plunged to $83.8 billion, reflecting a notable cooldown in risk appetite after an aggressive early-week rally.

Bitcoin (BTC) held steady at $84,510, up 3% over the past 7 days, while Ethereum (ETH) failed to break out, hovering at $1,590 with only a 0.2% weekly gain.

Solana (SOL), which surged 7% on Thursday following the debut of the world’s first spot Solana ETF in Toronto, stalled at $134.41. Meanwhile, XRP retreated slightly to $2.07, with momentum fading after a 3.6% weekly rise. Both altcoins appear to have entered consolidation phases after leading the altcoin surge earlier in the week.

Friday’s market movement reveals a clear shift in capital from altcoins back toward Bitcoin and stablecoins, as investors brace for regulatory uncertainty. The Securities and Exchange Commission’s (SEC) delay in approving or denying Grayscale’s Ethereum spot ETF staking, previously expected by April 17, has weighed heavily on sentiment.

While the SEC invoked its statutory right under the Securities Exchange Act of 1934 to extend the decision window by up to 90 days, this sudden procedural move has triggered short-term caution across top altcoin markets.

Crypto market performance, April 18 | Source: Coingecko

This hesitation is particularly evident in Solana and XRP, which had attracted speculative capital tied to ETF optimism and political tailwinds.

At the time of publication, SOL has stumbled below $135 support, after posting 7% gains on Thursday as a Canadian firm announced the launch of worlds’ first SOL ETF.

As the US SEC’s deadline elapsed, Polymarket bettors dropped odds on the July 31 SOL ETF approval deadline to 22%, 5% lower on the day.

Affirming the bearish sentiment, Ripple (XRP) price has also reversed toward $2 after rallying on Ripple and reaching a consensus with the SEC to pause all appeals in its long-running lawsuit.

The stalling of these top altcoins, alongside a slight uptick in stablecoins like USDC and USDT, suggests that institutional and large retail capital is rotating defensively while awaiting clarity from US regulators.

Crypto news update:

DOJ memo signals softer stance on crypto prosecutions under Trump administration

A newly released memo from the US Department of Justice indicates a shift in enforcement policy toward the cryptocurrency sector. Authored by Deputy Attorney General Todd Blanche, the document outlines a strategic refocus on crimes involving direct harm, such as investor fraud, terrorism financing, and money laundering through crypto.

The memo suggests a reduced emphasis on broader regulatory crackdowns, marking a departure from the Biden-era approach that targeted compliance failures and structural violations by crypto firms.

Former Wall Street executive arrested for gambling $7M in crypto casino project

Richard Kim, a former executive at Galaxy Digital, Goldman Sachs and JPMorgan, has been arrested on securities and wire fraud charges. The US Department of Justice alleges that Kim misappropriated nearly the entire $7 million raised for his crypto gambling project, Zero Edge, and used the funds for speculative trading.

According to an FBI affidavit, Kim induced investors under false pretenses and lost significant amounts through high-risk crypto bets. After failed attempts to recover losses through further trades and capital raises, Kim admitted wrongdoing and voluntarily surrendered to the US Securities and Exchange Commission.

eXch to shut down amid regulatory pressure, donates 50 BTC to privacy development

Privacy-focused crypto platform eXch has announced it will shut down operations following sustained pressure from a transatlantic crackdown targeting the project over alleged illicit activity facilitation. Despite distancing itself from being a mixer, the platform said it faced consistent misinterpretation from regulators and intelligence agencies regarding its privacy tools.

As part of its wind-down, eXch will donate 50 BTC to fund open-source privacy initiatives across Bitcoin, Thorchain, and Ethereum.