Bitcoin Price Forecast: BTC holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

- Bitcoin holds above $87,000 on Wednesday after its mild recovery so far this week.

- A K33 report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

- Amberdata’s volatility cone data for Bitcoin shows convergence, suggesting a period of lower volatility and market consolidation.

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements. Amberdata’s volatility cone data for Bitcoin also shows convergence, suggesting a period of lower volatility and market consolidation.

Bitcoin remains calm ahead of Trump’s tariff announcements

Bitcoin trades above $87,000 on Wednesday following a slightly dovish Federal Reserve (Fed) stance and signs that United States (US) President Donald Trump may be considering a more benign tariff strategy. Tuesday’s K33 Research “Ahead of the Curve” report highlights that the current market conditions are relatively calm and are shaping up for volatility as the market absorbs the tariff announcements.

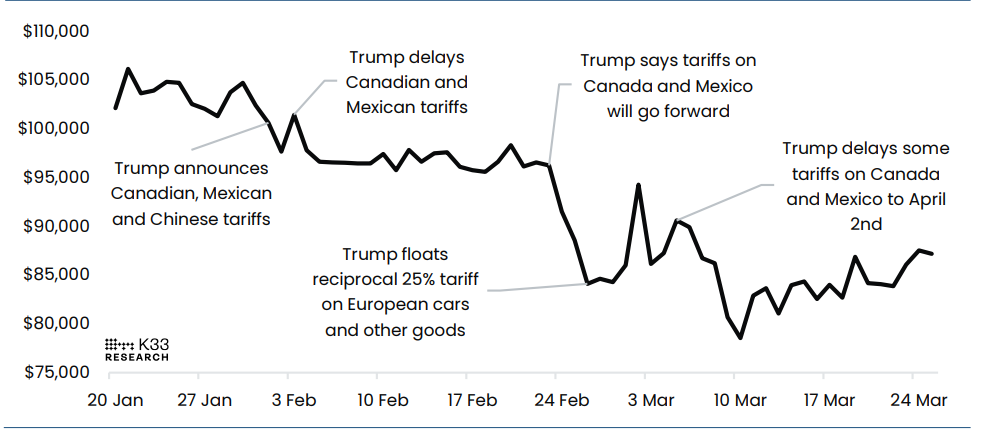

The report explains that the market’s calm tone may persist until April 2, the scheduled date for Trump’s major reciprocal tariffs announcement. This is shaping into a major market event, likely to reignite activity across both crypto and broader financial markets, similar to the sharp moves seen after Canadian and Mexican tariff developments earlier this quarter.

If President Trump softens his stance, markets could rally. If he remains vague, volatility may hit both long and short positions. If he takes a hard line, a sharp decline — similar to past tariff-related drops — is likely, as shown in the graph below.

“In a back-and-forth scenario, we could see a market environment similar to February and early March, when tariffs dominated the narrative. The US economy remains strong but is widely expected to slow due to tariffs—a risk already largely priced in by most economists,” says K33’s analyst.

BTCUSD vs tariff headlines chart. Source: K33 Research

Amberdata’s Volatility Cone metric for Bitcoin shows convergence, suggesting a period of lower volatility and market consolidation. While this may signal calmer market conditions, it also means that Bitcoin could be in a waiting phase, preparing for a potential breakout when volatility returns.

-638785845690697857.png)

BTC Volatility Cone chart. Source: Amberdata

GameStop adds BTC as a Treasury Reserve Asset

GameStop (GME), a US video game retailer company, announced on Tuesday that it had updated its investment policy to include Bitcoin as a treasury reserve asset. GameStop follows in MicroStrategy’s footsteps, which currently holds 506,137 BTC acquired for $33.7 billion at an average price of $66,608 per Bitcoin, making it the largest corporate holder of the cryptocurrency.

The move aligns with a broader trend of corporate adoption of Bitcoin, spurred by US President Donald Trump’s recent executive order to establish a strategic cryptocurrency reserve using government-held tokens. GME has $4.7 billion in cash and cash equivalent as of February 1.

Bo Hines, Trump’s Crypto Council Chief and head of the Presidential Council of Advisers for Digital Assets, stated in a recent FOX Business interview with Eleanor Terrett that he is open to exploring the idea of exchanging Fort Knox Gold Reserves for Bitcoin as long as it does not affect the government’s budget balance.

“If it’s budget neutral and doesn’t cost a taxpayer a dime, you kind of exchanging one for the other,” Hines said.

Hines also emphasized the administration's support for innovation across various crypto ecosystems, noting that the four altcoins — Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA) — were highlighted due to their market cap dominance and thinking behind including ETH, XRP, ADA and SOL in the separate stockpile.

Bitcoin Price Forecast: BTC nears its descending trendline; breakout to signal bullish move

Bitcoin price broke and closed above its 200-day Exponential Moving Average (EMA) at around $85,560 on Sunday and rose 4.45% until Monday. However, BTC stabilized around $87,000 the next day. At the time of writing on Wednesday, it continues to trade slightly above that level, approaching a descending trendline (drawn by connecting multiple high levels since mid-January).

If the 200-day holds as support and BTC breaks and closes above the descending trendline, it could extend the recovery to retest the key psychological level of $90,000. A successful close above this level could extend an additional rally toward its March 2 high of $95,000.

The Relative Strength Index (RSI) on the daily chart reads 52, above its neutral level of 50, indicating increasing bullish momentum. The Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on the daily chart last week, giving a buy signal and suggesting a bullish trend ahead. Additionally, it shows rising green histogram levels above its neutral level of zero, indicating strength in upward momentum.

BTC/USDT daily chart

However, if BTC faces a rejection from the descending trendline and closes below the 200-day EMA, it could extend the decline to retest its next support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.