Crypto Today: XRP, BNB advance as Blackrock records 16-day Ethereum buying spree

- The cryptocurrency sector valuation grazed the $3.6 trillion mark on Thursday, recording $252 billion worth of inflows since the market crash halted on Tuesday.

- In the last 24 hours, 85,893 traders were liquidated with the total liquidations coming in at $204.96 million.

- Blackrock's Ethereum ETF set a new record of 16 consecutive days of net-inflows.

Altcoin market updates: XRP, BNB advance as traders bet on third consecutive Fed rate cut

As the geopolitical crisis surrounding the fall of the Assad regime in Syria tapered off this week, dovish figures on the latest US CPI data raised investor optimism across the crypto market.

Bitcoin price held firm above the $100,000 level, Ripple (XRP) cleared the $2.40 resistance, while resurgent trading activity saw Binance Coin (BNB) break past the $725 level on Friday.

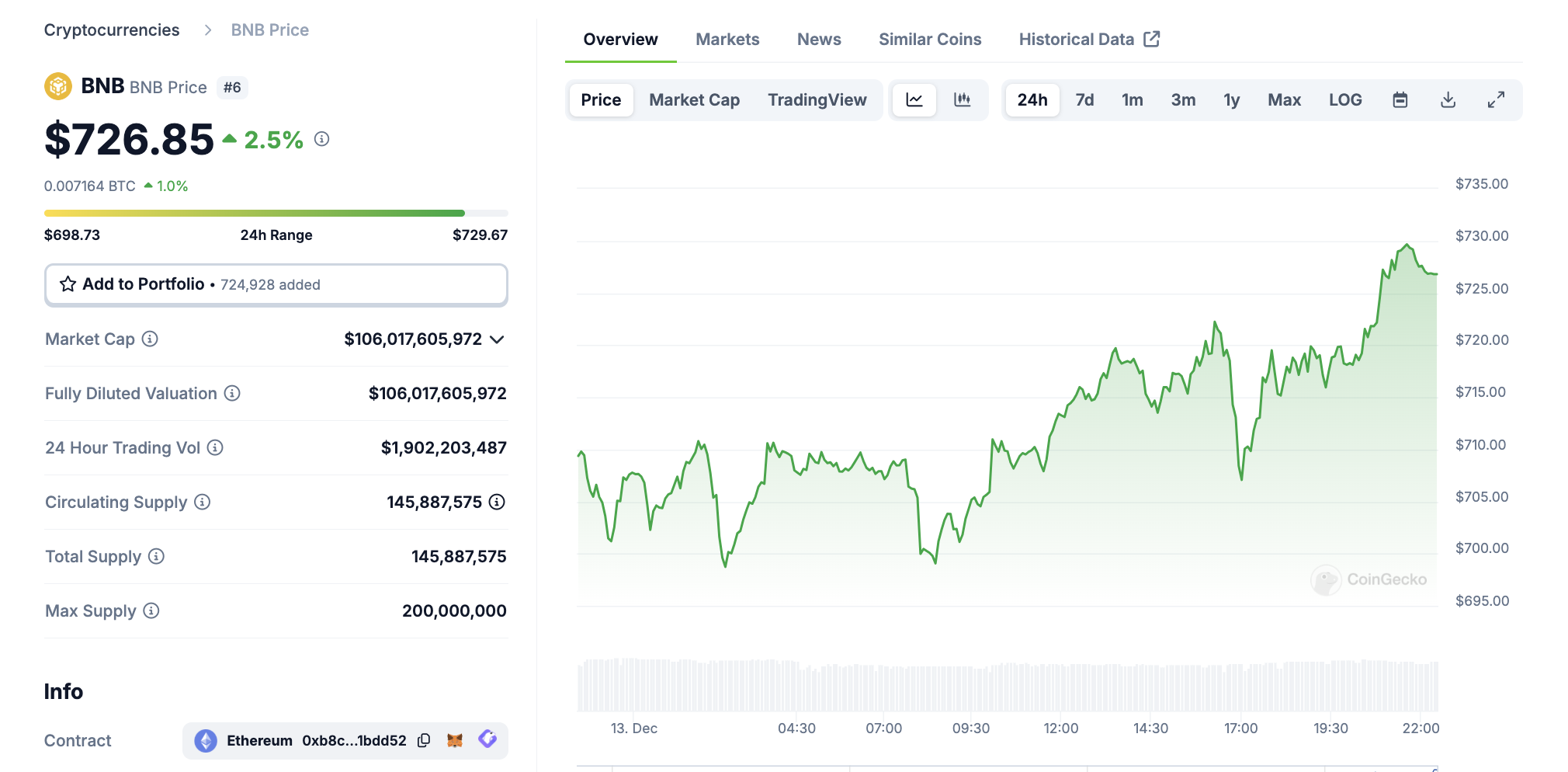

- Binance Coin (BNB) price surged 2.5% on Friday to emerge best performer among the top-10 crypto assets.

Binance Coin (BNB) price action, December 13, 2024.

BNB’s price surge on Friday saw it break above the $725 resistance level for the first time in five days, signalling that trading activity with the retail dominated markets on Binance is now recovering after the abrupt downtrend earlier in the week.

- Ripple (XRP) price also rebounded 2% to reclaim the $2.40 mark on Friday.

With the newly approved RLUSD stablecoin set to boost ecosystem liquidity and network demand, XRP price appears primed for another attempt at breaching the $3 territory, having topped out at the $2.91 level during last week’s rally.

Chart of the day: BlackRock's Ethereum ETF records $1.5 billion of inflows in under a month

Since Donald Trump nominated crypto-friendly Paul Atkins as Gary Gensler’s replacement in late November, US-based corporate investors have ramped up demand for Ethereum ETFs.

On Thursday, BlackRock’s iShares Ethereum Trust (ETHA) set a new record of 16 consecutive days of net inflows.

BlackRock’s iShares Ethereum Trust (ETHA) Net Inflows | Source: SosoValue

BlackRock’s iShares Ethereum Trust (ETHA) Net Inflows | Source: SosoValue

According to the SosoValue chart below, there were $200 million of inflows recorded on Thursday, bringing its total haul since November 20 to $1.5 billion.

Prior to this buying streak, Blackrock’s Ethereum ETFs had only recorded $1.7 billion since its launch in July.

The $3.6 billion fund has now positioned itself as a leader in the Ethereum ETF market, capitalizing on a recent wave of post-election investor momentum.

While Bitcoin has consistently dominated Wall Street’s interest through its spot ETFs launched earlier this year, Ethereum’s products are now catching up, suggesting growing institutional expectation of fairer regulation of altcoins by the incoming Paul Atkins-led SEC regime.

Crypto news updates:

- NASDAQ-100 Inclusion Could Propel MicroStrategy's Stock and Visibility

NASDAQ is set to announce its annual NASDAQ-100 reconstitution today with MicroStrategy emerging as a potential addition.

This inclusion hinges on its classification as a technology company since the index excludes financial firms.

Despite MicroStrategy's valuation being largely tied to its Bitcoin holdings, its status as a software company strengthens its eligibility for inclusion.

If added, ETFs tracking the NASDAQ-100, such as the iShares QQQ Trust, would be required to buy MicroStrategy shares, potentially leading to a significant increase in demand.

Bloomberg analyst, James Seyffart estimates initial ETF-driven net share purchases of $2.1 billion, which could boost the company's stock price and visibility.

MicroStrategy shares have already risen 2.5% in anticipation, trading above $400.

- BiT Global Takes Legal Action Against Coinbase Over wBTC Delisting

BiT Global has filed a lawsuit against Coinbase, alleging the exchange unfairly delisted Wrapped Bitcoin (wBTC) to promote its in-house product, Coinbase Wrapped Bitcoin (cbBTC).

The suit accuses Coinbase of using antitrust practices to dominate the wrapped Bitcoin market while citing misleading claims about wBTC’s compliance with listing standards.

This comes as Coinbase recently listed meme coins such as PEPE, WIF and MOG, contradicting its rationale for removing wBTC.

The complaint highlights that Coinbase’s decision to delist wBTC in favor of less conventional assets demonstrates market manipulation.

BiT Global asserts that this move was designed to eliminate competition for cbBTC.

The lawsuit demands over $1 billion in damages and calls for injunctive relief to protect the wrapped Bitcoin ecosystem from further harm.

- CHILLGUY Creator's Account Allegedly Hacked Amid Controversial IP Announcement

Philip Banks, creator of CHILLGUY, is at the center of speculation after a tweet from his account announced granting intellectual property (IP) rights to the CHILLGUY token team.

The unexpected post caused a 30% spike in the token’s value, which later plummeted as rumors of a compromised account spread.

Compounding suspicions, Banks’ account was linked to launching a meme coin featuring another character, Philb, on Pump.fun, which surged to a $1 million market cap before collapsing.

This prompted the CHILLGUY official X account to issue a warning, urging followers to practice caution and avoid unverified solicitations.

The announcement also contradicts Banks’ previous intent to take down unauthorized uses of CHILLGUY, further fueling concerns.

While the token initially saw gains, its association with potential account hacking and phishing scams has clouded the situation, leaving investors uncertain.