Crypto Today: Morgan Stanley to offer Bitcoin to clients, Ethereum gears for $3,000, XRP steady above $0.50

- Morgan Stanley advisors are ready to offer Bitcoin Spot ETF to their clients starting Wednesday, August 7.

- Bitcoin makes a comeback above $57,000, Ether gears for recovery to $3,000 and XRP gains ground above support at $0.50.

- Ethereum worth $2 billion from dormant wallet addresses is now on the move, per on-chain data.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades above $57,000 early on Wednesday, as Morgan Stanley advisors gear up to offer BTC Spot Exchange Traded Fund (ETF)to their clients.

Morgan Stanley advisors, controlling $1.3T in wealth, can offer BTC ETFs to their clients starting today.

— Tom Dunleavy (@dunleavy89) August 7, 2024

If we assume 0.01% of assets are interested that's $13B more in assets coming into crypto

- Ethereum prepares for a comeback above $3,000 asdormant wallets move billions in Ether per on-chain data.

- Lookonchain data shows that hundreds of wallets that have been inactive for over three years moved large amounts of Ether, 789,533 ETH worth over $2 billion.

- Hundreds of dormant wallet addresses are moving Ether post Jump Crypto’s $277 million Ether transfer.

Three signs that Ethereum could rally 20% after Monday’s crypto crash

- XRP sustained above $0.51, rallying nearly 2% on Wednesday.

Chart of the day

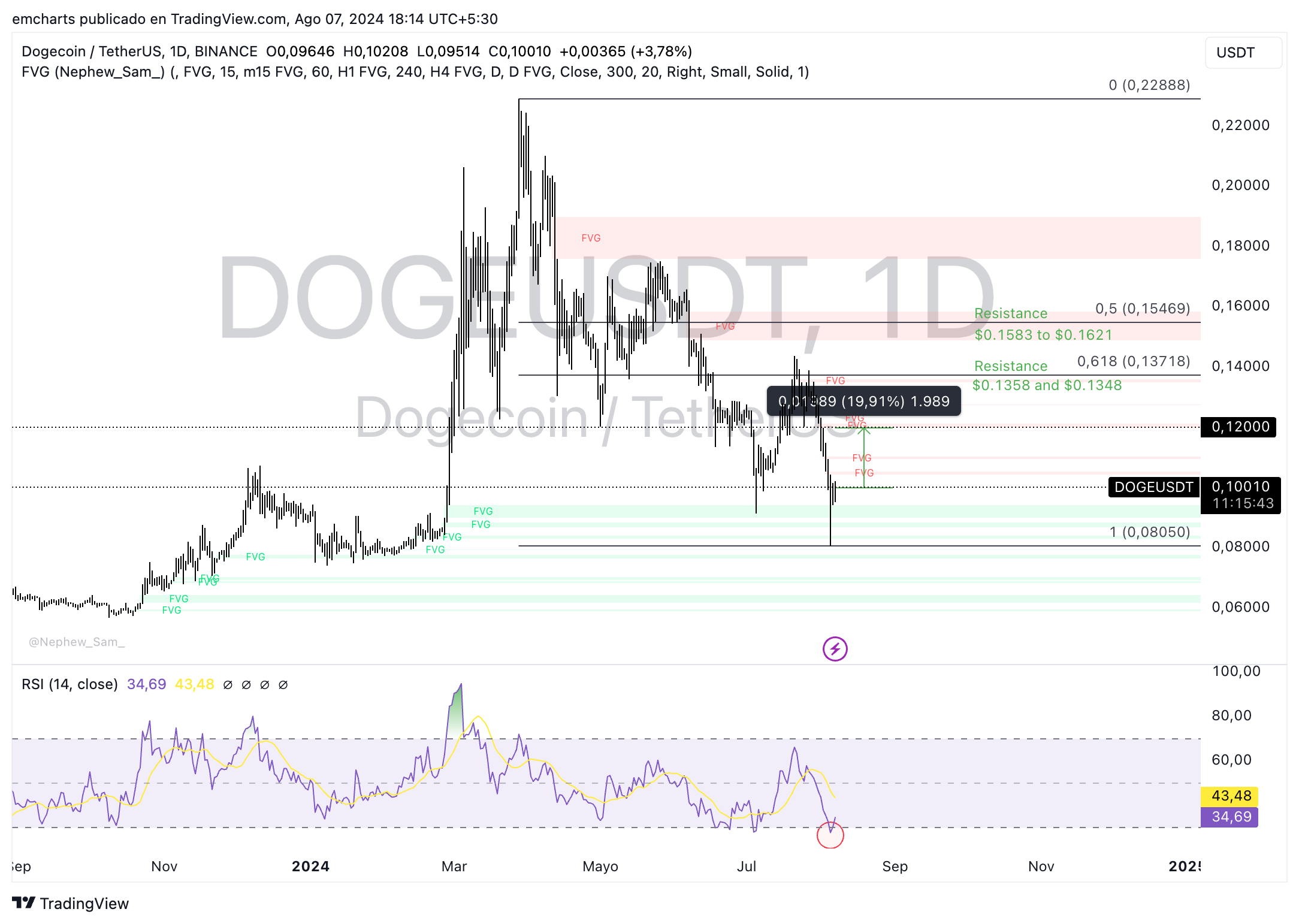

DOGE/USDT daily chart

Dogecoin (DOGE) trades at $0.10010 at the time of writing. The meme coin could extend gains by nearly 20% and rally towards its $0.12 target. The meme coin faces resistance at the Fair Value Gaps (FVG) at $0.10923 and $0.10425 as seen in the DOGE/USDT chart.

The Relative Strength Index (RSI) shows DOGE was in the oversold zone and it has recovered as RSI climbs back above 30. The momentum indicator supports a bullish thesis for Dogecoin.

Market updates

- The total net outflow of Bitcoin Spot ETFs was $149 million on Tuesday, August 6. The Grayscale ETF GBTC’s outflows continued, losing $32.18 million.

- Nasdaq exchange posted a filing to the Securities & Exchange Commission’s site, sharing a plan to list and trade options for its Spot Ethereum ETF.

- Ronin, a game and blockchain development company announced that a $10 million exploit was whitehat hackers and the funds have been returned. A bounty of $500,000 has been awarded to the hackers involved.

Ronin announced that the white hat hacker has returned about $10 million in ETH. The bug bounty program will reward white hats with a bounty of $500,000.

— Wu Blockchain (@WuBlockchain) August 6, 2024

Industry updates

- OKX exchange announces the delisting of seven tokens: MSN, OMN, REP, EURT, IGU, PCI, and SLN.

- Ethereum remains the dominant cryptocurrency even as DeFi apps see rising market activity. About 70% of the market share belongs to Ether, per a CoinGecko report.

17/ DeFi saw a 20% decline in market cap but a 6% increase in market activity. Ethereum remains the king of DeFi, holding about 70% of the market share.

— Our Crypto Talk (@ourcryptotalk) August 7, 2024

➭ Noteworthy DeFi Movements:

・ TON: Attracted enough users to become the 10th largest chain by TVL, thanks to tap-to-earn… pic.twitter.com/Kc4K6iYdMh

- Bitcoin funding rates have turned negative and this reflects a bearish sentiment, there is a dominance of short sellers in the asset. While this is typically a sign of a correction, it can be considered positive for price growth in the long term since the derivatives market is no longer overheated.

#Bitcoin's Decline and the Shift in Futures Market Sentiment: A Path to Potential Recovery?

— CryptoQuant.com (@cryptoquant_com) August 7, 2024

“The funding rates have now turned negative, reflecting an overall bearish sentiment and the dominance of short sellers. However, this could also be seen as a positive sign, as it… pic.twitter.com/VV8WoZPC39

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.