Global AI market could soar to $376 billion in 2026 as crypto AI falls behind

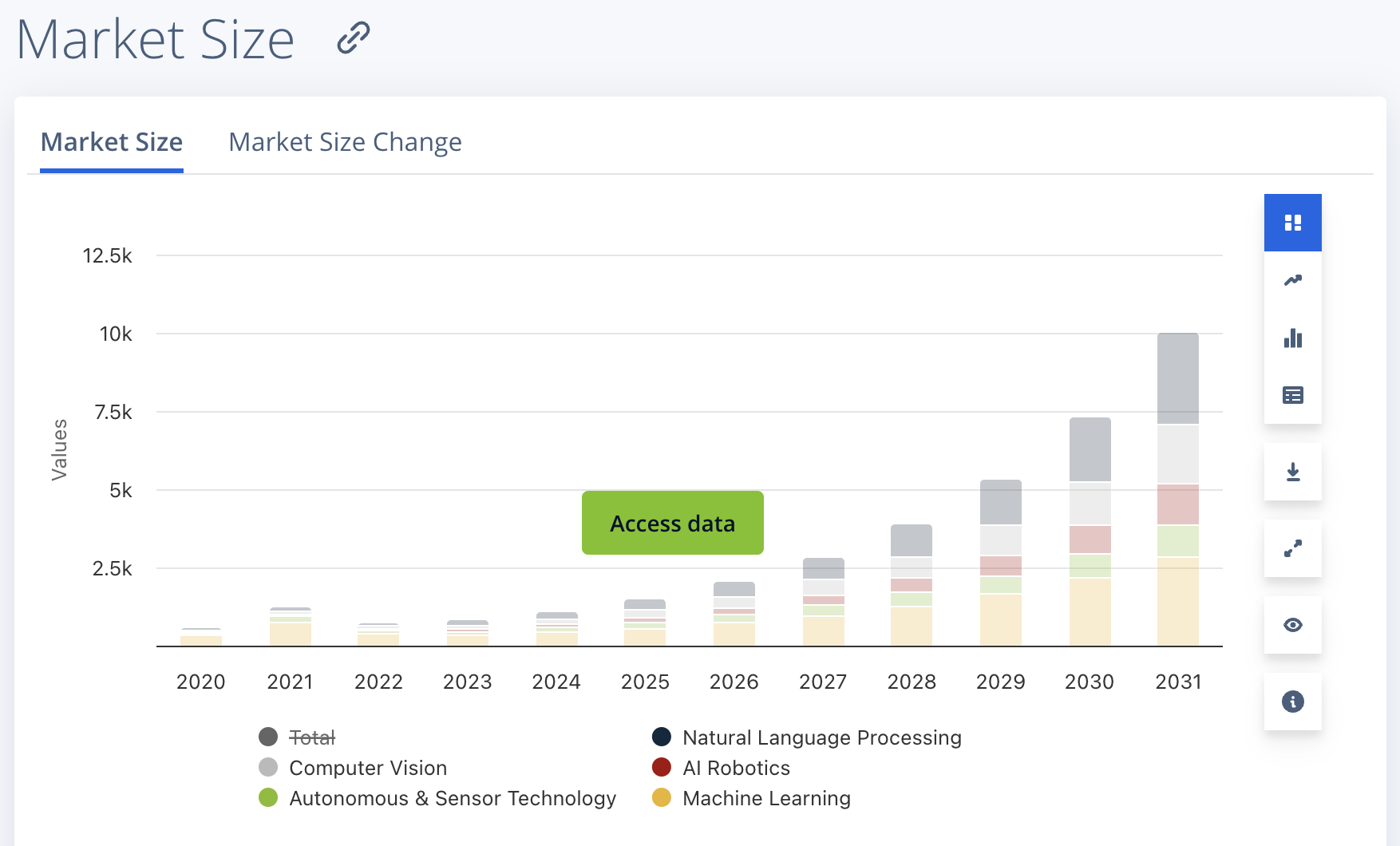

- The global AI market shows strong growth potential, with a Compound Annual Growth Rate projection of 26.6% through to $2.48 trillion by 2034.

- AI stocks led by Alphabet and Nvidia outperformed major crypto AI tokens in 2025.

- Chainlink, Bittensor, and Chainlink lag the mainstream AI market amid liquidity challenges, risk-off sentiment, and unproven revenue models.

The Artificial Intelligence (AI) market has emerged as one of the fastest-growing technology sectors worldwide, driven by high demand for computer hardware, cloud infrastructure and business adoption.

Fortune Business Insights data shows that the AI market was valued at $294 billion in 2025 and is projected to grow to $376 billion by the end of 2026 and $2.48 trillion by 2034.

Meanwhile, there has been a visible mismatch between the mainstream AI economy and the crypto AI sector, which experienced muted performance and significant drawdowns, driven by liquidity challenges and investor skepticism throughout 2025.

The crypto AI segment, led by projects such as Chainlink (LINK), Bittensor (TAO) and Near Protocol (NEAR), is valued at $22 billion, a fraction of the global AI market size, according to CoinGecko.

This article explores the divergent performance of the global AI and Crypto AI economies, compares fundamental metrics, discusses emerging trends, investor preferences, risks and sector projections for 2026.

Global AI explosive growth and future outlook

The global AI market was valued at $294 billion in 2025, according to Fortune Business Insights. It is expected to exhibit a Compound Annual Growth Rate (CAGR) of 26.6% through to $2,480 billion by 2034.

A report by UN Trade and Development (UNCTAD) released in April 2025 projected that the global AI market could soar to $4.8 trillion by 2033, marking a 25x rise from $189 billion in 2023.

AI simulates human intelligence using machines through processes that involve developing smart software and powerful hardware, ensuring continuous learning and advanced problem-solving.

The AI revolution has seen many companies embrace the technology to boost productivity by enhancing operations through data-driven analysis and decision-making.

Governments are also in the AI race, a technology that is believed to usher in a robust machine-centric future. Funding is being channeled into AI research and development to secure strategic economic growth, national security and competitiveness.

The United States (US) leads in key AI R&D investments, followed by China and Saudi Arabia. The European Union (including France and Germany) is also a top contender in the AI race, with Canada and India not falling far behind. Japan and the United Kingdom (UK) are also spending money to ensure they remain competitive globally in the AI space.

AI stocks stabilize after strong momentum in 2025

Top AI stocks surged in 2025, delivering impressive returns throughout the year as funding concentrated on the sector. Nvidia (NVDA) recorded a robust 55% over the past year, as the company expanded its position as the leading AI, video gaming, and supercomputer GPU manufacturer.

Demand for AI software accelerated Nvidia’s growth. The company’s revenue surged as it clocked in leading AI companies such as OpenAI and Google’s parent company, Alphabet. NVDA stock has since stabilized at $186 at the time of writing.

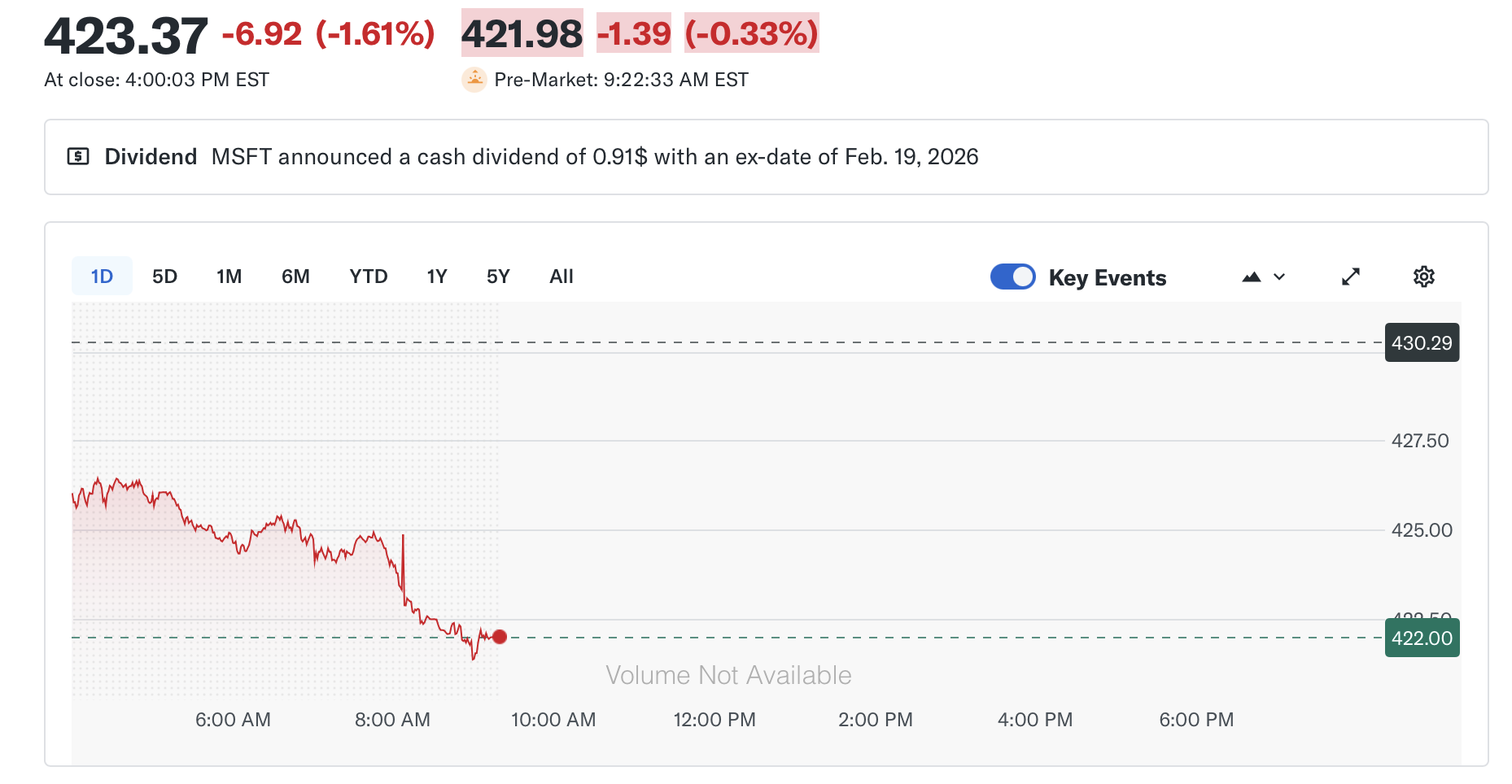

Microsoft (MSFT) posted a net return of 2.75% in the past year, trading at $423 at the time of writing. Despite the stock trading at a rather mature valuation amid extended market rotation, its AI integrations have advanced, supporting enterprise adoption. The company’s cloud computing department, Azure, expanded its revenue by leveraging its integration with OpenAI.

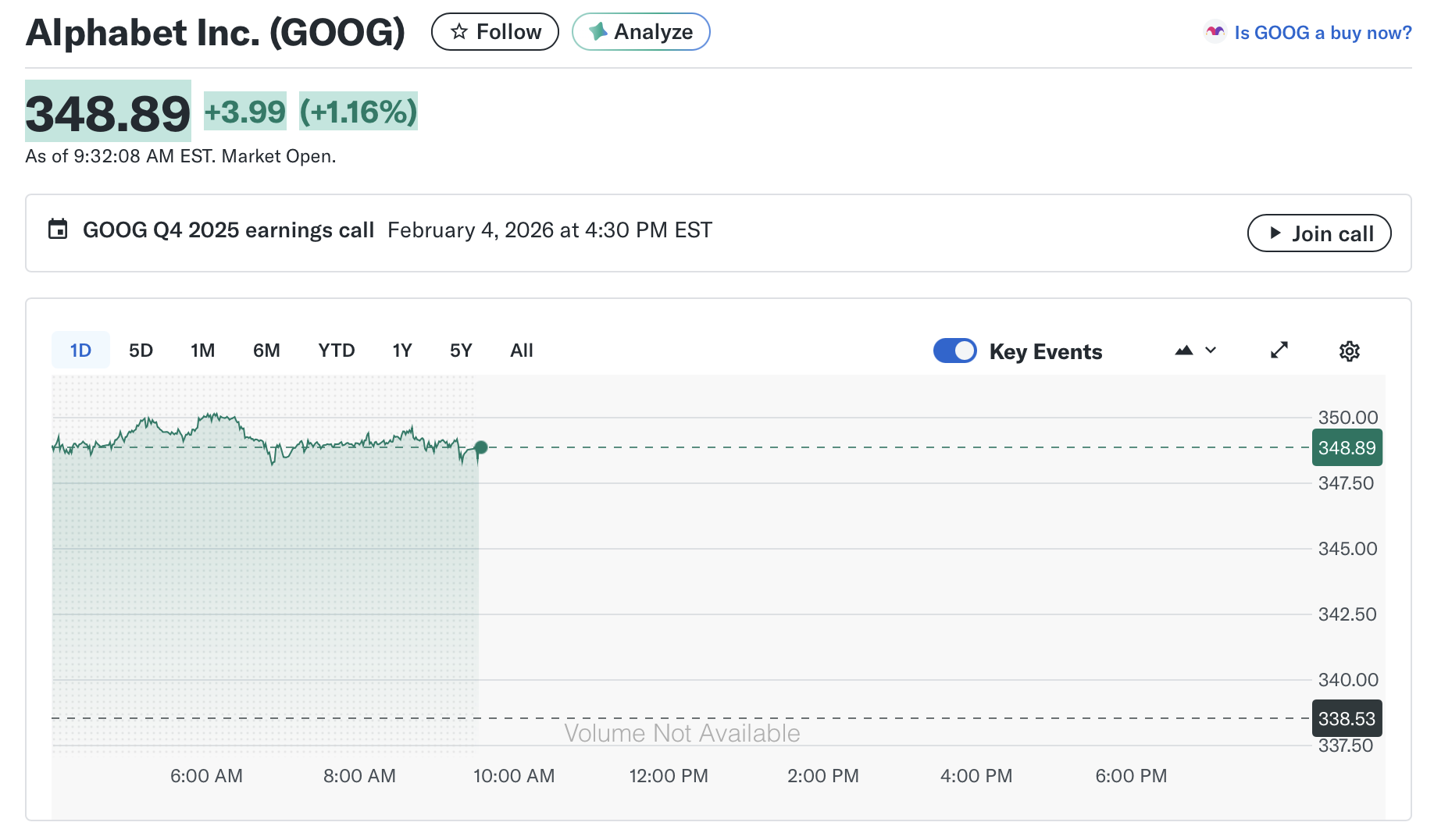

Alphabet (GOOG) stood out as one of the best-performing AI stocks, with a 68% yearly return. Over the last three years, GOOG has seen a combined 219% return on investment, according to Yahoo Finance. GOOG is trading at $349 at the time of writing, up 4% intraday.

Key factors behind Alphabet’s performance include advances in the AI sector, backed by the company’s dominance in cloud and search. Google rolled out Gemini, a direct competitor to OpenAI’s ChatGPT and integrated AI across its product suite.

AI stocks are expected to continue their performance spree in 2026, as the sector evolves amid increased funding. Emerging technologies within the space, including agentic AI, are likely to shape the outlook. However, cyclical tops could introduce unforeseen risks; hence, investors should prioritize diversification.

AI tokens extend sell-off as risk-off sentiment persists

AI crypto coins are experiencing a steady drawdown, reflecting risk-averse sentiment across the crypto market. The segments' total market capitalisation remains relatively flat at $22 million, despite some tokens such as AI Rig Complex (ARC) and UnifAI Network (UAI) posting double-digit gains of 36% and 18%, respectively, over the past 24 hours.

Top AI tokens such as Chainlink, Bittensor and Near Protocol remain underwater, as macroeconomic headwinds and geopolitical tensions weigh on the broader crypto market.

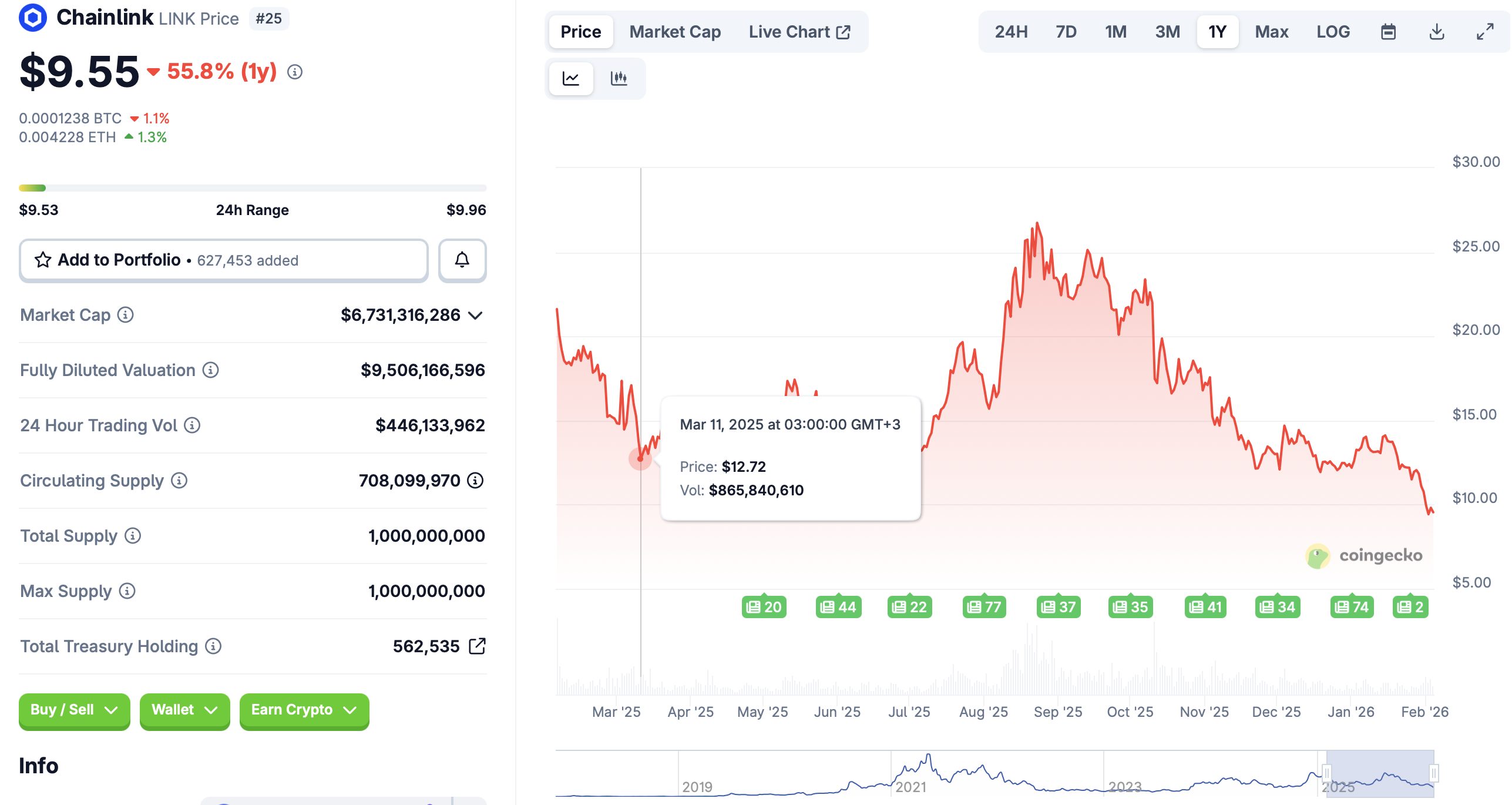

Chainlink is trading at $9.55, down nearly 3% intraday and 20% in the past week. The oracle token has sustained a long-standing downtrend over the past year, with returns averaging -56%, per CoinGecko data. LINK traded at a record high of $52.70 in May 2021 and has since lost nearly 82% of its value.

Chainlink is a decentralised computing network that solves the 'oracle problem,' enabling blockchains to access real-world data or connect to external systems. Protocols tap Chainlink as a secure bridge for smart contracts and data.

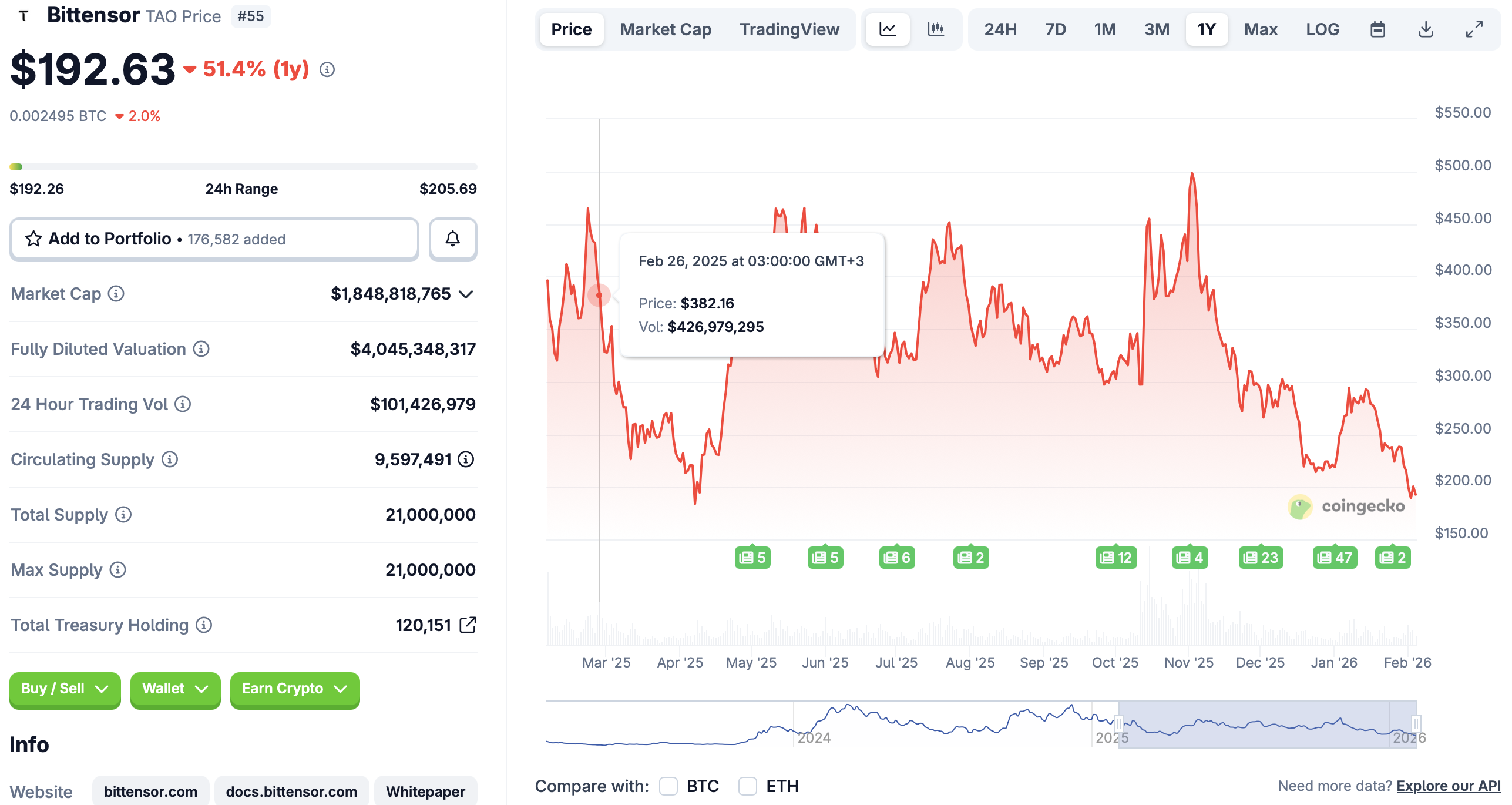

Bittensor, on the other hand, is an open-source protocol built on blockchain technology to create a decentralized machine learning network. This nettle plays a crucial role in enabling machine learning models to train collaboratively and earn rewards in the native token TAO. Bittensor envisions a marketplace for AI, allowing builders and couriers to interact in a trustless, open and transparent environment.

Bittensor’s performance over the past year has been overall bearish, with a return of -51%. The token is trading at $192 at the time of writing, down 3.6% in the last 24 hours, 16% over the past week and 27% in the past month. Bittensor has a market capitalization of $1.8 billion and ranks 55th in the crypto market.

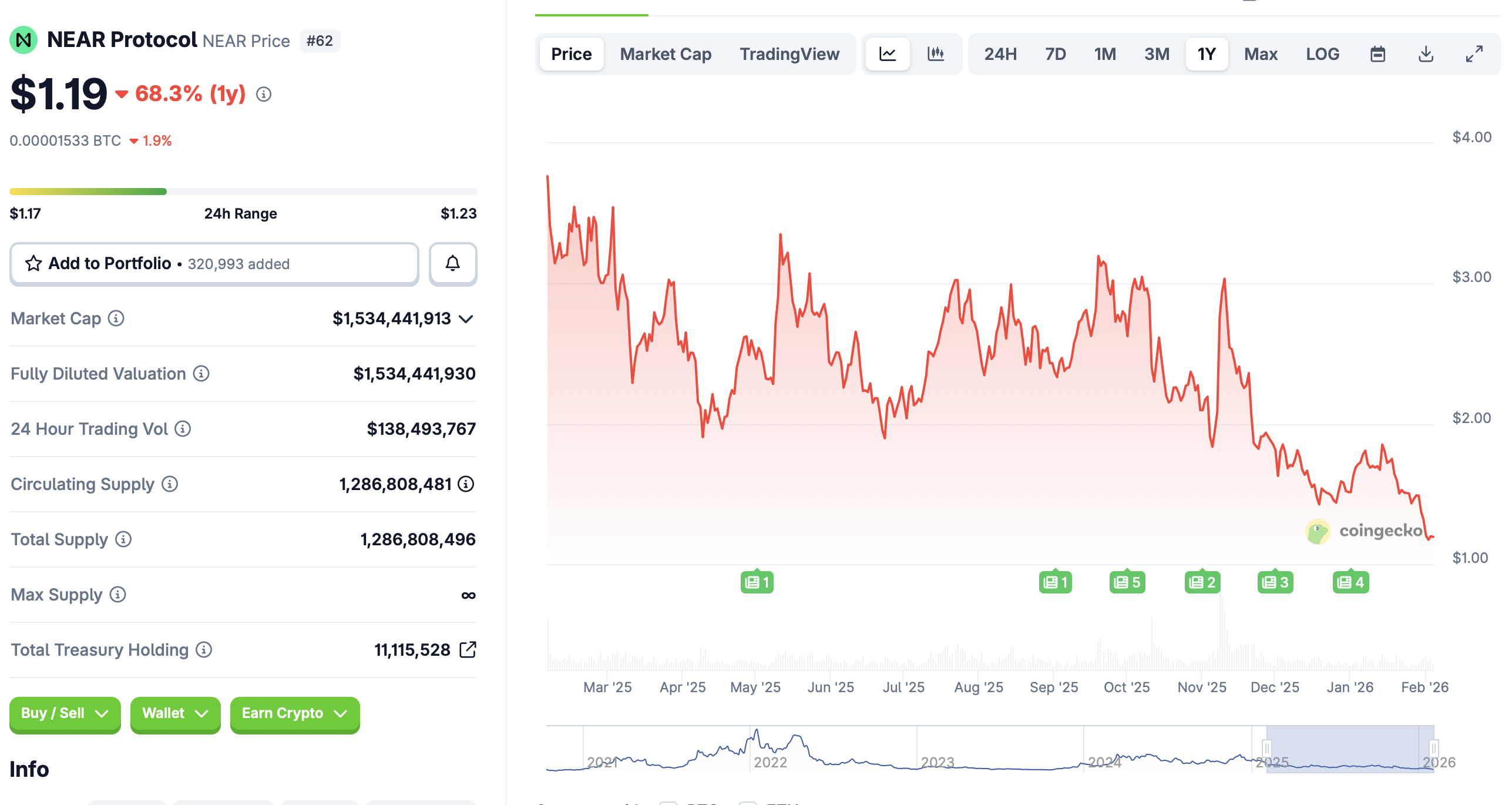

Near Protocol is also on the back foot, with the largest negative return of the three AI tokens at 68%. The token hovers at $1.19 at the time of writing, down 2.7% in 24 hours, 18% over the past week, and 31% over the past 30 days. NEAR has a market capitalization of $1.5 billion and ranks 62nd in the crypto market.

Near Protocol is a blockchain designed to power the next generation of decentralized applications (dApps) and AI agents. The protocol provides the infrastructure that AI requires to operate, and seamlessly integrates with Web2 and Web3 ecosystems.

Why the mainstream AI market outperforms crypto AI

The divergence between mainstream AI and crypto AI markets in 2025-2026 reflects fundamental structural differences. Companies such as Nvidia are recording significant growth in investment inflows and valuation. In parallel, the crypto AI sector is facing liquidity challenges amid risk-off sentiment, a broader crypto market drawdown, and dismal token performance.

Mainstream AI benefits from institutional funding models, driving innovation and valuations. In addition to deep liquidity in equity markets, mainstream AI receives government support, infrastructure incentive and regulatory clarity. Meanwhile, the largely retail-funded crypto AI segment constrains capital inflow, resulting in significant underperformance. The uncertainty associated with the crypto market often deters institutional investors.

Mature revenue models synonymous with the mainstream AI market ensure that companies generate measurable growth. However, the relatively untried AI crypto revenue models remain in experimental phases. Moreover, token valuations rely heavily on speculative risk appetite rather than established business models.

Conclusion

Both the mainstream and crypto AI sectors are poised to continue growing in the coming years. However, crypto AI tokens remain closely tied to broader crypto market cycles and volatility, which are heavily influenced by speculative retail flows. This means the performance gap is poised to persist until the crypto market receives regulatory clarity worldwide, increasing investor confidence and attracting deep liquidity capital flows equivalent to those in mainstream markets. Building business models beyond speculative tendencies would also boost adoption, allowing crypto AI to catch up with the mainstream AI industry.

`

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.